The Crypto Dilemma

February 4, 2023 | Expert Insights

Notwithstanding the huge wins and breakthroughs in the valuation of crypto assets in 2021 that infused confidence and optimism in crypto enthusiasts, 2022 was undoubtedly tumultuous: the crypto industry witnessed the dawn of the “crypto winter”, failed algorithmic “stablecoins” besides the steep domino effect due to a host of implosions and bankruptcies in the stockpile.

El Salvador, was the first state to declare Bitcoin a legal tender in 2021, in a bid to escape inflationary pressures, distance itself from colonial currency mechanisms while acquiring the ability to track every unit of currency spent. However, according to a report by Binance, the 2,301 Bitcoins the country had purchased between September 2021 and July 2022 for nearly $104 million. has devalued to a mere $44 million, leaving El Salvador with a massive impairment loss, it might take decades to recover from.

In 2022 traders all around the globe who invested in volatile cryptocurrencies and crypto-based assets such as non-fungible tokens (NFTs), faced the pernicious market effects of the Ukraine war, fall of the Terra [LUNA] cryptocurrency, the abrupt freezing of withdrawals by crypto lenders, mass layoffs across IT and fintech companies, collapse of the FTX exchange and more financial-legal regulatory action from governments worldwide.

Despite the huge number of industry upheavals and value depreciation over the past year, it is imperative to distinguish between lapses in blockchain technology and market failures that result from erroneous human judgement and poor investor decision-making. Moreover, 2022 was not all bad for the crypto industry: we saw an increasing mainstream adoption of crypto currency worldwide, and it also made its presence felt in celebrated sporting events such as FIFA World Cup Qatar 2022 and The Super Bowl. The multiple crypto events held across the various regions amongst industry leaders and regulators only highlight the prominence of cryptocurrency and blockchain technology in the financial sector which is set to progressively expand in 2023.

At the 2022 World Economic Forum's annual Davos conference, India called for global cooperation to tackle the challenges mounted by the crypto industry. In 2023, India's G-20 presidency, which involves some of the world’s largest economies, has set one of its main priorities to build a consensus for regulatory and general approach towards crypto assets, which sets the stage for India to spearhead the formation of global policy consensus on crypto assets.

Background

Since its birth in 2008, cryptocurrency has expanded to become a popular and important component of the global financial system because of their ability to alter existing financial structures. These changes, however, are shrouded in significant concerns about their potential negative impacts on markets, investors, users, the environment and on the overall monetary and fiscal stability of a country.

Cryptocurrency are new forms of digital assets which involve transactions and records maintained through a decentralized system using cryptography, rather than by a centralized authority, and thus is theoretically rendered immune to government interference or manipulation unless expressly regulated.

Thus, they are considered more vulnerable to criminal activity and money laundering because they provide greater anonymity compared to other payment methods since the public keys entrenched in a transaction cannot be directly backward-linked to an individual.

In fact, 3.8 billion dollars worth of cryptocurrency is how much hackers from North Korea stole, in October 2022; however none of them could be individually identified according to Chainalysis.

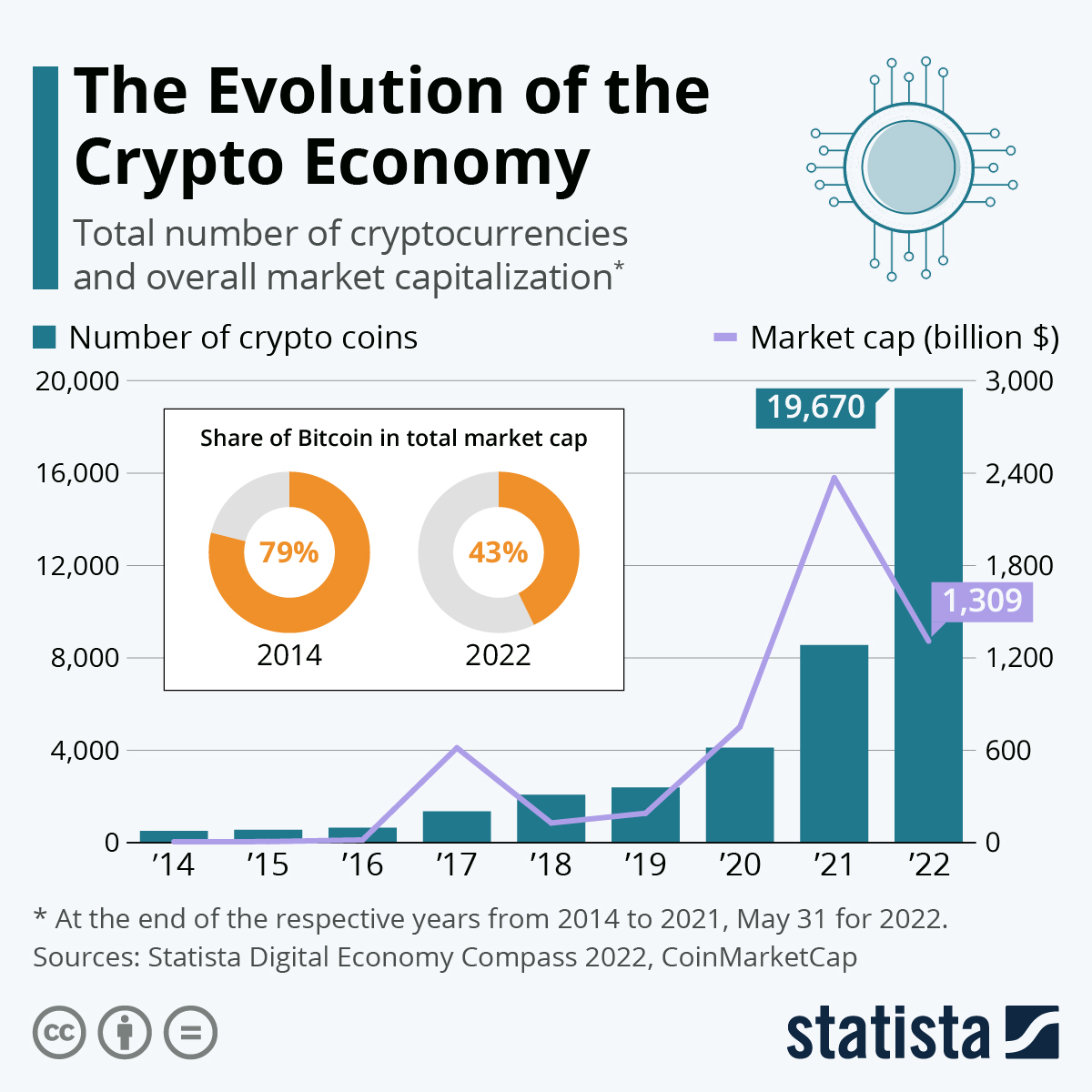

The crypto asset market has also been very volatile, steeply dropping from almost US$ 3 trillion in November 2021 to less than US$ 1 trillion in Jan 2023. Bitcoin and ethereum, the two biggest cryptocurrency fell by more than 50% from their all-time peaks which has underscored their governance problems stemming from decentralisation, as well as the complexity and increasing non-transparency of the crypto ecosystem. Therefore, with the related financial stability risks rising, the current focus is to promulgate regulations to bypass these issues while fomenting the innovative capacities of cryptocurrencies.

Analysis

Cryptocurrencies are wholly legal in ten G20 countries, which account for over half of the world’s GDP, while crypto regulation is under consideration in all G20 countries, mainly through tax policy, licensing requirements and partial institutional adoption of crypto payments to try and understand the crypto market better.

The U.S. government has increasingly expressed interest in new regulations for cryptocurrency.

In 2021, Federal Reserve Chair Jerome Powell said that he had “no intention” of outlawing cryptocurrency in the U.S. Corroborating him, the World Economic Forum has stated that banning crypto might not be the right approach, since the fluctuations in the sector are related to its infancy and that it is constantly evolving, as was seen during the early years of the internet.

Sensible and transparent regulations like advertising and cybersecurity requirements for service providers as well as investor accreditation could guarantee more stability in a notoriously volatile crypto market, besides having the potential to protect long-term investors, prevent fraudulent activity such as money laundering within the crypto ecosystem, ensure tax compliance of virtual assets and provide clear guidance to companies to enable innovation in the crypto economy — as long as it strikes the right balance between profit and protection. This would positively correlate to building investor confidence, leading to crypto asset creation and appreciation.

As per a research report by the Bank of America (BAC), 2023 will see an acceleration in the adoption of blockchain technology solutions in real-world applications such as financial services, banking, and insurance, healthcare and pharmaceutical sectors as well as e-Commerce and retail because the decentralized nature of blockchain technology enables a seamless and secure data storage system while eschewing the need for depending on third-parties.

Particularly a high demand for blockchain solutions exists in the traditional finance space, with players like J.P. Morgan conducting the first cross-border fixed income transaction on a public blockchain. Goldman Sachs also announced that they would be undertaking due diligence on multiple distressed crypto projects in 2023. Such a rise in the adoption of crypto and blockchain technology by institutional investors can harbour more use-cases for the asset while ushering a positive change for the industry.

Concurrently, a wider mainstream adoption of crypto and blockchain in 2023 would increase the demand for Web3 talents, thereby opening up relevant job opportunities. This is good news especially for India which is currently home to more than 450 Web3 start-ups and hosts around 11% of the global Web3 and crypto talent.

Bitcoin, the largest cryptocurrency by market capitalization is a good indicator of the outlook on the crypto market. There has certainly been a decline in the value of Bitcoin and of the crypto market as a whole from its 2021 heights, but total market capitalization still stands at 880 billion USD which amounts to more than double of its 2020 peak. Experts in the industry have maintained that the present lull period and uncertainties won't last indefinitely and investors that have sufficient resources to tide over this trough will be able to prevail and spearhead the narrative for the crypto growth and high returns in 2023.

2023 might also see bigger, global corporations jumpstarting the mainstream adoption of crypto in the context of Amazon recently making moves to that end by opening a posting for a 'digital currency and blockchain product lead'. With huge retailers like Amazon adopting cryptocurrency, it is bound to infuse credibility in the system and create a chain reaction of others accepting crypto payments.

Assessment

- Stablecoins, backed by a fiat currency, are predicted to be the next frontier of crypto regulation. Most countries uncomfortable with crypto volatility, but keen to utilise its many benefits are planning to usher in central bank digital currency (CBDC) projects, which are relatively secure and stable.

- Cryptocurrency is borderless and decentralised; therefore, any legislation whether for regulating or banning the assets would require international collaboration to eliminate arbitrage and foster harmonisation of currently disparate crypto taxonomy and standards.

- An outreach programme should be locally organised to create awareness among investors and consumers as well as close their knowledge gap regarding the real financial risks because crypto-assets are still being widely promoted in a risky manner despite the recent turmoil and huge losses in the sector.

Comments