The Great Pakistan-Russia Oil Deal

June 24, 2023 | Expert Insights

Energy diplomacy has always been an important component of the practice of foreign policy. This has generally been either coercive or altruistic in nature. Coercive energy diplomacy was seen when the Arab states boycotted the international oil market in 1973. This was the first time when oil was used as a weapon. Altruistic energy diplomacy occurs when one country gives another special energy concessions or comes to its aid in its time of need.

This is what we are seeing in the case of Russia and Pakistan today. Moscow is sending a number of subtle messages to Islamabad in the process.

Like most emerging economies, Pakistan is also a net importer of its energy requirements and has faced the brunt of rising oil prices due to the war in Ukraine. As per data available in the public domain, the country spends the biggest portion of its import funds, around $18 billion annually, on energy and fuel.

So, it was not surprising that amidst an economic crisis bringing it dangerously close to default, the Pakistani government hailed the receipt of the first batch of Russian crude as a diplomatic victory and called it ‘transformative’ for the country’s economy. While Pakistan insisted on calling the shipment purchased at 'discounted' rates, the Russian Energy Minister Nikolai Shulginov told media that there was no 'discount' involved in the sale. However, instead of dollars (of which Pakistan is woefully short), the payment has been made in Chinese currency, the Yuan.

Background

The twin global challenges of the Covid-19 pandemic and Russia's invasion of Ukraine have been especially devastating for Pakistan's economy. As a country especially dependent on foreign trade and assistance, the pandemic-related shutdown cut it off from the world market. There was no backup plan from the government's side. As a result, the common people paid the price. The Russia-Ukraine war has resulted in a sharp increase in international food and energy prices. Pakistan relies on both food and energy imports for its survival. So, it has felt the full ensuing negative impact.

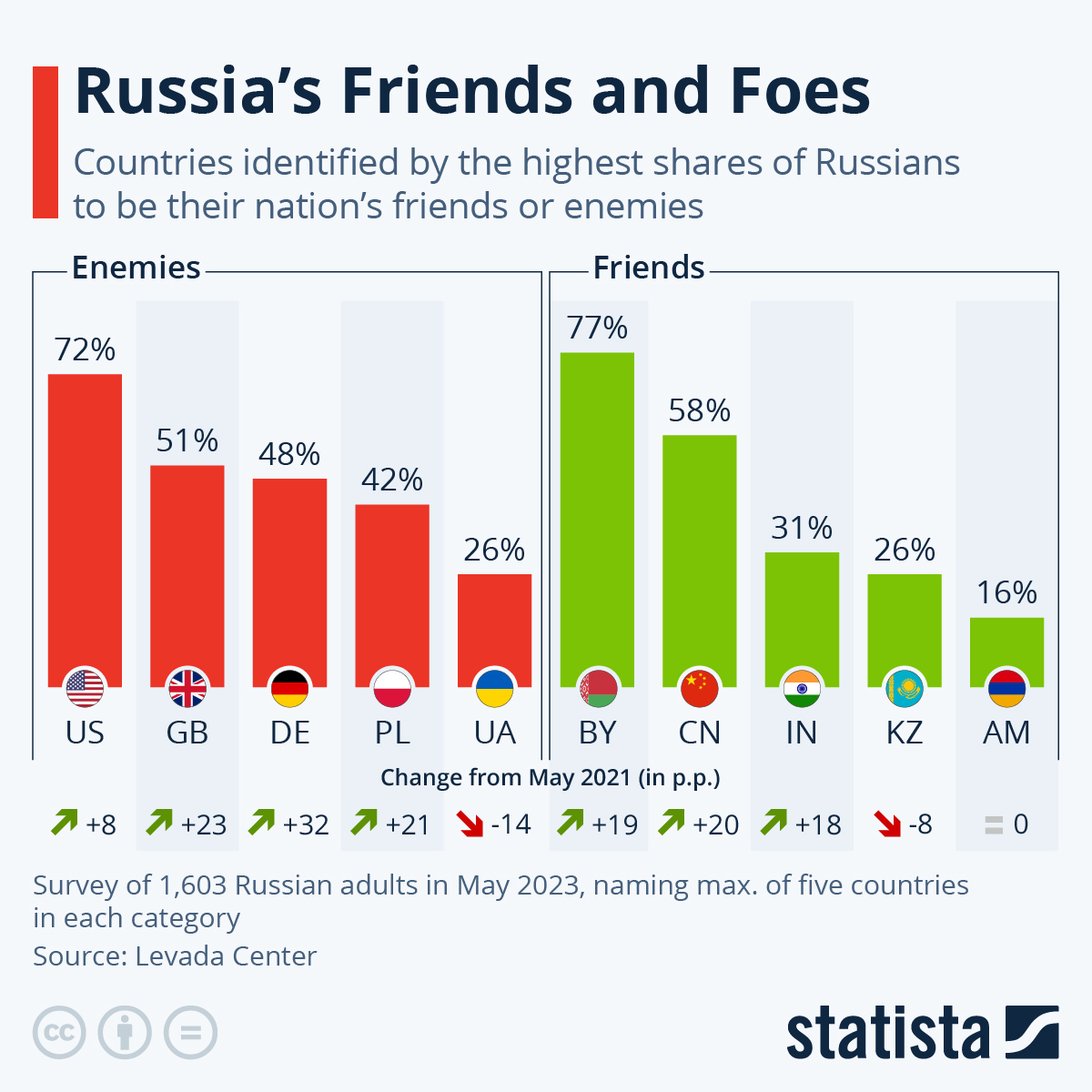

Russia’s vast energy resources saw a sudden flight of its European consumers as the West sought to isolate Moscow internationally. Revenues from this sector have fallen. So, the Russians are desperately searching for new markets. China and India have stepped in to buy huge quantities of Russian oil despite not-to-so-subtle threats from the West. These purchases, allegedly made at lower-than-world market prices, have attracted other consumers to Russian sources, including cash-starved Pakistan.

Reportedly, at the start of the Ukraine war, there was a sharp dip in the price of Russian crude oil, but by April this year, Urals crude stabilised around $35 below the Brent benchmark oil.

Analysis

Spurred by the media coverage of Chinese and Indian taking advantage of the $60 per barrel cap imposed on Russian crude by the Western allies to starve Russian funds from its oil exports, Islamabad has been trying very hard to get a slice of the Russian pie. It has also been exploring the likely U.S. response to any such deal through back channels and has apparently been assured by Washington that as long as the price cap is not breached, they are comfortable with the deal. However, Islamabad has not revealed the price being paid to Russia because Russians may be selling the so-called 'discounted oil' at different prices to different customers, and making this information public could reduce their negotiation power. More importantly, if the Russians have jacked up the prices for Pakistan above the $ 60 cap due to rising global prices, then Pakistan may have to face American enquiry.

Therefore, it is still not clear how beneficial the deal has been to Pakistan in real terms. As per experts, there are many challenges for Pakistan in buying Russian crude in bulk. Technically, Russian crude produces a higher percentage of furnace oil (nearly 45 per cent) than diesel which does not have many consumers in the Pakistani industry. Also, the transportation costs are much higher than Gulf oil considering the distance (Dubai is 1300 km away compared to 8000km for the nearest Russian oil facility) and the rising cost of cargo ships (and insurance premiums) for carrying the oil from Russian ports.

Pakistan's traditional crude oil suppliers are the Gulf nations, and accordingly, the refineries in Pakistan are designed to handle the much lighter Arabian crude. More importantly, in the past, Pakistan was able to secure very favourable credit lines for its oil imports from the Saudis and the UAE; these appear to be drying up in light of the poor credit ratings of Islamabad. It is unlikely that even Russia would supply the oil on credit.

Should India be concerned by this apparent Russian tilt toward its mortal enemy? Not necessarily. Pakistan can have economic ties with any country. That does not mean that they have become iron-clad allies. Moscow’s position on the Kashmir issue and terrorism remains in line with India’s. A Russo-Pakistani axis is still a far-fetched idea.

An air of defiance has been shown towards the West, perhaps miffed by the lack of progress.

Assessment

- From a geopolitical perspective, too much should not be read into this oil deal. A direct security relationship between Moscow and Islamabad seems unlikely. Russia cannot possibly be the saviour that Pakistan hopes it to be for its economy. For the moment, India has nothing to be concerned about this geopolitical development.

- The Russian crude procurement is largely designed to silence domestic critics accusing the current coalition of its non-performance rather than making any remarkable impact on Pakistan’s current economic condition.

Comments