Flooded With Rupees!

July 15, 2023 | Expert Insights

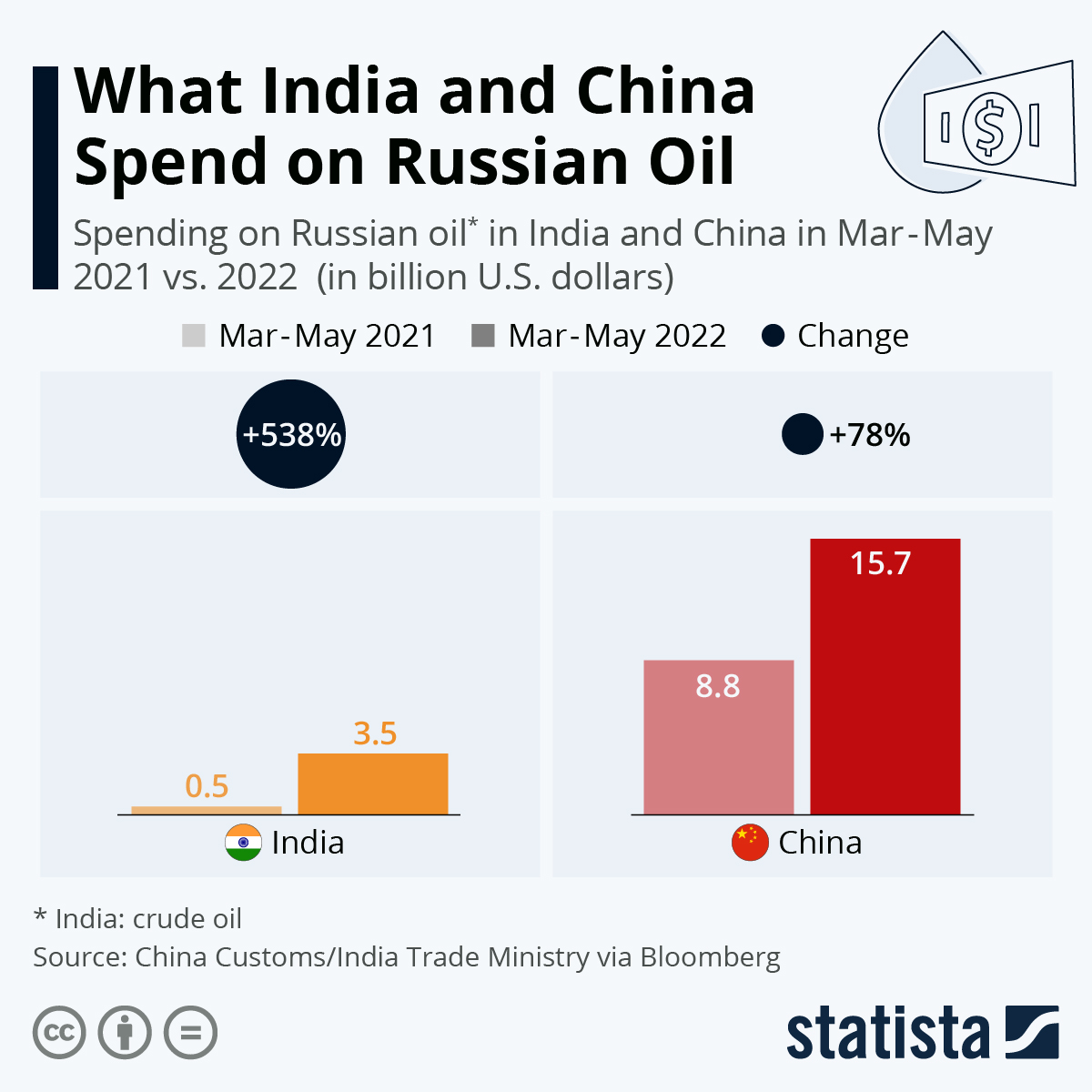

Since Russia launched its special military operation in Ukraine, India's imports from Russia shot up as it moved to avail of discounted Russian oil. In 2022, India's crude oil imports from Russia rose to almost 13 times the quantity imported in 2021. Russia is now India's top oil supplier, replacing suppliers like Iraq, Saudi Arabia, and the UAE.

However, this has led to a trade deficit since India’s imports from Russia far exceed its exports to the country. It also creates a challenge for Russia, which is unable to use the excess rupees that it earns from trade with India. In addition to a balance of payments problem, the two countries face issues with trade payments since sanctions have cut Russia off from the SWIFT payment network and the dollar-dominated trade payments system.

Background

With Western countries cutting their energy imports from Russia, Russia began selling energy at a discount to countries like China and India. Despite pressure from the West, India has refused to join the sanctions on Russian imports. As India has pointed out, as a developing country that relies on energy imports, it cannot afford to not avail of discounted oil. As the world’s third largest oil importer and consumer, India depends on imports for 85 per cent of its petroleum needs.

India-Russia trade relations go back to the period immediately following independence when India was striving to become economically self-sufficient through developing its heavy industry. The Soviet Union invested in many budding enterprises in heavy machinery, mining, energy production, and steel plants. Since then, trade has continued between the two countries in different sectors. India's imports from Russia have typically included petroleum and other fuel products, fertilisers, and agricultural goods. Russia continues to be one of India's leading arms suppliers. In 2022, fuel and fertilisers alone comprised 91 per cent of the trade between the two countries. In the last 26 years, Russian exports to India have increased at an annualised rate of 9.38 per cent from 1995 to 2021, while Indian exports to Russia have increased at an annualised rate of 4.98 per cent during the same period.

Before 2019, more than half of India’s payments for Russian imports were in dollars. However, after India began the S-400 defence contract with Russia, its ruble payments exceeded the dollar. In 2021, 53.4 per cent of India’s total payments to Russia were in Rubles, while 38.3 per cent were in dollars. India became one of the leading countries to switch to the ruble.

Before the Ukraine war, the dollar, euro, and other currencies made up most of Russia's trade payments; its efforts to de-dollarise failed to take off. However, with the war-induced sanctions and its leading banks being cut off from SWIFT, it became economically imperative for Russia to find alternate settlements for its foreign trade.

Analysis

With Russia now India’s leading oil supplier, both sides will have to devise a suitable payment mechanism. There were efforts to reactivate the Soviet-era rupee-rouble mechanism, enabling them to settle dues in rupees or roubles instead of dollars or euros. However, this plan did not come through for several reasons. The rouble faces issues as a trade currency because capital controls maintain its value and is not market-determined as reserved currencies are. It has also become volatile since the Ukraine war.

The most significant problem is India's massive trade deficit with Russia, which reached $43 billion in 2022 compared to its exports at $3.14 billion. Up to $1 billion worth of rupees is building up each month as Russian earnings in Indian banks, and Russia has limited options to use this accumulated stock of rupees. It is difficult to send the excess rupees back home due to Indian restrictions on foreign capital flows. Russia is considering ways to convert the rupee into other currencies.

India and Russia are also exploring ways for Russia to use the stock of rupees. One option is for Russian entities to invest in India’s capital markets. Another option is for Russia to invest the rupees in equity in infrastructure projects in India. The two countries have also devised a make-in-India solution where Russia will invest most of its rupee earnings in establishing industries in India to manufacture products that would then be exported to Russia. The exporting manufacturers could be fully Russian-owned companies or joint ventures.

Another alternative currency for trade payments is the yuan, which some Indian oil importers have been using. However, this poses a geopolitical problem for India, which has strained ties and political differences with Beijing.

Russia is likely to be more open to solutions or settlement mechanisms that are accompanied by reduced trade deficit through increased Indian exports. The exit of Western companies from Russia could encourage Indian businesses to enter the Russian market. With the West at a distance, it is an opportunity for Russia to develop partnerships with Indian companies.

Assessment

- Russia and India will have to devise a new trade payment mechanism or explore ways for Russia to use the accumulated rupees.

- A solution that addresses the trade deficit is more likely to be long-lasting. For India, rupee payments are the best possible option for now. If the two countries can utilise the rupees through investment and production in India, it could benefit both of their economies and deepen bilateral trade.

- Any solution that does not address the gaping trade deficit will not likely be more than a short-term solution. If the balance of trade problem is not resolved, Russia may eventually revert to the traditional Western currency trade system.

Comments