IMF: World unprepared for a slowdown

January 8, 2019 | Expert Insights

David Lipton, the first deputy managing director of the IMF said that the leaders of the world’s largest industries are not prepared to face the consequences of a global economic slowdown.

Background

An economic slowdown refers to a situation when the rate of economic growth in a country is gradually declining. Countries measure economic growth as the total value of goods and services produced in an economy during a specific period of time i.e., the GDP. Hence when there is a gradual fall in the value of GDP, a country experiences a slowdown. As a result, unemployment will rise and overall productivity reduces. Other indicators of a slowdown are when investment spending, capacity utilization, household income, business profits, and inflation fall; while bankruptcies and the unemployment rates are on the rise.

2018 marked the 10th anniversary of the 2008 global financial crisis. The meltdown occurred when the appreciated value of real estate led to high delinquency rates (late or overdue payment of mortgages). This resulted in the value of the assets to plummet and banks who were heavily invested in these assets to experience a liquidity crisis. Several banks in Wall Street had to declare bankruptcies and a global recession followed. The government established the Emergency Economic Stabilization Act of 2008 and prepared a $700 billion stimulus to save the banks. Some estimates note that the financial crisis cost $15 trillion globally.

Analysis

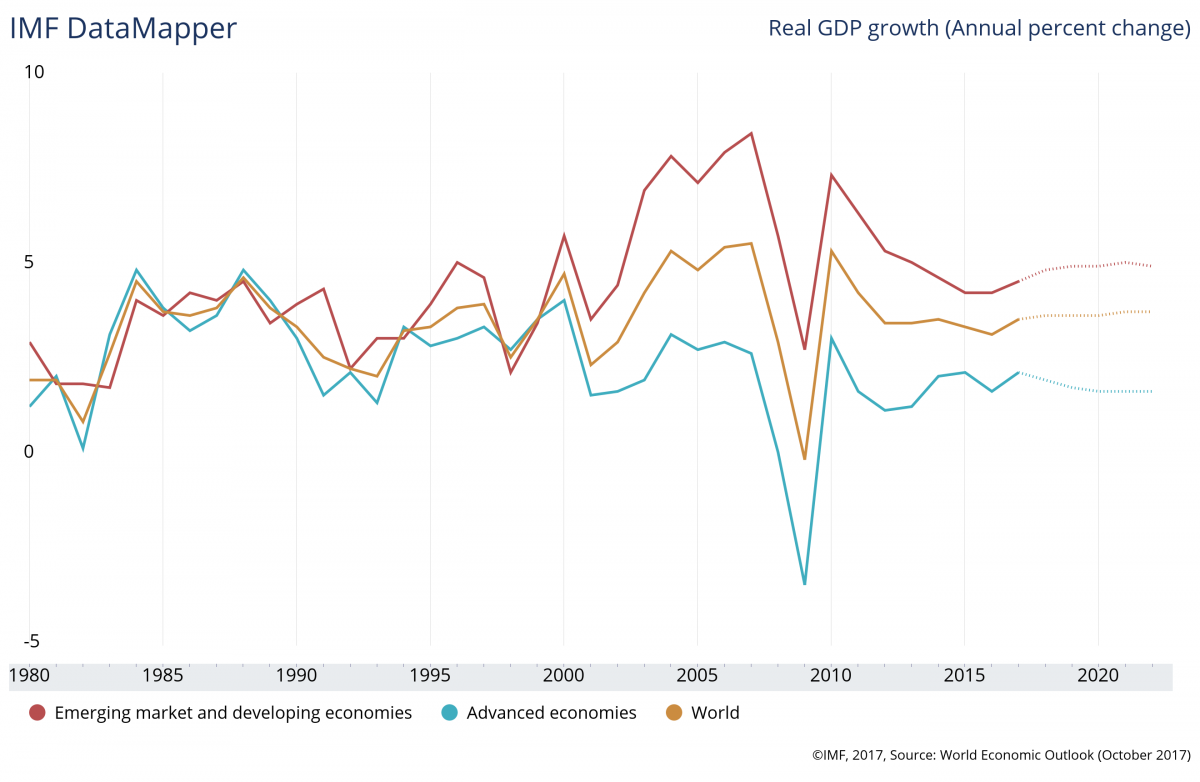

The IMF has warned that another global recession looms on the horizon. In the Economic Association annual meeting the IMF deputy director, David Lipton said that governments and global institutions are underprepared for the next financial crisis. He said that governments, in particular, would find it hard to use fiscal or monetary measures to offset the next recession.

Given these possibilities Mr. Lipton said: “countries should be paying attention to keeping their economy on a level trajectory, building buffers and not fighting with each other.” He also urged that the pressing need now is to work towards limiting the next, inevitable downturn to a "garden variety recession," as the risks of another 2008-style global meltdown remain high.

The IMF had recently projected a growth rate of 3.7 per cent for the global economy, however, Mr. Lipton admitted that the growth outlook is being undermined by trade tensions, policy flaws and weakness in Asia. Global markets are worried about the impact of tariffs on growth. Economic growth has suffered a jump in volatility over recent months, with investors wavering between optimism and despondency about the outcome.

Shehzad Qazi, managing director of China Beige Book International said: “China’s economy was already set to slow in 2019, but the trade dispute has added to it another set of intense pressures.”

According to Ye Tan, an independent economist based in Shanghai, “Economic figures have already started to reflect the downturn but we cannot tell exactly how awful it is.” He said that the impact is big for “some technology companies or larger companies that have bargaining power.”

The IMF is not the only institution predicting or warning about a nearing financial crisis. BlackRock, the world's largest money management firm, released its annual Global Investment outlook, putting the risk of the world slipping into a recession in 2019 at a very scientific-sounding 19 per cent. By 2020, the company predicts a 38 per cent chance of a major downturn, rising to 54 per cent in 2021.

The multinational investment bank and financial services company, JPMorgan has predicted that the next global financial crisis will strike again in 2020. Their study showed that many economies are still supported by the measures taken by governments and central banks across the world in the wake of the 2008 crisis.

Counterpoint

At the Economic Association annual meeting in Atlanta, Larry Kudlow, the White House economic advisor contradicted this outlook, and said that “there’s no recession in sight.” Besides, he urged economists to ignore the swings on Wall Street.

Assessment

Our assessment is that it would be wise for governments across the world to consider these warnings by experts. We feel that the anticipation for a positive outcome of the upcoming trade talks between the US and China will have a significant effect on the global markets and the economy. We believe that it is imperative for global institutions to prepare contingencies to mitigate the impact of another economic meltdown.

Comments