Chinese factory activity shrinks

January 4, 2019 | Expert Insights

As a result of the trade tensions with the US, China’s manufacturing sector contracted in the end of 2018 for the first time in 19 months. It is signalling a renewed deterioration in manufacturers’ operating conditions amid weakening market demand.

Background

China and the United States are engaged in a trade war as each country continues to dispute tariffs placed on goods traded between them. US President Donald Trump had promised in his campaign to fix China's "long-time abuse of the broken international system and unfair practices".

In April 2018, the United States filed a request for consultation to the World Trade Organization in regard to concerns that China was violating intellectual property rights. In adding various tariffs, the U.S. administration is relying partly on Section 301 of the Trade Act of 1974 to prevent what it calls unfair trade practices and theft of intellectual property.

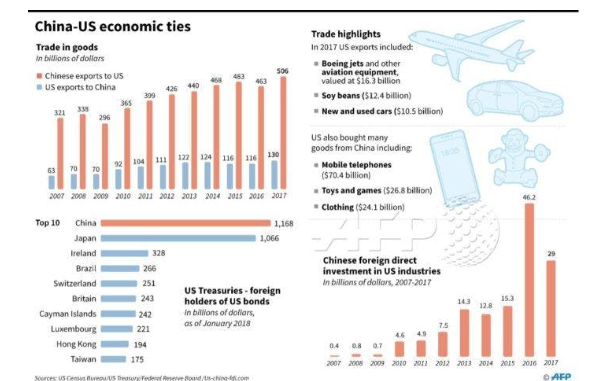

The U.S. trade deficit with China was $375 billion in 2017. President Trump promised to lower the trade deficit with China. US and China imposed tariffs on each other until the G20 Summit. US and China agreed to halt levy of new tariffs for 90 days at the summit in November 2018.

Analysis

China’s official manufacturing purchasing managers’ index (PMI) which was released in January showed a slowdown in activity for the month of December as the sector contracted for the first time in more than two years. Factory activity reduced for the first time in 19 months amid a trade dispute with the U.S.

The Caixin/Markit Manufacturing Purchasing Managers' index (PMI) fell to 49.7 in December from 50.2 in November. A reading above 50 indicates expansion, while a reading below that level signals contraction. In December, two separate measures for new orders and new export orders showed contraction, the Caixin survey showed. New orders, an indicator of future activity fell for the first time in two and a half years, with companies reporting subdued demand despite some price discounting. New export orders shrank for the ninth month in a row.

The PMI suggested small and mid-sized firms were seeing a sharper deterioration in business conditions than larger companies, a trend that policymakers have repeatedly tried to address through special loan programmes and steps to reduce operating costs. While production edged higher after two months of stagnation, factories cut jobs for the 62nd month in a row.

"That showed external demand remained subdued due to the trade frictions between China and the U.S., while domestic demand weakened more notably," wrote Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin. "It is looking increasingly likely that the Chinese economy may come under greater downward pressure," Zhong added. "The slide in China's PMI is "worrying" as there will be broader fallout on Asian exporters" said Vishnu Varathan, head of economics and strategy at Mizuho Bank. "I do believe, of course, the economy in China is decelerating. I do believe the numbers are worse than reported, of course, in that type of political environment where there's strong censorship, where media is essentially prevented from reporting," said Alex Capri, a visiting senior fellow at NUS Business School.

China's economy has been facing its own domestic headwinds. Even before the escalation in trade tensions with the US, Beijing was already trying to manage a slowdown in its economy after three decades of breakneck growth. Beijing's sustained drive to reduce debt risks in the economy has cooled the property market and curbed credit flows to the private sector. Meanwhile, the government's intensified crackdown on pollution has dented industrial activity.

China's weakness spilled over to other Asian economies, with Malaysia's manufacturing activity shrinking to its weakest pace of expansion since it launched the survey in 2012 and Taiwan contracting to its lowest since September 2015. Economic data from the world's second-largest economy is being closely watched for signs of damage inflicted by the ongoing trade war between Washington and Beijing.

Assessment

Our assessment is that trade war has resulted in billions of dollars of losses for both sides this year, hitting industries from autos and technology to U.S. agriculture. We feel that in this year Chinese economy will feel the strain of trade tensions even more which is likely to take a toll on Asian manufacturing hubs.

India Watch

India’s share in global merchandise exports is at 1.7 per cent compared to China’s 12.8 per cent. India will focus on boosting its exports to the US and other global markets as Chinese shipments become unattractive amid a trade war between the world’s biggest economies, the country’s trade minister said New Delhi is focusing on a handful of items including automotive parts, chemicals, electrical equipment.

Comments