Cryptocurrency exchange hacked

December 30, 2017 | Expert Insights

A South Korean cryptocurrency exchange has declared bankruptcy after a hack resulted in the loss of 17% of its total assets.

The value of cryptocurrencies like Bitcoins have continued to rise in 2017. Experts now state that this is in a dangerous bubble.

Background

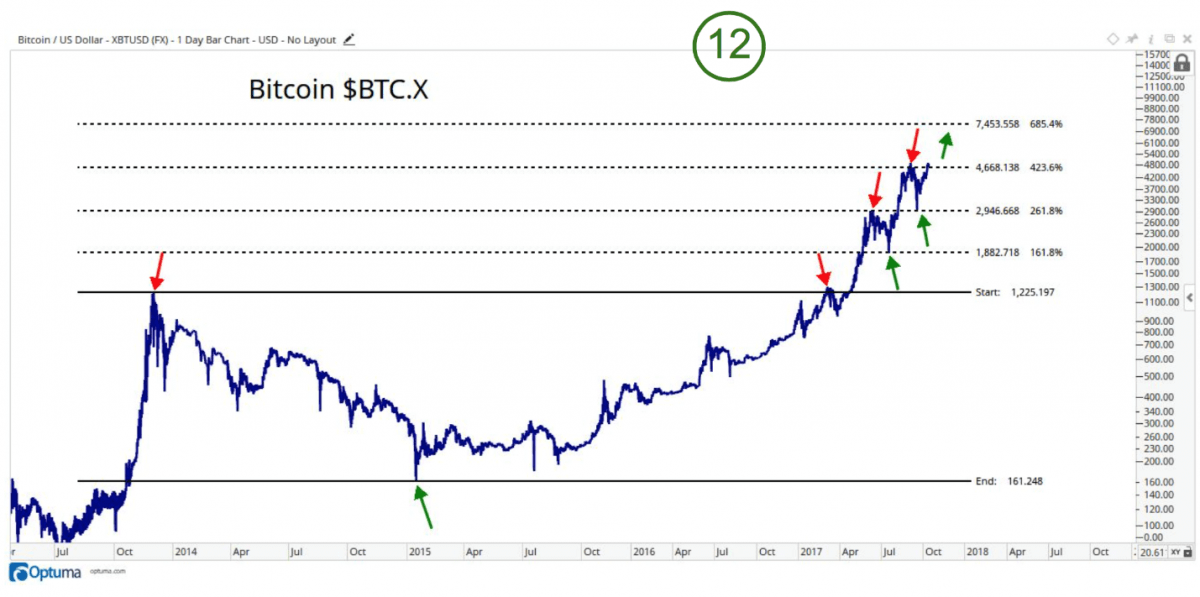

Bitcoin’s price has risen stratospherically in 2017. It shot past $16,000 during trading in December after climbing some 67 percent over one week. The value at times has climbed on an hour to hour. This has increased the debates around the cryptocurrency. Some believe that it is currently in a bubble and will burst.

Cryptocurrency is a digital asset (in other words a form of digital money) that is designed to stay secure. It uses cryptography to secure its exchanges making it nearly impossible to counterfeit. Cryptocurrency, in particular, is classified as a subset of digital currencies. Bitcoin was the first decentralized cryptocurrency.

Bitcoin is a community-run system. It has often been referred to as the first “start-up currency”. By the beginning of 2015, there were 100,000 merchants and vendors who accepted Bitcoins as payment. Bitcoins have been used in illegal trade online as well. Critics argue that digital cash systems are volatile and speculative in nature and comes with a number of inherent risks.

One of the reasons why cryptocurrencies, in general, have become so popular is due to the fact there is no middle man in this system. Transactions are made with no middlemen and therefore there is no use for banks in this system either. The currency cannot be printed and there are no transaction fees. Additionally, there is guaranteed security in the transactions as there is no need to give your real name.

Analysis

Bitcoins have traded dangerously high despite the fact in November the company behind tether, a cryptocurrency used by bitcoin exchanges was victim to a theft. Nearly $31 million worth funds were stolen from the company. The tether in a statement noted, “Yesterday, we discovered that funds were improperly removed from the Tether treasury wallet through malicious action by an external attacker. Tether integrators must take immediate action, as discussed below, to prevent further ecosystem disruption. $30,950,010 USDT was removed from the Tether Treasury wallet on November 19, 2017, and sent to an unauthorized bitcoin address. As Tether is the issuer of the USDT managed asset, we will not redeem any of the stolen tokens, and we are in the process of attempting token recovery to prevent them from entering the broader ecosystem.”

Another large hack took place in South Korea. A cryptocurrency exchange called Yapian, a company that owns the Youbit exchange in South Korea, filed for bankruptcy after a hack resulted in the loss of 17% of its cryptocurrency. Tether, with a market capitalization of $673 million, is the world’s 19th most valuable virtual currency, according to data on Coinmarketcap.com. In a statement, the company stated, “After the accident in April, we have done our best to improve the security, recruitment and system maintenance, and have managed to lower the hot wallet rate. Then, at 4:35 am, we lost our coin purse due to our hacking.” It added, “However, in order to minimize the damage to our members, we will arrange for the withdrawal of approximately 75% of the balance at 4:00 am on December 19. The rest of the unpaid portion will be paid after the final settlement is completed.”

Youbit’s systems were breached earlier this year in April 2017. The hack resulted in the value of Bitcoin to drop temporarily. It fell around 10 per cent on Wednesday to $15,800, before rebounding to $17,000 late afternoon.

Henri Arslanian, a fintech specialist at PwC, said, “The Mt Gox scandal in 2014 slowed the momentum of bitcoin globally. But the crypto universe is much bigger now that an issue with one exchange is less likely to have the same significant global impact. Many expect more cyber attacks in the crypto space in the foreseeable future. The pressure on crypto exchanges to continuously improve their security features may come from their retail and institutional clients who will expect the same level of security that they do from their traditional banks and brokers.”

Assessment

Our assessment is that the latest attacks have proved that cryptocurrencies are highly susceptible to hacks and breaches. This could possibly negatively impact financial structures across the world. There is also the fear that Bitcoins and other cryptocurrencies are in a bubble and if it were to burst, that could trigger another financial meltdown.

Comments