RISE OF THE YUAN?

July 16, 2022 | Expert Insights

Geopolitical tensions, economic sanctions, and unpredicted disruptions in global supply chains of food and energy have sent shock waves around to world, depressing currency values. With Russia embargoed from SWIFT transactions, there have been fluctuations in financial transactions, sending traders into a tizzy, desperately seeking loopholes to re-establish commercial links with Russia. Pushed to a corner, Moscow is insisting on Rouble based transactions, an option that few of its remaining trading partners wish to risk.

Amidst the reigning confusion, China is pushing to replace dollars with Yuan, which has greater acceptability as a much wider bandwidth of nations depend on trade with the Dragon.

Background

Beijing is grappling with a slowing economy as recurring waves of COVID 19 have shut down manufacturing hubs repeatedly. Still, the Chinese Yuan has outperformed the US Dollar (USD). In 2021, the Yuan soared more than 8 per cent, compared to 24 other major currencies. The CFETS RMB Index is only 0.26 per cent away from its previous record high of November 2015. It has also gained ground against the dollar, with the rise being between 2.4 per cent and 2.8 per cent this year-the offshore rate currently trades at 6.34 yuan per USD. Gaining in strength, Beijing's currency holds the power to trade with the Rouble in the Russian market.

Analysis

Under existing geopolitical conditions, trade with Russia is impossible in the traditional way, and direct banking transactions with Moscow are no longer feasible. Recent reports highlight the use of Chinese currency to trade with Moscow, allowing businesses in partner nations to maintain commercial relations without concerning the west. The largest cement manufacturer in India, UltraTech Cement, is bringing in a shipment of Russian coal and paying with Yuan. A unique payment mechanism that dealers claim could become more widespread is described in an Indian customs document examined by Reuters.

The increasing use of substitutes for dollars to settle payments could help insulate Moscow from the effects of western sanctions. India shares longstanding political and security ties with Russia. But these indirect transactions will eventually increase the value of the Yuan in the global market. Beijing has been using this for trade settlements for years. To circumvent the use of the Yuan, reportedly, talks are underway with Moscow to set up a rupee payment mechanism.

Subash Chandra Garg, a former economic affairs secretary at India's finance ministry, said," If the Rupee-Yuan-Rouble route turns out to be favourable, the businesses have every reason and incentive to switch over.” Slowly the Asian market might switch to Chinese currency with sanctions continuing on Russia. “I have never heard any Indian entity paying in yuan for international trade in the last 25 years of my career," said a Singapore-based currency trader quoted by Reuters in their report dated June 29th.

The trade involving Russia has dipped since February. The unavailability of raw materials has led to a steep hike in price. Indirectly the price hike has led to a fall in demand. Due to the unstable market, consumers are hesitant to spend and end up saving. Moscow's central bank keeps Yuan in its reserves. About 13 per cent of reserves are in Yuan assets, circumventing USD and western sanctions without triggering them. The Rouble to Yuan trade has reached a record high since the Ukrainian war.

Considering the price differential, Russian raw materials cannot be ignored for long as they are the most price competitive. If the sanctions get prolonged over the years, we will see Central Banks worldwide stock up on the Yuan as a reserve. Not surprisingly, it is an opportunity for Beijing to project the Yuan as a credible alternative to the USD. It is reported that China has been reaching out to several countries offering to build up their Yuan reserves, willing to contribute up to 15 billion Yuan, equal to 2.2 billion dollars. Replacing the UD could exponentially increase the value of the Yuan in the global market. It is creating a global financial system, one that is driven by the Yuan and not the USD, a challenge that America is bound to contest. Therefore, the global currency markets are set for even greater convulsions in the near future.

Assessment

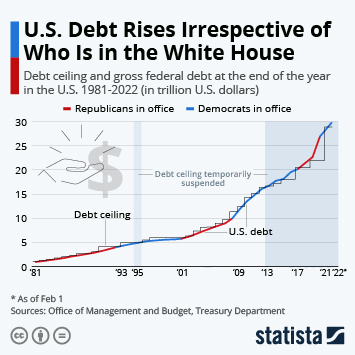

- The Whitehouse sanctions on Moscow have led to a fall in the use of USD. Russia can never be isolated from global trade despite sanctions by the west. Cheap raw materials turn them into a dependable trade partner. Current sanctions have benefitted Beijing in hiking the Yuan value globally.

- Establishing the two financial systems will likely increase rivalry between China and the West. The global financial system may face further disruptions and instability. Countries like India, caught in the crossfire, will have to navigate the path of international trade with alacrity and prudence.

Comments