Norway’s Salmon Tax: Can Resource Rent Tax Work?

April 29, 2023 | Expert Insights

Norway's government has proposed to increase the resource rent tax on its lucrative aquaculture industry. Norway is a major producer of farmed salmon, the country's largest source of income after fossil fuels. The proposal to increase the 'salmon tax' aims to better distribute profits using the country’s key ocean resources. Initially introduced at 45 per cent, the tax was reduced to 35 per cent (on top of corporation tax of 22 per cent). Soon after the proposal was announced, share prices for salmon companies dropped, and the seafood index on the Oslo Stock Exchange dropped sharply. However, despite this short-term effect, the government has proceeded with the proposal, although the bill is yet to be passed into law.

The proposal has met with opposition from the industry for its potential negative effects. However, it has also been hailed for the significant benefits it offers. In addition to ecological preservation, it enables the government to bring in more revenue from the use of ocean resources, distribute the profits more equitably, and create a better playing field for smaller fish farmers.

Background

Like other European countries, Norway faces the economic effects of Europe's energy crisis, sparked by the Russia-Ukraine conflict. The pandemic, the electricity crisis, and increased costs have increased government spending. The salmon tax would bolster public funds and reduce the government's reliance on oil funds.

The 1982 UN Convention on the Law of the Seas upheld the principle that a nation has sovereign jurisdiction over its territorial waters. Since then, governments have sold tracts of ocean territory to private companies through state licenses. With the rapid growth of marine industries, private companies have increasingly exploited ocean resources for various activities, including drilling, deep-sea mining, and aquaculture. Resource rent tax is a way to ensure that the profits from these lucrative activities are better distributed.

The ‘salmon tax’ is a ground rent tax - a kind of resource rent tax charged as a rental fee for using natural resources. Ground rent tax is not new in Norway. Oil and hydropower industries are also charged ground rent tax in addition to the regular corporation tax. Norway is the only nation that imposes such a tax on its oil companies. The revenue has substantially contributed to Norway’s Oil Fund, the government’s pension fund.

Analysis

The salmon tax offers a way to harness and share income from valuable ocean resources. Taxing the profits of the lucrative fish farming industry brings in more public funds and supports public spending in a period of rising costs and expensive electricity. The tax also allows local communities to benefit from natural resources by sharing income between the host municipality and the state.

The salmon tax is aimed at larger firms with higher profits; it exempts firms earning below a certain cutoff. This protects smaller businesses and offers them a competitive advantage. One of the likely effects of the tax is that smaller fish farmers will buy more state licenses and increase production.

Further, by making the exploitation of ocean resources more expensive for large players in the market, the tax could contribute to ecological preservation.

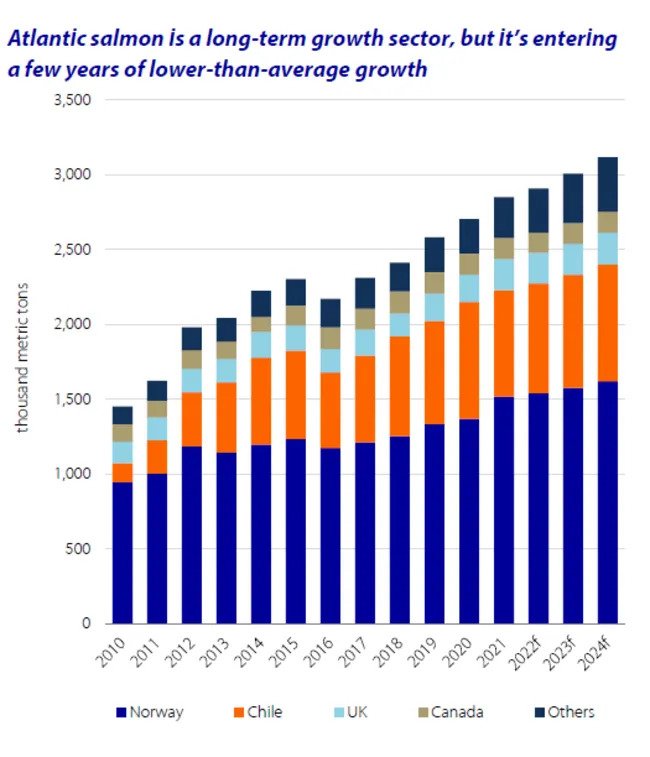

However, opponents of the proposal point out that it will discourage production and growth in an industry that has been doing well due to substantial investment, risk, and innovation. There are concerns in the industry that the new salmon tax will create uncertainty in the market and spook investors, causing them to hold back on investing in new projects. It could also lead to less competitive prices at the level of international trade. Other major farmed fish suppliers, like Chile, Canada, and Scotland, may either seek to take advantage of this or take a cue from Norway and follow its example.

Despite the potential drawbacks, Norway’s tax on the lucrative aquaculture industry could serve as a key example of a resource rent tax for other countries to adopt. Few other countries impose resource rent tax on the commercial use of natural commons. The UK government imposed a Petroleum Revenue Tax in 1975 to target the high profits generated by oil companies. Australia charges resource rent on the profits of its mining industry.

Developing countries could particularly benefit from resource rent tax to reap the dividends of their abundant natural resources. While India does not impose a resource rent tax, the Orissa government had suggested a mineral resource rent tax in light of the high profits a few private companies were generating from mining in the state.

A resource rent tax on aquaculture in India could help balance its rapidly growing aquaculture industry with a higher cost in exploiting the coastal resources. While this may not make fish farming more sustainable, it could at least make it more expensive for large fish farmers to exploit marine resources. This could reduce the intensity of industrial fish farming and contribute to species conservation.

Assessment

- While Norway’s salmon tax may potentially slow down a thriving fish farming industry, it could enable a more equitable distribution of its profits. It also marks a step towards limiting ecologically destructive activities. Further, the resource rent tax may set an example for other countries.

- India could benefit from a similar resource rent tax on its aquaculture industry since it would limit the destruction of coastal ecosystems and could benefit coastal communities and smaller fish farmers. However, it would face similar challenges as the salmon tax.

- Such a tax could discourage new projects due to high profitability requirements for capital-intensive or large-scale endeavours. It could also make prices less competitive in global markets. Lastly, the political will to impose such a tax may prove to be an issue.

Comments