Max Safety Versus Max Profits?

January 28, 2023 | Expert Insights

On January 26, 2023, aerospace giant Boeing pleaded not guilty to criminal charges before a Federal Trial Court in Texas. Boeing is facing felony fraud charges in connection with the crashes of its 737 Max aircraft in 2018 and 2019, which killed 346 people.

Post-crash, the company was investigated by the FBI, U.S. Congress, and U.S. Department of Transport (DoT). According to the investigation, the company misled federal regulators about the safety of a critical automated flight control system that played a significant role in the crashes.

In 2021, the company entered a secret settlement with the Justice Department; however, the question arises: can this settlement of 2.5 billion dollars exonerate the company of such malpractice that claimed the lives of 346 individuals?

Background

Boeing is a more than a century-old company with global revenues of $66.608 billion, up about 7 per cent year over year. In 1967, the company introduced the 737 aircraft to the market. Since its introduction, Boeing has manufactured and delivered over 100 aircraft across the globe. It turned out to be the biggest revenue earner for the company.

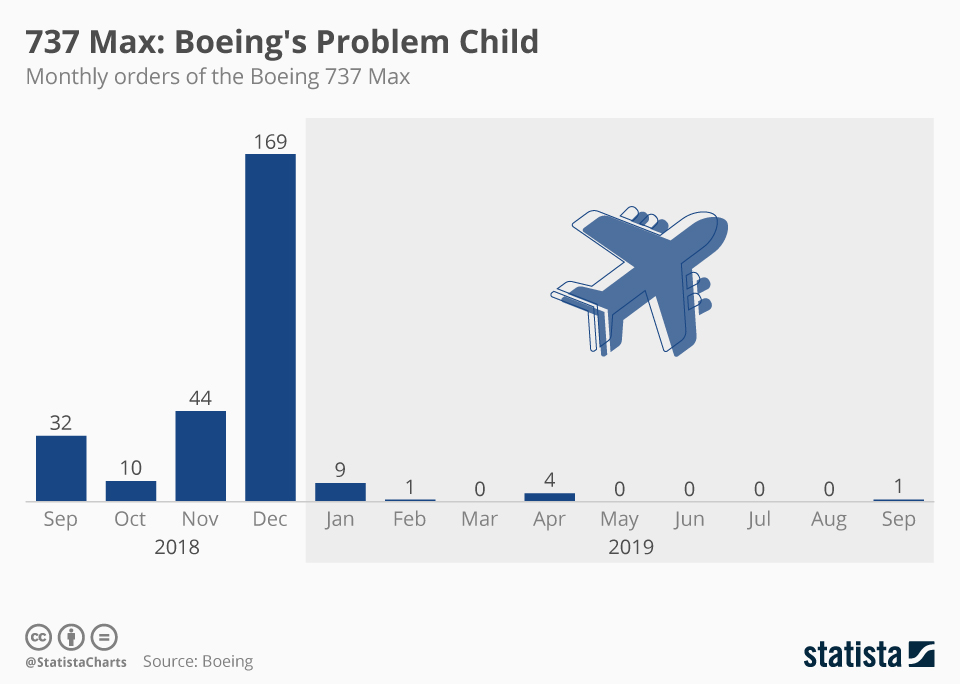

However, following the launch of the A320 Neo by its sole competitor, Airbus, which claimed to be more fuel efficient, Boeing's senior management predicted a decline in the 737's market share. Nine months later, Boeing launched the 737 Max to counter its competitor. The company promoted the newly launched aircraft as 15 per cent more fuel efficient. However, to cut costs and meet tight deadlines, it failed to ensure safety standards.

In 2019 disaster struck; two 737 Max crashed- one in Jakarta with 189 passengers and the other in Ethiopia with 157 people on board. Immediately, all Max operators grounded the fleet when the evidence, including the Black Box data, indicated that the cause was a software glitch in a system designed to avoid stalls.

Analysis

Boeing compelled the Federal Aviation Administration (FAA) to approve the design and give safety certification to be competitive, meet market needs, and outwit its competitors. There was complete ignorance of the problem related to the Manoeuvring Characteristics Augmentation System anti-stalling system and the faulty data feed by the Angle of Attack (AOA) sensor.

To keep pace with rival Airbus, Boeing didn’t care about much-needed pilot training. Boeing even failed to mention changes in the new model of aircraft in the Flight Crew Operations Manual. There was no reference to mandatory flight simulator training. Due to this deliberate suppression of facts, the pilots were clueless when the plane behaved erratically in mid-air, and bad sensor data remained useless.

Boeing suppressed facts regarding the safety standards from the FAA. The company was not meticulous in the integrity and safety context and launched an ill-prepared product in haste. Through their investigation, the DoT found that Boeing's leaders had done bad engineering, cut costs without thinking, and appeased government regulators. Dennis Muilenburg, the CEO of Boeing, was held accountable, and the board dismissed him in December 2019. The company also pinned the blame on two technical pilots, whom they alleged had misled the regulators while working on the aircraft certification. Only one of these pilots was prosecuted, and the other was acquitted in 2021.

After admitting to defrauding the FAA and concealing safety problems during the investigation, Boeing and the Department of Justice (DoJ) entered a deferred prosecution agreement to settle the charges. However, the victims were not included in the consultation process. Boeing agreed to pay 2.5 billion dollars (approximately 3.37 per cent of its yearly global revenue for 2021), including 1.7 billion dollars in compensation to airlines that had purchased 737 Max aeroplanes and were grounded for 20 months after the second plane crash. It also agreed to pay $500 million in compensation to the victims' families.

The agreement also required Boeing to make significant changes to its safety policies as well as its corporate culture. It was also agreed that if the company and defence contractor lived up to the terms of the agreement, criminal charges would be dropped after three years. The testimonials of the family members of the victims led to the reopening of the case before the Federal District Court in Texas.

Families of those killed claim that the arrangement Boeing made with the DoJ in 2021 to settle a criminal conspiracy allegation was a "sweetheart deal" that violated their rights and let the firm escape being held completely accountable. The DoJ has defended its decision by saying that the settlement was fine because it couldn't prove beyond a reasonable doubt that Boeing's alleged crimes caused the two crashes. The company has said that reopening the agreement is "unprecedented, impossible to implement, and unfair." The families requested that the judge appoint an external monitor to check on Boeing's compliance with the agreement and mandate public disclosure of the company's compliance efforts. But it's still not clear if the legal action will lead to the agreement between Boeing and the DoJ being reopened in the end.

Assessment

- In the world of corporate governance, there are many instances of unethical practices, malpractice, and subversion of safety measures, and the case of the 737 Max is no different. The story of the 737 Max is an example of the corporate culture of non-compliance with safety guidelines and the overall failure of corporate governance.

- Further, the fine and compensation amount appears to be a slap on the wrist; however, Boeing is one of the two companies that dominate the aviation industry and an important player in both the global and U.S. economies. Therefore, there is doubt about how far the U.S. authorities will go to prosecute this aerospace giant, considering its contribution to the industry and the economy.

- If we recall the fate of the Bhopal gas tragedy and the action taken against Union Carbide Corporation, we can draw a plausible conclusion to this case from the precedent.

Comments