A Thumbs Up for Dark Chocolate!

February 10, 2024 | Expert Insights

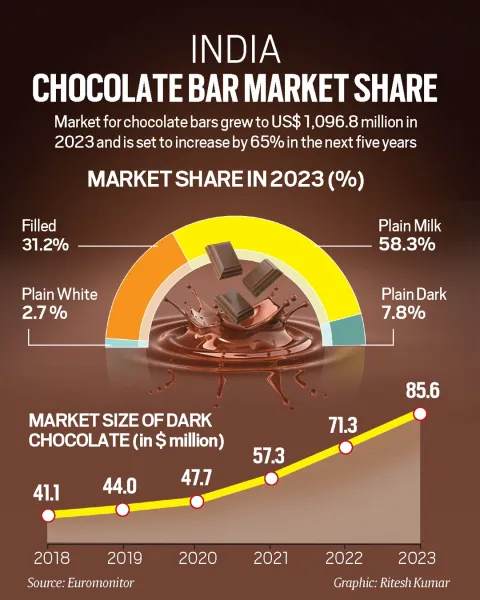

A silent revolution is underway in India even as consumer tastes take on a definite international flavour; the more expensive dark chocolate is gradually edging out the more traditional preference for strong milky and sugary variants. In fact, dark chocolate is projected to be the fastest-growing segment in India.

With a higher concentration of cocoa and less sugar and milk, dark chocolate is enjoyed as a healthier variant as well as a high-quality treat with nuanced flavours. While milk chocolate continues to occupy the lion’s share of the chocolate market in India, demand for dark chocolate is growing at a faster pace than the milk chocolate market.

Background

Chocolate is one of the most popular confectionery foods in India. So far, Indians have exhibited a predominant preference for milk chocolate, likely because its sugary and milk-rich flavour brings it closer to most traditional Indian sweets and desserts. However, a growing number of Indian consumers are acquiring a taste for the more concentrated and less milky-sweet dark chocolate. Whether it's a standalone treat, a baked delicacy, a dessert or candy, dark chocolate is on an upward trend.

India’s dark chocolate market more than doubled in size over the last five years, expanding at a sizable 16 per cent annually, while the dominant milk chocolate segment grew at 11 per cent a year. Additionally, the COVID-19 pandemic witnessed the onset of a worldwide trend in increasing health and wellness awareness that added to the dark chocolate trend and made its presence felt in India.

Analysis

Consumers are increasingly drawn to the potential health benefits of dark chocolate. Its higher quantities of cocoa solids are rich in antioxidants, flavonoids, and minerals, linked to benefits like improved cardiovascular health and the potential to enhance moods. This is in addition to the more evident benefit of less sugar.

Health benefits (like reduced sugar) have emerged as key consumer considerations. Many domestic brands are hopping on to the trend and launching local lines of dark chocolate products. For instance, India’s dairy giant Amul is targeting the healthier chocolate segment, launching 75 per cent, 90 per cent, and 99 per cent dark chocolates and even plans for a 100 per cent variant.

These brands also tap into consumer desires to be more mature consumers with refined tastes. Dark chocolate, with its complex and bitter-sweet taste, is associated with a more sophisticated palate. For instance, Cadbury blatantly marketed its dark-milk variant as a "grown-up chocolate".

This trend is also the result of rising disposable income levels and urbanisation, accompanied by changing lifestyles and preferences. Consumers are willing to pay more for premium products with improved quality and flavour. This can also be witnessed in the growing global demand for organic vegan, gluten-free, and sugar-free chocolates.

Moreover, dark chocolate is popularly considered a luxury or indulgent treat, and this adds to its appeal. This is enhanced by an emerging trend of rising consumer spending on luxury chocolates (premiumisation), particularly for gifting and celebrating festive or special occasions. In the financial year 2022-23,India displayed a significant surge in demand for luxury and premium imported chocolates, recording a whopping 45 per cent increase from the previous financial year. This could be part of a general premiumisation of the Indian economy: consumption of luxury goods has significantly increased in the last few years, according to a Goldman Sachs report.

Brands have responded to the rising demand and evolving preferences by offering a range of dark chocolate products with varying cocoa content (like Amul), nuanced flavours, and premium packaging. Major players have used specific marketing and distribution strategies to promote dark chocolate products' unique flavours, origins, and sustainability factors as they look to accentuate a new niche. This is compounded by the proliferation of e-commerce and online retail platforms, allowing consumers to easily access dark chocolate.

Domestic brands, rather than global confectionery giants, seem to be gaining the largest share of this rapidly growing segment. Leading international players like Nestle, Mondelez (owner of Cadbury), and Hershey's continue to focus on the milk chocolate segment in India with limited dark chocolate offerings and gear towards rural penetration with mass-market products. On the other hand, domestic brands like Amul, ITC's Fabelle, and Mason & Co are innovating with niche products and emphasising single-origin cocoa sources. For instance, Amul has dark chocolate bars in five flavours, including orange and mocha, and eight different single-origin dark chocolate bars with cocoa beans sourced from places like Venezuela, Columbia, Ivory Coast, and Madagascar.

Yet, industry insiders note a trend of luxury dark chocolate products increasingly being imported, which is projected to continue. Along with this, more premium foreign brands are poised to enter the Indian market.

Assessment

- The rapidly expanding dark chocolate market in India results from growing health awareness and increasing demand for premium products and unusual flavours. This trend is enhanced as more consumers acquire the taste for the bitter-sweet delicacy.

- Homegrown brands are claiming the largest market share as they target consumer segments that are urban, health-conscious, and looking for niche products. Yet, imports of premium and luxury dark chocolates are on an upward trend.

- Despite India's growth story, only a small percentage of Indians can enjoy the joys of such expensive confectionary. However, greater Indian production in this category may find an Asian export market where consumers have identical tastes.

Comments