Sustainable Aviation Fuel

February 24, 2024 | Expert Insights

The demand for air transport has increased, and international travel has picked up since COVID-19. In 2022, aviation constituted 2 per cent of worldwide energy-related CO2 emissions, having increased faster in recent decades than rail, road, or shipping. It reached around 800 Mt CO2, or 80 per cent of the pre-pandemic level.

This sounded alarm bells in the aviation industry and the International Civil Aviation Organisation (ICAO), whose long-term aspirational goal for international aviation is to reach net zero carbon emissions by 2050. The world grapples with the urgent need to reduce global greenhouse gas emissions, and Sustainable Aviation Fuels (SAFs) are playing a big role in efforts to decarbonise the aviation industry.

Background

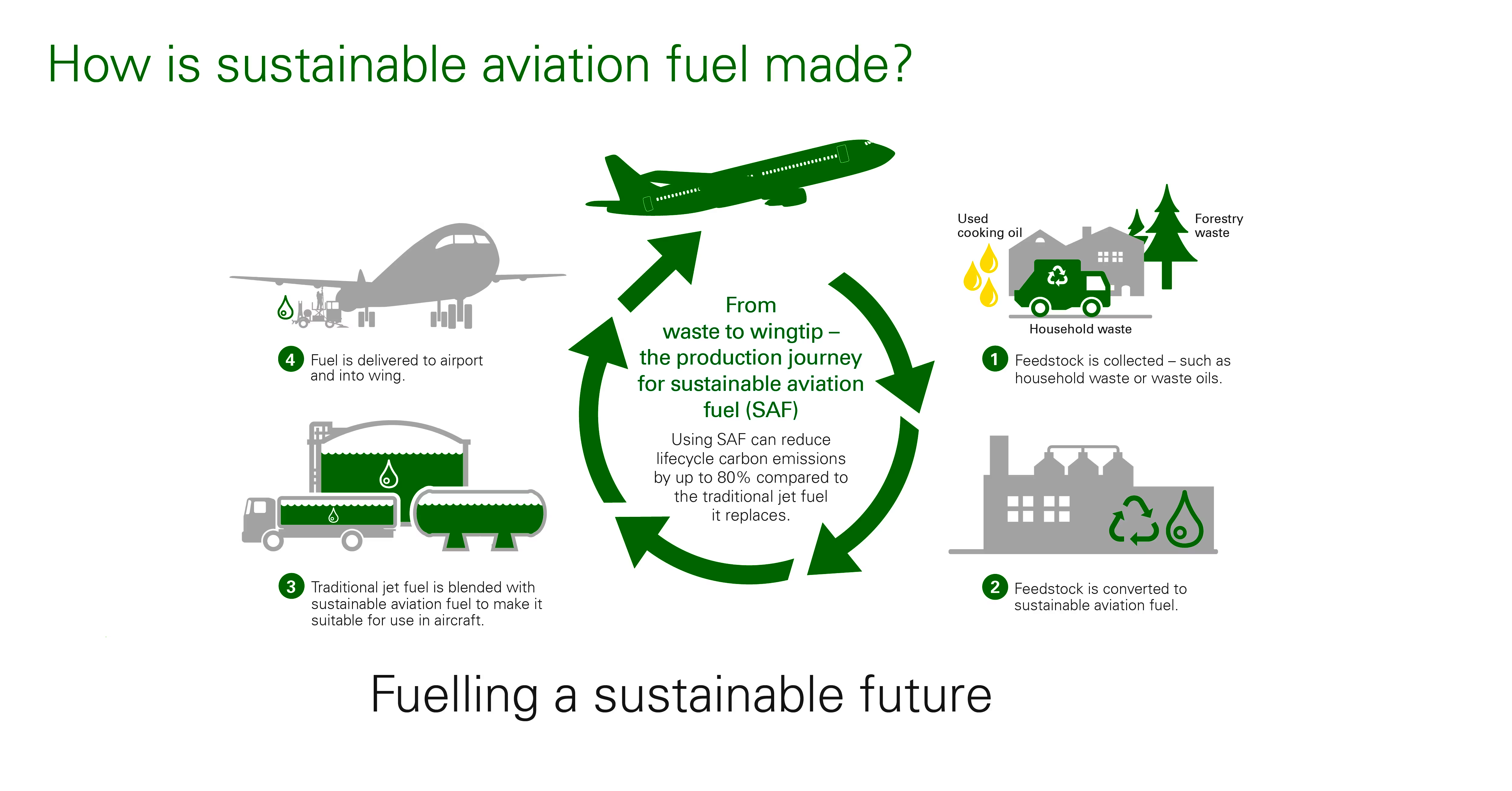

SAFs are alternatives to traditional jet fuels made from renewable, low-carbon sources like waste oils, fats, green and municipal waste and non-food crops. With an 85 per cent or greater life cycle assessment of greenhouse gas emission reduction, the aviation industry roadmap suggests that SAFs supply must scale by around 1600 times.

Analyses suggest that Southeast Asia (SEA) will be the epicentre of demand for air travel over the coming decade. Singapore is ideally positioned to assume regional leadership in SAF commercialisation efforts. Mr Han Kok Juan, director-general of the Civil Aviation Authority of Singapore (CAAS), responded to a moderator's question about expanding the adoption of environmentally friendly jet fuel a day after CAAS unveiled its sustainable air hub blueprint on February 19. It outlines Singapore's plan to impose a new green jet fuel charge on departing passengers beginning in 2026, as planes from the city-state must use sustainable aviation fuel. Singapore International Airlines (SIA) began a one-year pilot programme with Exxon Mobil and Neste in July 2022, in which the companies blended 1000 tonnes of neat SAF with jet fuel and supplied it with SIA and Scoot flights in Changi Airport.

Singapore is a refinery, aviation and finance hub, and by adopting supportive policies, investing in research and infrastructure and inviting collaborators, it can accelerate the adoption of SAFs. Finnish refiners Neste officially opened its second 1.3 million tonnes per year (TPY) renewable fuels plant in Singapore with the world’s largest SAF production capacity. An Airbus A350-1000 also used sustainable aviation fuel in flying displays at the Singapore Airshow this month. The fuel, supplied by Shell Aviation, is a 35 per cent blend of discarded cooking oil and tallow, or animal fats, with the remainder being conventional jet fuel. Singapore’s Ministry of Transport is aligned with ICAO’s 2050 net zero plan by participating in their Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

Another initiative aside from SAFs is to improve air traffic management by upgrading with sophisticated Air Navigation Systems, thereby burning less fuel. They also account for Changi Airport's domestic emissions by looking into energy efficiency in internal operations, solar deployment on the airfield and electric and renewable diesel vehicles for specialised ground handling vehicles.

Singapore's civil aviation chief stated that the authorities had no alternative but to mandate airlines to use green jet fuel amid worries that a planned passenger charge will raise air travel prices and decrease Singapore's competitiveness as an air hub. It is true that while the change is inevitable, so are the consequences that Singapore's CAAS plans to carry by relying on travellers' willingness to spend on air travel and their unique competitive edges.

Analysis

Implementing SAFs is crucial to pushing the aviation sector's goal of net zero emissions by 2050, but the adoption is nascent. The Singaporean regulatory environment is favourable, with government authorities and associations engaging in policy frameworks and discussions to support SAF adoption. However, the production and supply chain, investments, technological innovations and collaborations are inadequate. Feedstock availability is abundant in SEA, but efficient collection, processing and sourcing needs to be met. Technological innovations to help make feedstock conversion more cost-effective and efficient depend on investments in research and development and collaboration with key players, research institutes, and international organisations to build capacity. Finally, the initial investment into SAF projects is high, which can be intimidating to

Around $500 billion will need to be budgeted for SAF over the next 26 years, which is an intimidating start for investors. The World Economic Forum led a workshop called the First Movers Coalition for Aviation, highlighting the importance of collaboration, understanding what is at stake and forging relationships and business partnerships. The government can throw the ball by providing incentives and grants to usher private-public sector partnerships necessary to produce high Carbon Intensity (CI) reduction SAF in the near-medium term. Establishing a nurturing investment environment for new projects like SAF is important and extremely necessary to help them gain momentum in global dynamics. With adequate risk and fiscal security policies, key players and stakeholders need to feel more supported through the energy transition as it becomes a global necessity.

Regional partnerships will also play a significant role in the transition, as Singapore still relies heavily on feedstock imports from the ASEAN region. India aims to set up a SAF production plant by 2026 with an 87,000 TPY production capacity. According to Indian Oil Corp Director of Research and Development SSV Ramakumar, they are set on investing over 15 billion Indian rupees in the project. Oil Minister Hardeep Singh Puri also shared the plan to mandate 1 per cent SAF for domestic airlines by 2025 to cut emissions.

Cebu Pacific, a low-cost Philippian airline, also signed a long-term strategic partnership with Shell Eastern Petroleum to make SAF more widely available for its fleet. Qantas and Airbus set off the SAF industry in Australia by investing AUD 2 million from a $ 200 million fund. Airbus and China National Aviation Fuel Group (CNAF) signed an MOU to increase SAF production. Collaboration and knowledge sharing, technological innovations, investments, policies and financial support are all a part of the regional opportunities that build the partway for sustainable growth and implementation of SAFs in aviation.

Assessment

- While the regulatory environment in Singapore is favourable, and the government is making initiatives to push for the transition to green energy, production and supply chains, technological innovations, information sharing, research and development, and financial support are undervalued.

- High initial investments can be soothed by government incentives, grants and supportive policies that lure investors towards SAF project funding.

- The India Aviation Market size is estimated at USD 13.54 billion in 2024 and is expected to reach USD 23.24 billion by 2029, growing at a CAGR of 11.41% during the forecast period (2024-2029). If successful, the Singapore model could act as the template for a global switch to SAF, especially in India, where aviation is an engine of growth.

Comments