The Rouble Tumbles

August 26, 2023 | Expert Insights

Economics and politics are co-joined at the hip-one cannot survive without the other's positive support. Comprehensive National Power might showcase the military component, but the real power lies in the economic heft. The sudden collapse of the USSR and now our nuclear- armed neighbour Pakistan teetering on the edge of an abyss showcase that real power comes out of national wealth and not guns.

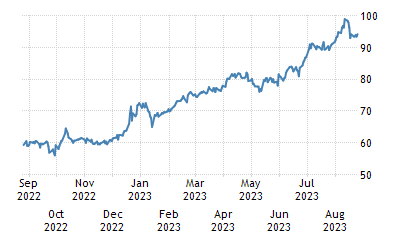

The Russian Rouble stoically survived the headwinds of an economic storm delivered by the combined heft of the Western democracies and their acolytes for the greater part of a year. But now, reality is catching up as Russia faces the nightmarish possibility of a collapsing national currency.

On August 14, the BBC reported that the Russian rouble had fallen to its lowest value in 16 months, falling past 100 per US dollar. The sharp decline was a consequence of the increasing pressure on all segments of the Russian economy, with rising imports (especially military exports purchased at jacked-up prices from shady arms dealers) and failing exports.

Background

The Russian economy has always had a fragile foundation, sustained by its energy and agriculture sectors.

The economic system remains top-down, a legacy of nearly 80 years of socialism. Diversification to different sectors has still not taken place. Its large size means that any economic impact the country faces has a certain lag time before it is fully felt.

Even before the invasion of Ukraine, the Russian economy was small compared to the nation's vast expanse. The main lifeline of the economy has for a long time been energy exports. Some have even gone to the extent of calling Russia a giant gas station. Being the jewel in the crown, the energy industry is heavily controlled by the state (and the oligarchs).

Soon after the start of the conflict in February 2022 heavy sanctions were placed by the West on Moscow. There was an over-optimistic expectation that the Russian economy would collapse soon. This did not happen. There was a brief scare with the currency. But this too soon passed.

But what we see in the currency markets now is the time running out for the Russian economy.

Analysis

This currency crisis was bound to happen sooner rather than later. In the initial period following the invasion, the rouble had dropped. Then, the international energy markets came into play for Russia. As Russian energy supplies were cut off, the world energy market felt the pressure. Energy prices started to rise as a consequence.

Moscow took full advantage of this. Production was ramped up. In Russia, most of the energy companies are state-owned and state-affiliated. Thus, they have no option but to do the Kremlin's bidding.

This period of high energy prices actually caused a boom in the Russian economy. A false sense of complacency set in Moscow. There was a belief that these sanctions might actually be busted. With no economic pressure, the war continued. This was, however, a false positive. The Russian economy was living on borrowed time.

As the Russian products were comprehensively shut out of European markets and American allies like Japan, South Korea, Australia, New Zealand, etc., other countries came into play. These included India and China. Moscow was willing to provide cheap oil at discounted rates. This was an enticing proposition that New Delhi and Beijing could not ignore. The Chinese already had pipeline connections with their northern neighbour. For India, Russian oil tankers must travel considerable distances to reach Indian shores. As a result, the ensuing transportation costs are also quite high.

As long as oil prices were high, this system worked pretty well. But energy prices do not stay high forever. They eventually fall. And this is what happened. This is a classic case of resource curse. Russia is a rentier state. This is a state which depends on a few select natural resources for its national revenue.

A rentier state's advantage is that it does not have to tax its citizens as much as other countries. Being a dictatorship in Russia, this allows the population to be compliant. The flip side to this is though not beneficial. Dependence on a single resource no matter how abundant means putting all one’s eggs in one basket. When that basket breaks, there is a catastrophe.

As global oil prices started falling, Russia had to rethink its sanctions-busting mechanism. Just selling the oil was not enough. There is no point if it does not bring in sufficient revenues. Also, the sanctions started having a biting effect on the Russian economy. Russia was totally removed from the international SWIFT payment system. This meant huge difficulties for Russian traders. They could not carry out their trade transactions in a normal fashion like other countries. Instead, they had to do this in a convoluted way. This added to the total costs quite substantially.

The economic lifeboats for Russia turned out to be temporary. Chinese purchase of cheap Russian oil means Beijing has a huge stake in the Russian economy. The economic terms and conditions are being set by Xi Jinping and not by Vladimir Putin. Chinese investment is flowing in at an unprecedented rate in Russia. Whether this investment is good or bad, nobody knows. As a rule-taker and not a rule-maker, Moscow has no option but to accept Beijing's terms.

Russian authorities have told people not to panic in this crisis. They are saying that they are handling the disaster. The Russian central bank has raised key interest rates. It is expected that the rouble will jump after a certain period. This might be true, but the structural damage to the Russian economy because of the war in Ukraine is something that Moscow cannot ignore.

The India View

In India's case, the problem is a little bit different. Russia was never an important trade partner for New Delhi. The main basis of this relationship has always been weapons supplies from Moscow. This was especially true during the days of the Soviet Union. Today, India is seeking to reduce its defence dependence on Russia.

So, the trade relationship between India and Russia is highly skewed in favour of the latter. India has very little goods to offer, which Russia wants. At the same time, India's imports from Russia are very high. Such an unbalanced trade situation is difficult to manage in good times. In bad times, this becomes almost impossible to sustain.

Following Russia's invasion of Ukraine, India decided to trade with Russia in its currency, the rupee. This was based upon the belief that the rupee should finally take centre-stage in New Delhi’s economic transactions and that it should reduce its reliance on the dollar as the preferred currency of transactions. This was a very noble intention. However, this did not take into account certain economic realities. This is because India's share of global trade is still very small. The Indian economy might be booming. But this has not been translated into more trade with many countries.

Due to this, Indian rupees began to stack up in the coffers of Russian banks. It is very difficult to convert the rupee into other currencies. This means the Russians cannot use the rupee for other transactions. After the fall in oil prices, Russia is no longer giving oil discounts to India. As a result, purchasing oil from Russia is becoming very expensive for India.

Many alternative solutions have been proposed. These include using the Chinese yuan and the UAE dirham. There are problems with these as well. India does not want to depend too much on the Chinese yuan for international transactions. The UAE dirham, on the other hand, is linked to the dollar.

Assessment

- The Russian economy has not collapsed due to the falling currency. Still, this is a warning of greater dangers to come.

- The war in Ukraine is not the only cause of the present crisis in the Russian economy. Failed policies, cronyism and corruption added to this. In any case, Russia was never a big player in the world economy to begin with. Now, it has even less of a presence.

- All this shows that the dollar remains the dominant currency in the world. All other currencies have to depend on the dollar one way or another.

Comments