Oil prices in a contango

April 28, 2020 | Expert Insights

On 20th April, prices as per West Texas Intermediate (WTI- the benchmark for oil from U.S. oilfields), fell to a negative $37.63 a barrel, the first time in history. The global international index Brent (Brent crude pricesfor North sea oilfields), on which 2/3 of world's oil trade is based, was at around $20.

How is it happening?

The Coronavirus contagion has quickly emerged from being a health crisis to a financial one, winding up businesses, upending trade and sending financial markets on a tailspin.

Oil is contracted in the futures market and does not involve the physical delivery of the commodity. Internationally, there are two benchmarks for oil futures. These are North Sea Brent Crude and West Texas Intermediate (WTI). North Sea Brent is traded on the Intercontinental Exchange by countries in Europe, Africa and the Middle East, while WTI is traded in North America on the New York Mercantile Exchange or NYMEX. The two prices generally move in tandem. In India, trading of oil is done in Multi Commodity Exchange or MCX.

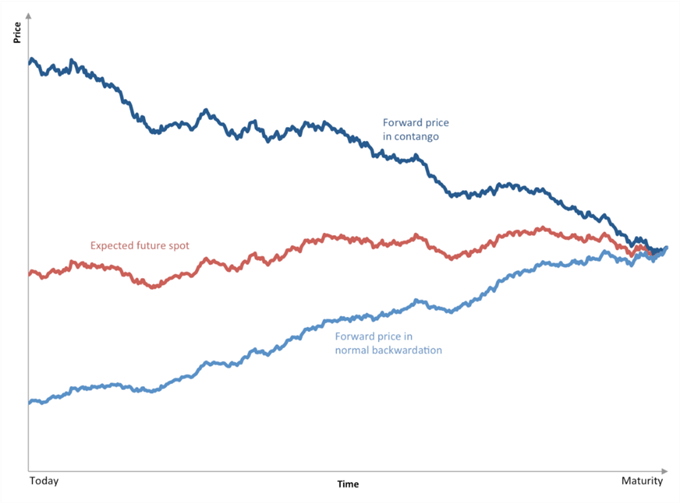

Light sweet crude oilis the most popular grade of crude oil being traded because it is the easiest to distill into other products and has lower sulphur content. West Texas Intermediate crude prices for future delivery have risen well above the spot market—a situation known as contango—and that can encourage traders to store oil. The contango is a situation when physical barrels can't find buyers and are sold at distressed prices.

The negative plunge was for the WTI contract for May, which expired on Tuesday 20th April, which was the day when the contract owner was to take delivery. The oil storage terminal in Cushing, Oklahoma where WTI is delivered had no further capacity to store oil. As per Stephen Innes, Chief Global Market Strategist at AxiCorp, as cited by the Economic Times, "The oil price reflects the economic value of oil, less than the cost of storing oil. As WTI requires physical delivery and storage is very expensive to access, the cost of storage in May exceeded the economic value of oil in May."

The June WTI is also falling but is currently stabilised at around $16.60. Holders of this contract hope that the consumption will increase by June, which will allow cheaper storage for the stock when they take the delivery. This could be further facilitated by the agreement between the major oil producers to cut down in oil production, as storage remains a major issue.

Countries are running out of storage space with even strategic oil reserves full to the brim. The world is awash in petroleum crude. "For the first time in history we are seeing the likelihood that the market will test storage capacity limits within the near future," said Antoine Halff, a founding partner of Kayrros, a market research firm. As oil-producing countries, and large consumers, find it hard to find storage space, the prices continue to drop, forcing many countries to shut off their wells. The amount of oil placed on tankers to take advantage of the slump has grown up by over 25 percent with over 81 ships, a record number, sailing around the globe as portable oil tanks. This situation is even though ship storage is many times more expensive than land storage.

With producers unable to sell and consumers unable (and not needing) to buy, this leaves a high supply of oil with no one able to cash in on it. As per IHS Markit,a research firm, the oil demand could plummet down as much as 14 million barrels a day (more than the entire daily consumption of China), by May-Jun this year.

What would this mean to consumers?

Petrol prices have slightly declined in most parts of the world, but remain mostly unaffected in India, staying at Rs 76.31 ($1) a litre (in Mumbai) in April. The reason for this was that firstly, most of India's consumer price on petroleum and diesel depends on taxes levied on it, and secondly, India does not trade with WTI. India's portfolio represents oil from Oman, Dubai and Brent crude, the price of which did see a five percent decline, but overall is at $27 a barrel. It's not as cheap as WTI, which is the benchmark U.S. oil. Some states in India have seen petrol/ diesel sales as a natural source of adding revenue to meet the additional social and medical cost of COVID 19 by putting surcharge to the sale price.

India does not buy much of its oil from the U.S., and to that extent, Indian refineries will not be able to leverage the low prices of WTI. In any case, with depressed demands and refineries functioning at 50-60 percent capacity, the storage space does not add up to stock up cheaper crude.

The flipside

Collapsing oil prices does not necessarily mean doomsday. In July 2008, oil prices fell from $147 to $33 in February 2009, with LNG prices nosediving from $14 to $4. This, however, happened at a time when the global economy was functional. As per the World Bank Global Economic Prospectsreportof 2015, a supply-driven 45 percent oil price decline between 2014-2015 led to an increase in overall GDP of about 0.7-0.8 percent in the medium-term. Yet with most of the economy in pause, such an assumption is not realistic for the present.

Assessment

- With demand at near-inertia, oil and fuel tanks around the world are close to brimming — a blunt indication of the global oversupply and a function of the "contango" structure of the futures market, where contracts for later delivery trade at a premium to the front-month.

- If all the storage tanks are filled, oil companies will close it wells, which can impair oil fields. Many tankers are currently full of oil and floating at sea.

- When oil prices decline, gasoline prices decrease, and this is beneficial to the consumers. However, prices are falling today because people are travelling a lot less. It's therefore difficult for anyone to take advantage of lower gasoline prices if there is reduced mobility. So there's no clear winner in the present situation.

Comments