India slows down on the digital highway

May 8, 2017 | Expert Insights

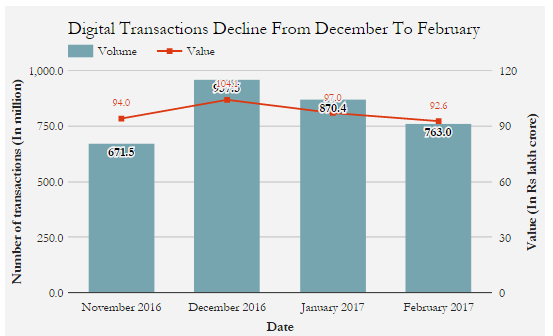

For the government and most of its supporters, pushing towards a cashless society may help deliver solutions to the problems of corruption, lack of development, increase production and ending poverty. Post demonetisation, there was an increase in the volume of digital transaction from 672 million to 985 million. But in the first quarter of 2017, there was a steep decline in electronic transaction by 20% to 763 million. The use of the National Electronic Funds Transfer (NEFT) platform has widely reduced signifying India’s move towards remonetisation thereby indicating people’s preference for cash.

Why digitalization?

The government gave a big push to digital transaction post-demonetisation simplifying the transaction process. India slowly started concentrating on online methods of payment which lead to a decline in the usage and need for cash. With demonetisation, millions of Indians have not only been forced to queue up at ATMs but also fall in line with Modi’s government’s digital push. But it seems to be strange obsession when the essential infrastructure and banking access are not in place for a country like India. Hence, growth of digital transaction slowly seems to decline with the availability of cash in ATMs and many bank branches.

Decline in Digital Transactions

The cost of digital transactions are ultimately borne by the consumers even when they are charged by the purchaser or the vendor. This charge can range between 0.1% to a much as 4% of the value of the transaction. The poor typically make small purchases since they cannot afford purchases in bulk. With digital transaction, they would end up paying a non-negligible amount for the transaction alone. The poorer sections become open to exploitation by the corrupt.

One of the recent cases from the Kukharkheda panchayat in the Bhim block of Rajsamad district in Rajasthan shows that many digital methods have become subjects to corrupt practices. In a case reported a ration dealer had temporarily seeded his Aadhaar into the ration cards of 80 families to illegally withdraw their rations, and then de-seeded the numbers. This happened in a supposedly “fool proof” system which implies that there could be misuse of personal details by private players through basic everyday digital transactions.

Assessment

India is a country that is composed of several small consumers and suppliers and transactions are generally in-hand. For a developing nation, where most of the population are not accomplished with the internet, digital payments would not quite serve the purpose. A large part of India’s consumers are generally serviced by the small suppliers with low cost bases and mostly from unorganized sectors, hence payment with cash would be more economical. Payment through cash would not require internet or any sort of electronic device which becomes acceptable anywhere and everywhere, particularly for the rural sectors.

The major risk with digital payments are centred around the risk of online hacking of bank accounts which could be one of the main reason for most people to become hesitant about adopting digital payment systems. India is a developing country and lot of work would have to be done with respect to cyber security. The increasing cybercrimes cases in India, has created numerous myths about cashless transactions in the minds of people. People in backward areas are still not aware of such payments methods and many villages in India are still not equipped with advanced banking facilities which would make digital transactions almost impossible.

It would be unnecessary to force people to move to cashless payments, when there is not sufficient means to meet the scale of demand, this quickly.

Comments