Investment Controls: Choking Global Trade?

August 26, 2023 | Expert Insights

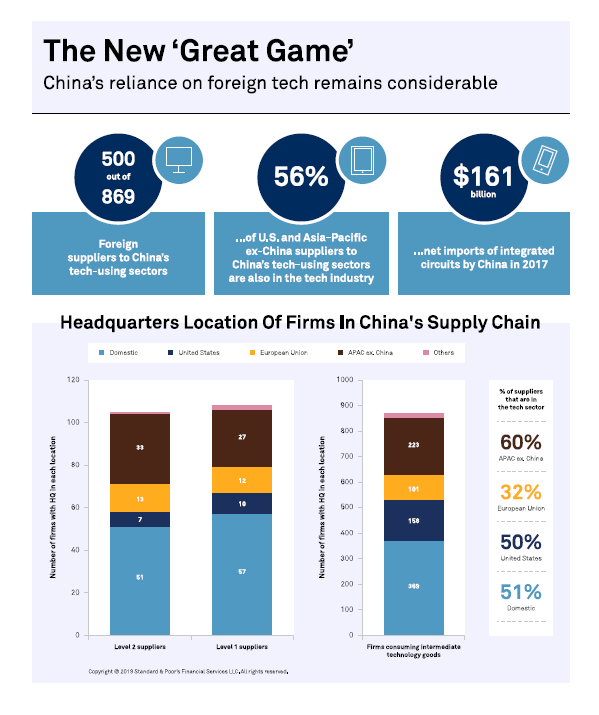

The United States and China have recently imposed a number of investment controls in an effort to protect their national security and economic interests. These controls have had a significant impact on global trade, and they are likely to continue to do so in the years to come.

Background

On August 15, 2023, U.S. President Joe Biden signed an executive order that expanded the scope of the Committee on Foreign Investment in the United States (CFIUS) to include outbound investment. This means that CFIUS can now review and block U.S. investments in foreign companies that could pose a national security risk.

The executive order also created a new interagency working group to develop recommendations for additional outbound investment restrictions. The working group is expected to focus on investments in countries that are considered to be national security threats, such as China. These restrictions are designed to prevent U.S. companies from investing in Chinese companies that are involved in sensitive technologies or industries. The restrictions are part of a broader effort by the U.S. to counter China's economic and technological rise.

On its part, China has also imposed a number of investment controls in recent years. In 2020, China passed the National Security Law for Hong Kong, which gives the Chinese government broad powers to intervene in the city's economy. The law has been used to justify the crackdown on pro-democracy protests in Hong Kong.

In 2021, China also passed the Foreign Investment Law, which gives the Chinese government more control over foreign investment in the country. The law requires foreign investors to obtain government approval for certain types of investments, and it gives the government the power to expropriate foreign assets without compensation.

In 2022, China announced that it would create a new investment review agency to scrutinise foreign investment in sensitive sectors. China has also taken steps to restrict foreign investment in its financial sector.

Analysis

The U.S. and China investment controls are likely to significantly impact global trade. First, the controls could make it more difficult for U.S. and Chinese companies to invest in each other's countries. This could reduce the flow of capital and technology between the two countries, which could hurt economic growth.

Second, the controls could make it more difficult for U.S. and Chinese companies to do business with each other. This could lead to higher costs and decreased efficiency for companies that operate in both countries.

Third, the controls could create uncertainty for businesses about the future of their operations in either country. This could discourage investment and make it difficult for businesses to plan for the future.

The implementability of the U.S. and China investment controls in the short term (2-5 years) is uncertain. On the one hand, the controls are likely to be met with resistance from businesses and governments in both countries. This could make it difficult to enforce the controls effectively. On the other hand, the U.S. and China have a strong track record of implementing trade restrictions. They are also likely to be motivated to enforce the controls to protect their national security and economic interests.

India View

India is a major trade partner of both the U.S. and China. The U.S. is India's largest trading partner, while China is India's second-largest.

The controls could make it more difficult for Indian companies to invest in the U.S. and China and make it more difficult for U.S. and Chinese companies to invest in India. This could reduce the flow of trade and investment between India, the U.S., and China, which could have a negative impact on the Indian economy.

In addition, the controls could create uncertainty for Indian businesses about their future operations in the U.S. and China. This could discourage investment and make it difficult for Indian businesses to plan for the future.

India has expressed concerns about the U.S. and China's investment controls. The Indian government has argued that the controls are discriminatory and that they could harm the Indian economy. India has also said that it will take steps to protect its own interests in response to the controls.

Assessment

- The U.S. and China investment controls are a major development in the global trade landscape. These controls are likely to have a significant impact on global trade in the years to come. It is important to monitor the situation closely and to assess the impact of the controls on the economies of the U.S., China, and India.

- In addition to the economic impact, the U.S. and China investment controls could also have a political impact. The controls could further strain relations between the two countries, leading to increased tensions in the global economy.

- It is too early to say what the long-term impact of the U.S. and China investment controls will be. However, it is clear that they are a major development that could have a significant impact on global trade and the global economy.

Comments