RBI’s repo hike

August 2, 2018 | Expert Insights

RBI’s Monetary Policy Committee has raised the repo rate from 6.25% to 6.5% on 1st August. The hike was made to tackle accelerating inflation and to support the weakening rupee.

Background

The Reserve Bank of India (RBI) is India's central banking institution, which controls the monetary policy of the Indian rupee. It commenced its operations on 1 April 1935 in accordance with the Reserve Bank of India Act, 1934. Following India's independence in 1947, the RBI was nationalised on 1 January 1949. The RBI plays an important part in the Development Strategy of the Government of India. It is a member bank of the Asian Clearing Union.

Repo or Repurchase rate is the rate at which the RBI lends money to the commercial banks for a short-term, that is, a maximum of 90 days. If RBI wants to make it more expensive for the banks to borrow money, it increases the repo rate similarly, if it wants to make it cheaper for banks to borrow money it reduces the repo rate. Generally, repo rates are cut down whenever the country needs to progress in banking and economy. Interest Rate in India averaged 6.66 percent from 2000 until 2018, reaching an all time high of 14.50% in August of 2000 and a record low of 4.25 % in April of 2009. In its fifth bi-monthly Monetary policy review on 6 December 2017, RBI kept its Repo Rate unchanged at 6%.

Recently, on June 6th, the RBI increased the benchmark interest rate for the first time in four and half years. The repo rate was increased to 6.25% from 6%. This hike, the first since the Narendra Modi government took charge, was likely to lead to higher lending rates for borrowers. Despite the interest rate hike, which usually drags markets down, the Sensex gained nearly 1% soon after the announcement. This was because the RBI painted a fairly encouraging picture of the world’s fastest-growing major economy, in spite of the rising risk of inflation. The central bank had also retained the full-year economic growth forecast at 7.4%.

Analysis

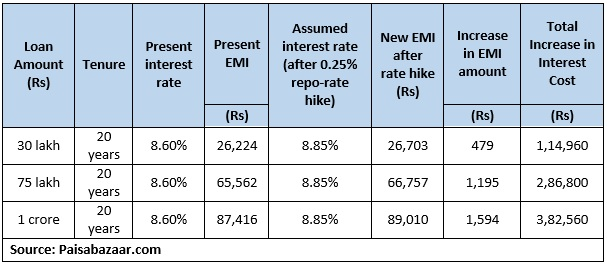

The Reserve Bank of India increased its key policy repo rate by 25bps to 6.5 % on August 1st 2018, in line with market expectations and following a similar hike in the previous meeting. Policymakers reinforced that the decision is consistent with a neutral monetary policy stance and is in line with achieving the inflation target of 4% while supporting growth. The reverse repo rate was also adjusted to 6.25 % from 6 %. The impact of this hike in repo rates is said to affect home loans, debt funds, fixed deposits and small saving schemes. However, the hike was driven by factors such as - inflation, RBI’s resolve to stay ahead of the curve, hike in Kharif MSP, loose fiscal policies, high crude oil prices and relative weakness of rupee.

Adhil Shetty, CEO, BankBazaar.com said: “In June, several leading banks including SBI had increased their MCLR. With the rate hike today, we’ll see loans get costlier.” He suggested that in such a scenario, it makes immense sense for customers repaying loans to make periodic principal prepayments. MCLR hikes, however, will not immediately impact most existing home loan borrowers as they will continue to pay their existing lending rates till the next reset date of their loan.

The repo rate increase brings bad news for debt mutual fund investors. This is because the prices of bonds fall and bring down the net asset value of bond funds. Analysts advise that it would be better for investors to steer clear of long-term debt funds and go for funds with shorter maturity periods. As short-term debt funds are expected to deliver lower volatility and low risk in this scenario.

The bank fixed deposit rate are expected to rise as well in this scenario. A few days back, the SBI hiked its deposit rates by 5 to 10 basis points. This indicates that there will be marginally higher interest earnings for customers opening fixed deposits with banks.

With RBI’s two consecutive hikes in the repo rate, taking it to 6.50%, there is now heavy expectation of increase in small savings returns. For the April to June quarter, the rates remained unchanged. However, it is suggested that investors looking for risk-free, guaranteed returns may continue to invest in PPF, NSC, Sukanya Samriddhi, Post Office Savings, etc.

RBI has tried to maintain a neutral stance amid increasing global and domestic risk, this cooled bond yields after the policy announcement. Naresh Takkar, MD & Group CEO, ICRA Ltd, said, “Looking ahead, we expect the 10 year G-sec yield to trade in a range of 7.65%-8.0% in the remainder of this quarter. On the other hand, the announcements of additional open market operations by the RBI could help cap the G-sec yields.”

Counterpoint

“Investors will forget the rate hike and refocus on individual companies and their outlook,” said Kishor Ostwal, managing director at CNI Research Ltd. “The fate of general elections next year will be the focus of attention.”

Assessment

Our assessment is that RBI’s neutral stance comes from assessing the current global and domestic scenario. We feel that the hike is a logical move as it is supported by several factors like inflation, rupee, oil prices and fiscal slippages. However, there is no clarity on the issue of liquidity,thus, we feel that the RBI will carry out open market purchases in the coming financial year. We believe that the implication of this repo hike will affect consumers by making home loans costly and by bringing down NAV of bond funds. We also believe that continued global risks could be met with another rate hike in the next fiscal year or so.

Comments