FIGHT FOR SILICON SUPREMACY

August 12, 2022 | Expert Insights

The CHIPS and Science Act of 2022, signed by President Joe Biden on August 9th with much fanfare, is a large calibre volley fired by the U.S. in its Tech War with China. Critics of the Act would call it too little too late, as the common perception in the tech world is that Beijing has already established an unassailable lead in cutting-edge high-tech segments like quantum computing and artificial intelligence, to name a few.

In his speech on the occasion, the President called the new Act a game changer. “This bill is about more than chips. It's about science as well… It authorises funding to boost our research and development funding… This increased research and development funding is going to ensure the United States leads the world in industries of the future, from quantum computing to artificial intelligence to advanced biotechnology,’ he said.

Backed by a massive $ 52 billion budget, the Act could potentially change the landscape of the global chip market.

Background

The focus of the new Act would be on the lucrative semiconductor industry, which has become the heart of all devices today. Disruptions caused by the pandemic on the chip supply chains and the pressure exerted by the U.S. on its Asian allies, who dominate chip manufacture, have created a global shortage of semiconductors that is seriously impinging on the manufacturing industry especially big time players like the automobile sector.

What triggered this response from the U.S. is not far to seek. In 2021, President Xi Jinping pledged 1.4 trillion dollars to accelerate China's tech industry – a move that could make China utterly independent from foreign technology. SMIC, China's largest semiconductor chip manufacturer, recently signed an agreement to build a 2.5-billion-dollar semiconductor foundry. In the years to come, we can expect more private-public partnerships where private entities such as SMIC drive more efficient private capital into national objectives.

Stunned by the size of the Chinese investment, an American retort was on the cards. The gloves are now off, and the Americans have made their intentions crystal clear. By taking away the core elements of all modern electronic devices, the U.S. would hamstring the Chinese rise as a tech superpower, a position that was claimed by the U.S. since the end of World War II.

It is not only China that is on the docks; the Taiwan Semiconductor Manufacturing Company, better known as TSMC, the largest chip manufacturer in the globe, could fall into Chinese hands like a ripe plum, a contingency that no longer appears remote. American dependence on Asian manufacturers is a risk that the U.S. cannot afford in these dangerous times. It has been a wake-up call for the U.S. to bring the industry home, irrespective of the cost involved.

Analysis

From Beijing's perspective, U.S. sanctions are a way to keep China at the bottom end of the supply chain, forever stuck as a low-level manufacturing hub. The Chinese Embassy in Washington was quick to respond, calling the Act a “Cold War mindset.”

China has not been sitting ideal, but things have been getting difficult. Over the years, there has been a decline in the talent available in the field of hard sciences. China has been accused of stealing talent away from Taiwan's multi-billion-dollar semiconductor industry, which is among the most efficient in the world. China is giving its chip industry the attention it gave to its atomic bomb programme, which could mean some serious trouble for the U.S.

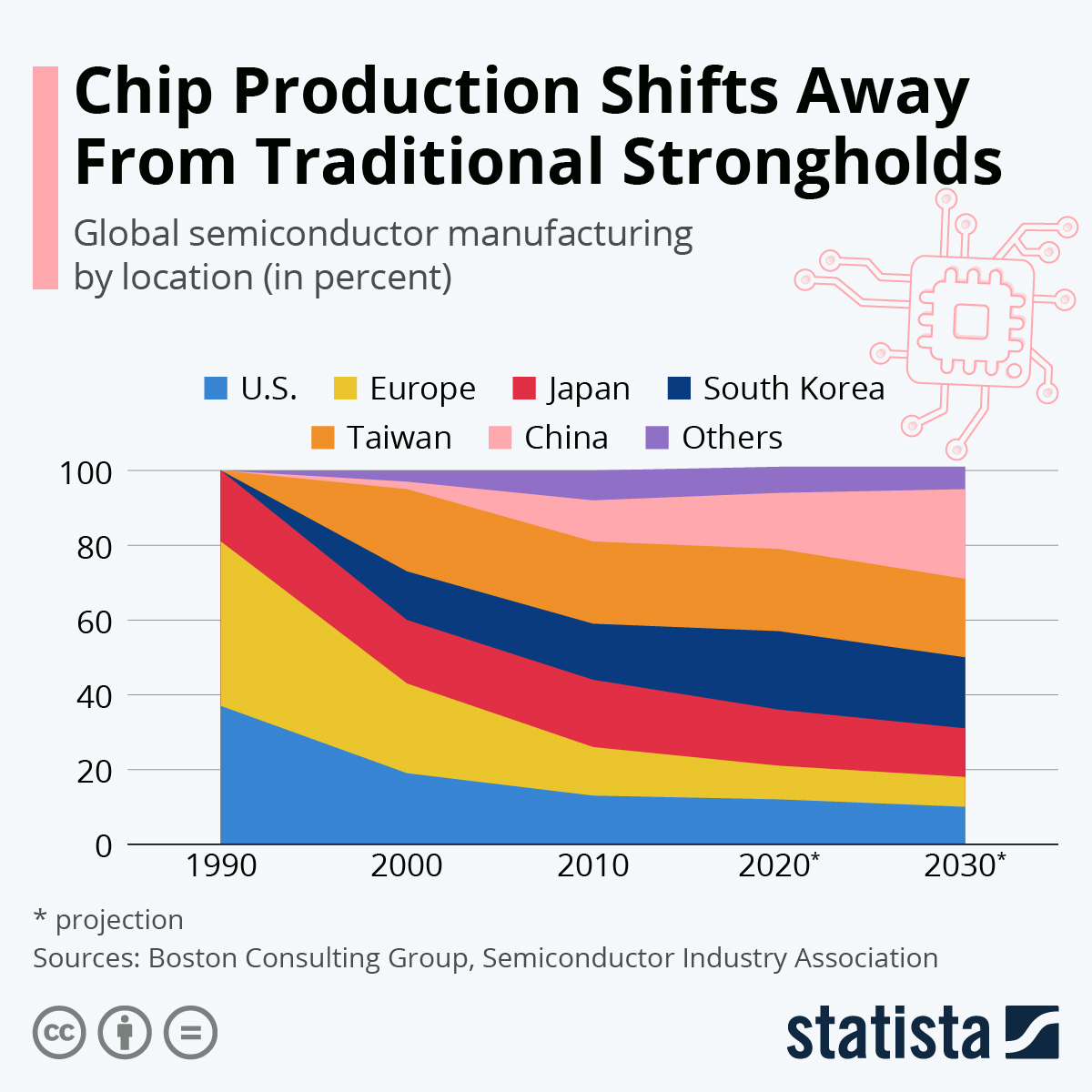

As of recent reports, the U.S. accounts for only 10 per cent of the global semiconductor manufacturing industry, a number they hope to increase exponentially in the future. According to the Semiconductor Industry Association (SIA), the United States today accounts for just 12 per cent of global chip production capacity, which is three times lower than in 1990. According to the SIA, just four new factories will be established in the United States by 2020, compared to ten in China, ten in Taiwan, five in South Korea, five in Japan, four in Europe, and one in Singapore.

The new Act could be a chance for businesses, the scientific communities, and universities to collaborate and widen the United States' role on the semiconductor map. The CHIPS Act also paves the way for them to boost representation within the tech industry.

If China invades Taiwan, the U.S. understands there is no replacement for TSMC. This choke point came to light during a chip shortage during the pandemic that cost the auto industry billions of dollars. The U.S. is planning to impose a limit on the exports of U.S. chip-making equipment to China.

U.S. President Joe Biden has also announced a new Chip 4 Alliance – which serves as a strategic partnership between four semiconductor industry's global powerhouses, including South Korea, Japan, Taiwan, and the U.S. China has been very critical of South Korea joining the Alliance, going so far as to deem it "commercial suicide", thereby implying a potential cut-off from the Chinese market. China believes this move could disrupt the global trade value and supply chain.

The fact is that no country today is entirely independent in the manufacturing of semiconductors. Companies along the semiconductor value chain pursue economic efficiency using various processes and technologies (such as design, production, and assembly). In the sector, however, no area has gained strategic autonomy. Taiwanese foundries manufacture the chips for U.S. fabless firms. In turn, the foundries rely on equipment, chemicals, and silicon wafers from the United States, Japan, and Europe. As a result of technological complexity and the necessity for scale, many firms with business models centred on a single layer of the semiconductor value chain have emerged.

India would do good to learn from the Chinese lesson of self-sufficiency. Indian Prime Minister Narendra Modi announced a $10 billion plan for the semiconductor industry in India. As of 2021, a total of U.S. $75 billion has been invested in the semiconductor industry in India.

Assessment

- Since semiconductor value and supply chains are closely interlinked, it will be tough to eliminate the U.S.'s dependence on China in the short term entirely. Still, the CHIPS and Science Act by the Biden administration is a good start.

- Looking at the prospective future of the semiconductor industry, the worst outcome would be a complete decoupling that could lead Chinese chip firms to "design out" U.S. technology standards. This would, in turn, create two separate ecosystems that would ultimately result in higher costs and a loss in innovation for the end-users of semiconductors.

- The need of the hour is the need for Indian-designed chips where the intellectual property remains Indian. But to achieve this, a massive collaborative effort between the Government, the private industry, especially the technology industry, and our scientific community, including R&D organisations, would be required. Else, India would continue to be relegated to the status of a low tech manufacturing hub.

Comments