India’s Energy Outreach: Has It Been Worthwhile?

September 1, 2023 | Expert Insights

A nation’s national security is closely linked to its energy security. A booming economy transitioning from a developing to a developed status will require a lot of energy. A net energy importer, especially crude oil, India faces serious challenges in ensuring energy security.

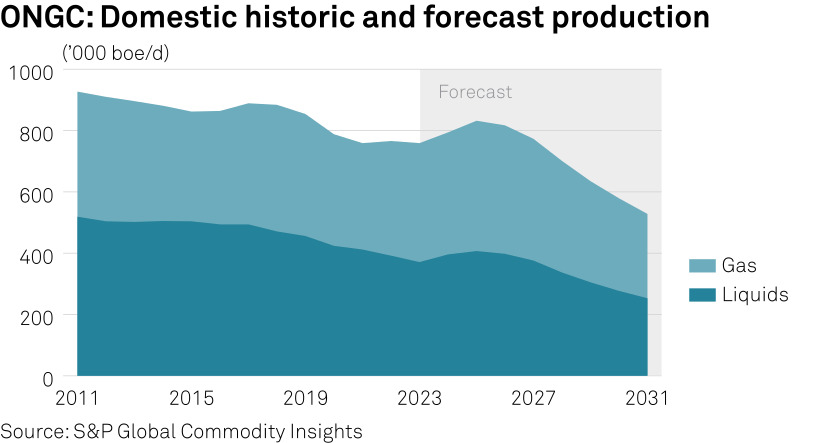

ONGC Videsh has certain crucial responsibilities. This includes prospecting for oil and gas reserves outside India in the context of exploration, development and production. This external branch of ONGC has Participating Interests in 32 oil and gas assets in 15 countries. However, Its total reserves and production are not insignificant. It produced 6.349 MMT of Oil & 10.171 MMTOE of Oil & Gas in the financial year 2023, 21.7% and 16.0% of India's domestic production, respectively.

Background

The Persian Gulf region is the main source of India’s energy supply. The reasons are not far to seek- the proximity makes transportation costs substantially lower, which adds up to the cost of the actual fuel product.

However, putting all the eggs in one basket is courting an energy disaster. Therefore, like another net energy importer, China, India is always looking for alternate, cheaper and more reliable sources of oil and gas. As compared to China, India is a latecomer in this arena. The foreign branch of the Indian national oil company, ONGC Videsh Limited (OVL), has made its presence felt in certain parts of the world. This includes the Russian Far East, Sudan and Angola. However, success has been mixed.

Analysis

When Indian oil companies embark on foreign exploratory work, they face a completely different environment from their Western counterparts. The energy sector in India is significant. But it has nowhere near the clout which it has in Western economies. Energy diplomacy has not become a part of India's foreign policy like that of the West.

This structural difference is quite self-evident. India has no equivalent of a conglomerate of oil companies controlling the market in an oligopolistic fashion. Unlike in the West, there is no revolving door between the energy industry and the government. Even state-owned oil companies have to do most of the groundwork on their own. There is no energy lobby in the corridors of power in India as it exists in the United States.

All this means that Indian oil companies must figure things out on their own as they go along. The first decision that has to be made is to find out which part of the world to look at. Western oil companies have already taken traditional countries with huge oil reserves as their exclusive monopolies. A shining example of this is Saudi Aramco. In such places, Indian oil companies will be seen as interlopers. So, the Indian oil sector has to look for places with scope for penetration.

A second factor that draws back Indian oil companies' exploratory capacity is capability. The oil business is highly cost-intensive. This includes both labour and technology. India has an abundant supply of labour. However, in terms of technology, Indian oil companies lag far behind their Western competitors. The science and technology aspect of the oil business has received insufficient attention from Indian policymakers.

India also has no leverage over its rivals in the oil sector. Other countries use various means to get oil concessions. Underhand methods also fall into this. India likes to play it straight. It places all its cards on the table right from the beginning.

Security is a very important factor in the oil business. Without security on the ground, nothing else matters. A lot of oil infrastructure might be built. But they will prove to be meaningless and wasteful in an insecure environment. Other countries try to solve this problem in their way. Some build exclusive oil facilities which are completely cut off from the surrounding countryside. A high level of security is placed around these facilities.

This security cannot be local unless the host country is very stable. Otherwise, the chances are high that the people meant to protect an oil facility will themselves plunder it into destruction. This is not an easy assessment to make. Security teams from the oil companies’ parent country arrive to look at the situation on the ground. Proper coordination with local authorities is required. Any misjudgements could lead to major losses and disasters. India cannot build up a security presence in each and every country where it is granted an oil concession. It just does not have such a capacity. So, the only viable option is to use local security arrangements. Here, those giving insurance to Indian oil companies in their foreign venture take a chance, especially in conflict-prone parts of the world.

Now, let us look at certain specific cases of Indian oil concessions abroad and whether they have succeeded or failed.

In the Russian Far East, the ONGC acquired a stake in the Sakhalin field in 2001. Since then, the Indian involvement has grown here. Russia has much appreciated the presence of India in this context. The Far East is one of the most underdeveloped regions of Russia. It has an extremely low population but vast reserves of natural resources yet to be exploited. The start of the Russia-Ukraine war has made Sakhalin all the more significant. The Russian economy is isolated from the world. Chinese investment is entering Russia in a big way. Beijing is also interested in the Russian Far East. However, the terms and conditions that the Chinese will impose on the Russians to gain oil concessions will differ from those offered by the Indians. The Russians know this. Hence, they, too, want a greater presence of Indian oil companies on their territory.

The Russian Far East has a geo-strategic significance of its own. It is a key pivot to Asia in the northern half of the Indo-Pacific. So, international connectivity will play a big role here. The connectivity in question here will be with East Asia. The East Asian country crucial for India is Japan. Indian working professionals could also start coming to this region to make up for its sparse population. Thus, this is a win-win proposition for New Delhi in the future.

In the case of Sudan, India got an oil concession there by chance. This was due to the country's global isolation because of its human rights situation. Then, the Sudanese Civil War broke out. When South Sudan separated from Sudan in 2011, the oil blocks allocated to India, which straddles the border between the two countries, were split, with a major share of production and reserves now going to South Sudan. Post-secession, as the government of Sudan's share of total production from Sudan was insufficient to meet local refineries' requirements, foreign firms were asked to sell their share of crude oil to it. However, the payment of dues on account of crude oil purchased by the government of Sudan was not received by ONGC, so it could not continue to function there. In South Sudan, things went no better for India. When conflict broke out in that country, the Indian oil sector had to completely withdraw its operations there.

The final case study of Angola offers an interesting contrast. ONGC Videsh tried to buy a stake in an oil block in 2011. It failed in this regard, losing out to the stronger bid coming from Exxon Mobil. The Chinese competition to India here is tough. Chinese oil companies have been present for a much longer time in this country. They also have a deeper connection with the Angolan economy. So, India has a certain amount of catching up to do in this country. This process has begun under the present Indian government. Representatives from ONGC Videsh Ltd, Reliance Industry Ltd, HPCL Mumbai, Engineers India Ltd and Mittal Investments UK Ltd have visited Angola to explore possibilities for cooperation in the oil and gas sector.

Ultimately, what does all this mean for ONGC’s latest success in the South China Sea? The South China Sea is a critical strip of water. India is not a party to the multi-lateral dispute here. It has got this concession through the good graces of Vietnam within Vietnamese territorial waters. Of course, China does not consider these to be Vietnamese waters. So, it will be unhappy that India has got an extension of this concession. This should not worry New Delhi.

Assessment

- As oil entrepreneurs, Indian energy companies have had a mixed record. There have been notable successes and also abject failures. Indian oil companies cannot directly compete with Western and Chinese oil companies on their terms. The talent pool that India offers is New Delhi's advantage.

- Securing energy concessions is a key means of carrying out energy diplomacy. Indian policymakers will have to look at this issue more and more from this perspective.

- The global demand for gas supplies is a major factor for the Chinese drive to secure long-term contacts with suppliers. India should also seek similar long-term deals in which gas can be supplied through ships or, where feasible, through pipelines. However, the obstacle is Pakistan, which has to be motivated to be part of the deal.

Comments