Losing its Shine

April 12, 2022 | Expert Insights

Sri Lanka is in the throes of a significant economic crisis. Amidst food shortages and soaring inflation, thousands of protestors have taken to the streets against the Rajapaksa government, calling on the ‘Family’ to quit.

Background

In 1995, Sri Lanka’s foreign debt stock had accounted for over half of its GDP. With greater globalisation, as its domestic export market (ready-made textiles) and tourist inflow increased, the debt-to-GDP ratio eventually (2014) dropped to a manageable 30 per cent.

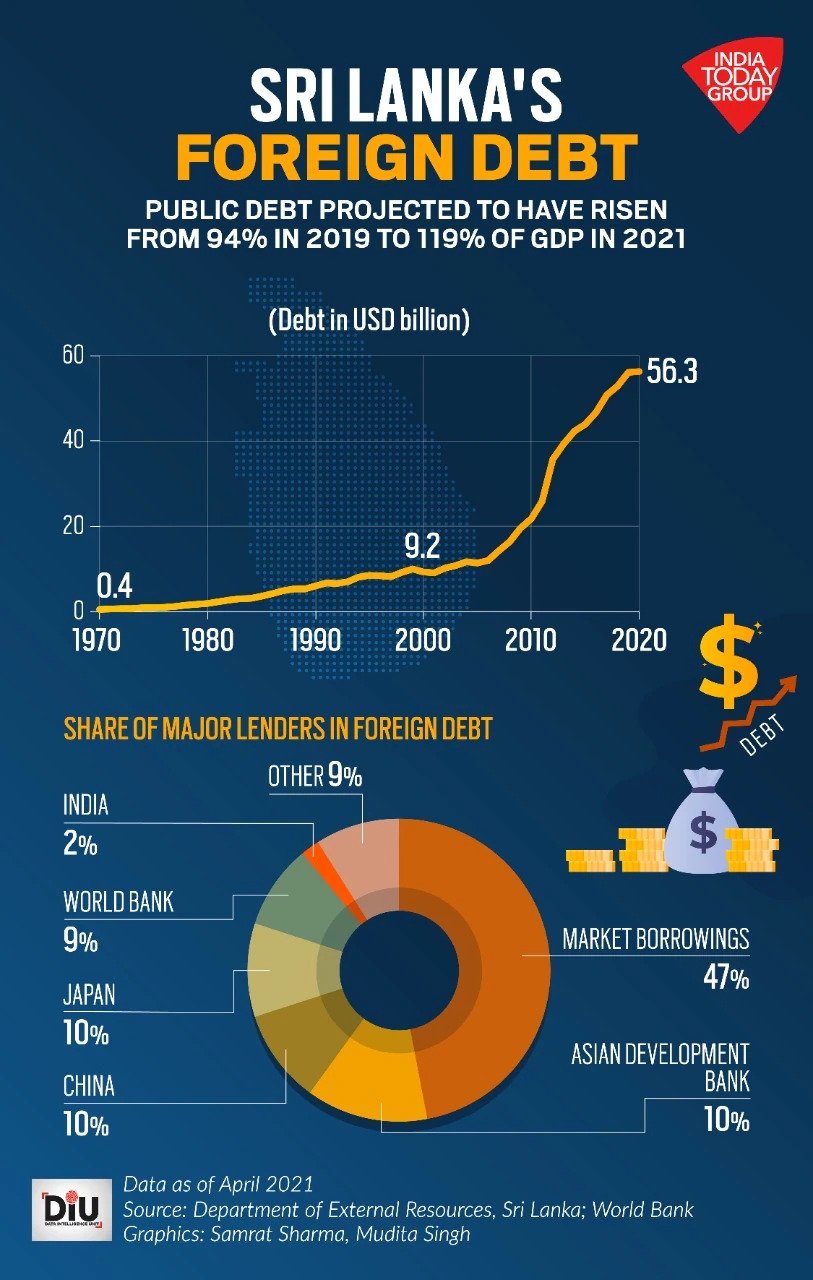

But the primary issue for the nation was its public debt. This debt has continued to grow since then, with a majority of it financed by international sovereign bonds and loans from China. From 2014 to 2019, the foreign debt levels started rising at a greater pace, and by 2019, it had reached almost 43 per cent of the GDP. The reason for this surge was that its economic growth was slowing down, and the issuance of ISBs (international sovereign bonds used to repay the previous debt) was piling up on the existing debts.

Analysis

Due to the rapid growth in the country in the 90s and early 2000s, Sri Lanka is now considered a medium-income country. This means that the loans the country took in the 90s had much better terms and conditions than what it has now.

In 2004, only about 2.5 per cent of Sri Lanka’s loans were commercial loans. However, by 2019, 56 per cent of the country’s foreign loans were ISBs. ISBs have a very short payback period (about 5 to 10 years) and a relatively high-interest rate (about 6 per cent). Finally, there are principal payments; in other words, the total borrowed amount of an ISB has to be settled at the maturity date all at once. When an ISB matures, the foreign debt skyrockets, leading to large amounts of currency outflow.

Critics say that the root cause of the problem is decades of economic mismanagement, with successive governments creating a twin deficit. According to a 2019 Asian Development Bank working paper, a twin deficit is a “signal that a country’s national expenditure exceeds its national income and that its production of tradable goods and services is inadequate." To ease the situation, the government has tried different ways of limiting the outflow of foreign currency.

Sri Lanka’s central bank prohibited traders from exchanging more than 200 Sri Lankan rupees for an American dollar and stopped traders from entering forward currency contracts. To stabilise the economic crisis, the government tried to limit the engagement with the foreign market to keep as much foreign currency in the country as possible. Forward currency contracts allowed traders to offload risk on professional speculators; due to this ban, many traders were unwilling to import necessary products.

Back in 2020, due to the pandemic, the government was able to restrict imports. It managed to reduce the outflow of foreign currency by 3.9 billion dollars. A significant fall in oil prices also helped to stem the outflow. However, the pandemic also led to the near-collapse of the tourism industry (which was 10 per cent of the GDP). Consequently, people lost jobs, and the total number of residents living in poverty went up. In 2020, nearly 12 per cent of the country lived on a daily income of 3.2USD.

To complicate matters, there were some well-intentioned but economically unviable schemes pushed by the government. One such initiative was to make Sri Lanka the first country to rely 100 per cent on organic farming. The results were chaotic, with food prices rapidly rising, forcing the government to reverse its policy. Significant tax cuts were also introduced just before the pandemic, which could not be reversed as incomes dropped and added to the revenue woes of the cash strapped government.

At the moment, the country’s shortage of foreign currency has left it unable to pay for essential goods and services. The value of its rupee has also taken a major hit. The public is facing significant shortages of fuel, food, and medicines, with power cuts for over half a day. Predictably, public anger has scaled new heights.

Following widespread protests and clashes with security forces, the country saw a nationwide curfew. President Rajapaksa, who was extremely popular in 2019 (as he swept the election), had to send soldiers to prevent crowds from entering the capital square. Not only was the nation put under a 36-hour lockdown, but all major social media platforms were also taken down under special instructions from the Defence Ministry.

Opposition party members, human rights groups and ordinary people are worried that this lockdown may trigger further human rights violations or even a military takeover. It is clear that President Rajapaksa is desperate. He has offered ministerial positions to opposition parties to calm the situation, but few seemed keen to board a sinking ship.

Since the start of the year, India’s support for Sri Lanka has crossed about 2.5 billion dollars. This includes a billion dollars line of credit for food and medical supplies as well as another 500 million dollars line of credit to buy fuel. The RBI has initiated a currency swap of 400 million dollars. The Sri Lankan President is keen to continue seeking help from China and the IMF. Many have warned that being indebted to China will only worsen the situation (like it has in the past).

Assessment

- The once-flourishing Island nation is today in the grips of an existential threat of a collapsing economy. Another South Asian neighbour, Pakistan, is similarly struggling. The double whammy of the pandemic and the ongoing war in Ukraine has wreaked havoc on the global economy, and South Asia, with its teeming millions, is even more vulnerable. Both countries present a glaring lesson for the rest of the region, which must come together to deal with it. In this regard, India, the largest regional economy, has a critical role to play, its own economic concerns notwithstanding.

- Having survived a prolonged and bloody civil war, the Sri Lankans now face the daunting prospect of an authoritarian system replacing their democracy, as a beleaguered government resorts to quashing human rights and constitutional norms to secure its position. This must not be allowed to happen.

Comments