Endangering Carbon Neutrality?

September 16, 2023 | Expert Insights

Theoretically, BRICS is the biggest multilateral framework that provides a forum for developing economies to interface with each other and establish policy mechanisms for sustained growth. However, whether it has succeeded in hedging against hegemonic structures that an over-dependence on developed countries might create remains debatable.

The most well-covered news from the recent BRICS summit held in South Africa (apart from the glaring absence of President Putin under an ICC arrest warrant) was that some of the richest oil economies have been welcomed into its fold with much fanfare.

Background

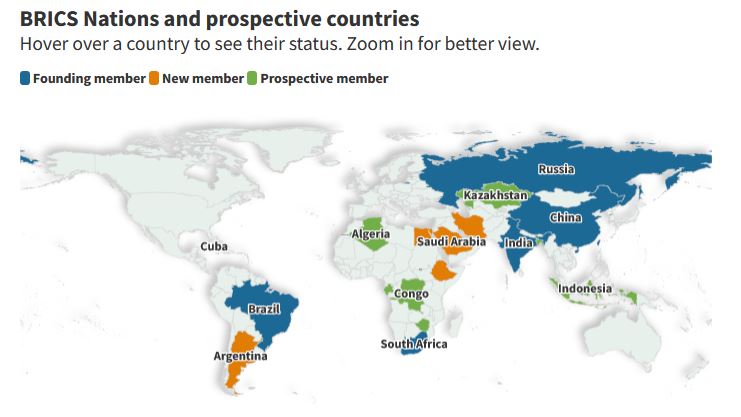

The Johannesburg summit saw six developing economies added to the bloc, resulting in the formation of BRICS+6, a potential economic powerhouse comprising 31.5 per cent of the global GDP. This is a significant event given that it turns the power dynamic with respect to the G7 group of developed economies, which in turn form 30 per cent of global GDP.

Over the past decade, BRICS countries have grown in population, with an expected increase of 625 million people by 2026, forming the basis of the global workforce in the future. With 5 per cent and 2 per cent increases in merchandise trade share and share in traded services, respectively, BRICS+6 is a competitive economic force.

However, the most significant development is the inclusion of Saudi Arabia, UAE, and Iran in the bloc. This cements a 22 per cent increase in the share of global oil production, resulting in BRICS+6 being home to 40 per cent of global oil!

Analysis

Clearly, for the first time, BRICS could hold a great influence over oil trade, with the three largest aforementioned exporters of oil aside from Russia and the two largest importers (China and India) residing within the same bloc. In fact, the trade bubble would prove so lucrative that oil sales in national currencies are an outlook for most BRICS+6 countries, desiring to move away from the dollar due to political motivations not limited to economic losses incurred during trade sanctions on Russia in the Russia-Ukraine war.

However, there are the Sustainable Development Goals (SDGs) and Vision 2030 to consider. The goal with respect to carbon neutrality stands at not exceeding a 1.5 per cent increase relative to pre-industrial levels of carbon emissions. The biggest area of consideration is the actions of BRICS economies, which voice the status of developing economies. Economic growth while divesting from fossil fuel trade is the challenge for developing economies in order to achieve carbon neutrality by 2030. However, the recessionary past few years - post-pandemic and Russia-Ukraine war - have created an incentive for developing countries to accelerate and optimise oil production and trade in the short term to boost industry and serve the needs of a growing population.

With the inclusion of a dominant oil bloc in BRICS it signals a move towards short-term fossil fuel trade, potentially in national currencies independent from Western interests. In some quarters, especially amongst climate activists, this could be perceived as hindering carbon neutrality goals as envisioned in the SDGs and Vision 2030.

According to the academic perception of the environmental Kuznets curve, a short-term increase in fossil fuel consumption results in a long-term decrease once an economy is developed enough to divest. However, this idea has been proven deficient as there has been a growing malaise in the developing world against Western backtracking on climate finance imperatives. The expectation for developing economies is to leapfrog fossil fuel-driven mechanisms for development and adopt alternative energy sources. Climate adaptation financing from top global carbon emitters, often developed economies, is crucial towards this. However, a decade-long frustration against lack of climate financing and diplomatic ambiguity from the West has led developing countries, especially those in Africa and coastlines most affected by climate change, to resolve towards a new multipolar framework to derive its interests from - BRICS+6 being a key element.

The concern is that while BRICS+6 is reliable in support for emerging economic development, the situation regarding carbon neutrality and divestment from fossil fuels remains ambiguous. The recent rupee-mediated oil trade between India and UAE and incursions of Chinese and Indian oil extraction firms in the Russian Far East signal an opposite movement of interests, harmful to global goals, at least in the short term.

The long-term vision towards carbon neutrality is a different story, however. BRICS countries have pledged ambitious targets that may skirt Vision 2030 but provide an alternative aspiration for carbon neutrality. China, the biggest emitter by far, has pledged carbon neutrality by 2060. India has set the ambitious task of shifting 40 per cent of electricity generation towards renewable sources by 2030. Brazil’s Lula da Silva's political campaign is formed on the basis of a reforestation programme of 12 million hectares in the Amazon by 2030. Independent BRICS institutions such as the New Development Bank and the Business Council for Sustainable Development aim to accomplish these targets, separate from traditional multilateral institutions such as the World Bank, IMF, and UNFCCC.

This indicates the presence of a new forum for norm-setting climate action goals in the coming decades, especially for developing economies, signalling two key attributes - a development-sensitive approach to long-term carbon neutrality and climate financing and a reaction away from Western backtracking on climate financing targets. Given that developing economies are at a greater risk of climate-related crises in the upcoming decades, a responsible alternative to the current climate regime is the need of the hour. This, however, begs the question, how does the inclusion of oil-based gulf countries like Saudi Arabia and UAE, in addition to Iran, align with these long-term interests towards carbon neutrality?

This defines the diplomatic ambiguity of BRICS+6 as it concerns decarbonisation and climate action in general over the coming decades. BRICS remains a conglomeration of developing economies with convergent economic interests but heterogeneous foreign policies, in this case with regard to carbon neutrality. Given the primacy of economic development within the bloc, the countries are not aligned in action for carbon neutrality and never will be. However, each country has outlined unilateral commitments towards the carbon neutrality goal - albeit varying in importance and long-term priority. The resulting structure is a democratic, consensus-based structure where larger economies enjoy greater influence. This creates an ambiguous order that will define divestment policy for fossil fuels in the coming decades within BRICS+6.

Will the environmental interests of influential economies like China, India, and Brazil accelerate climate consciousness of gulf oil interests in the medium-to-long term or will the development agenda favour fossil fuel trade, hindering goals of carbon neutrality in the same time period? It remains to be seen.

Assessment

- Just like the SCO, the BRICS is also a complex composition of contradicting interests with differing approaches to the Great Satan-the Rich West. So, how effective it will be as an economic platform and in the drive towards de-dollarisation and providing an alternative to IMF and WB remains a matter of conjecture, at least in the short term.

- Similarly, the concerns that it may derail global carbon neutrality goals when the biggest oil consumers and producers sit at the same table may be a bit premature. At best, it could be a message to the Global North to generously open their purses to climate financing! After all, the emerging economies are facing the brunt of catastrophic climate events.

Comments