China: Tremors in the Economy?

June 9, 2023 | Expert Insights

The year started on a positive note, with Chinese shares performing incredibly well over the past six months, as investors placed their hopes on the country's expected economic recovery following the abolishment of pandemic restrictions. However, stocks of Chinese companies around the world have lost about $540 billion in value after China released data on its first-quarter economic output on April 18th.

Certain impacts of the ongoing tensions with the U.S. were expected, especially when the assorted U.S. sanctions started taking effect on key Chinese industries. Not surprisingly, investor confidence adopted a cautious approach as they began to limit their investments in China.

Background

Relations between the United States and China have grown increasingly tense over the past few months, as the U.S. increases sanctions against key Chinese industries, and Beijing displays a growing distrust of foreign companies. These rising geopolitical tensions have led to economic uncertainty in the country. Matters were not helped much by the ongoing crackdown on Hong Kong, the golden goose, which came into prominence on the anniversary of the Tiananmen Square massacre.

The chief investment officer for Hong Kong-based Kaiyuan Capital states that "Investors remain sceptical (of China) for two primary reasons," the first being the disappointing rate of recovery post-pandemic and the other being a concern in the country's "fundamental investability” - regarding the geopolitical tensions and Chinese policy risks.

The Nasdaq Golden Dragon China Index and Hong Kong’s Hang Seng Index (HSI) have both lost more than 5 per cent since April 18, and the Shanghai Composite Index and the Shenzhen Component Index have fallen 3 per cent and 6.5 per cent, respectively.

The selling was not limited to equities; unfortunately, the Chinese yuan, an indicator of investor sentiment, also fell over 2 per cent within a month of the data release. The currency weakened further soon, hitting its lowest level in nearly six months.

China saw a quick economic rebound once Beijing abolished pandemic restrictions, with consumption-led growth of 4.5 per cent in the first quarter, but economic data released by China indicate that this recovery is uneven and largely disappointed investors.

Nomura and Barclay lowered their growth projections to 5.5% and 5.3%, respectively, following the data release, but UBS and Goldman Sachs have maintained their predictions at 5.7 per cent and 6 per cent for the year.

The consumer price index rose by only 0.1 per cent in April, the slowest recorded pace in over two years. The producer price index, which measures factory-gate prices, declined by 3.6%, marking the biggest contraction in three years and reinforcing the risk of deflation.

Imports also fell by 7.9 per cent, acting as an indicator of weak domestic demand.

Analysis

Although the nation looks to attract foreign investment once more, a recent update on China's counter-espionage law has fuelled a campaign against consultancies that have thrown off business people. The campaign has launched a series of raids on consultancies, including Capvision, Bain & Company and Mintz Group, accusing Capvision of helping leak sensitive military information to foreign forces.

“Beijing’s moves to reduce foreign access to domestic information and business intelligence make equity investment in China more challenging,” explains Neil Thomas, a fellow at the Asia Society Policy Institute’s Center for China Analysis, adding that the increased focus on national security in economic policymaking is a prime example of how President Xi Jinping’s leadership is creating political risks that discourage foreign firms from investment in or business with China.

Such moves by Beijing to protect against espionage have led to many companies facing difficulties in obtaining regular information about Chinese companies that they would generally factor into their decision-making.

China’s real estate sector was formerly the nation’s main economic driver and made up as much as 30 per cent of China's GDP, but this industry seems to now be "faltering". Home prices have been in a historical decline for about 18 months before February, after which prices rose only 0.3 per cent in April, following a rise of only 0.4 per cent in March, once more indicating fading demand.

China’s deteriorating growth and the collapse of its real estate market- a significant source of income for local governments - have exacerbated local debt crises. Local governments face enormous debt problems that have grown dramatically over the past decade. As it seems less likely that these provinces will be able to resolve their debts on their own, they will soon turn to the central government for aid, the possibility of which has sparked concerns over the enormous - estimated $23 trillion cost - to the central government, should it implicitly guarantee local debts.

The debt-heavy growth model China has utilised over the last two decades has been unable to guarantee prosperity in the nation's poorer regions and will eventually cause similar crises in such places. As issues intensify, the central government has been warned by economists and investors that they have few palatable options and must come to the aid of struggling weak links.

Investors are particularly worried about the ability of LGFVs (state-backed firms that run like private firms) to repay their debts, as many of the infrastructure and property projects they have backed are providing investment returns well below the cost of debt. In the debt-stricken region of Guizhou, LGFVs have experienced over 20 defaults on trust loans and other hidden debts since the beginning of 2022.

Cinda, one of China’s largest state-owned asset managers, planned to send a team of 50 experts to this province to assess the situation. Centrally controlled firms like Cinda could be used to inject liquidity into struggling LGFVs, and dissolve their debts in exchange for equity. Measures like these could be used to buy time.

Assessment

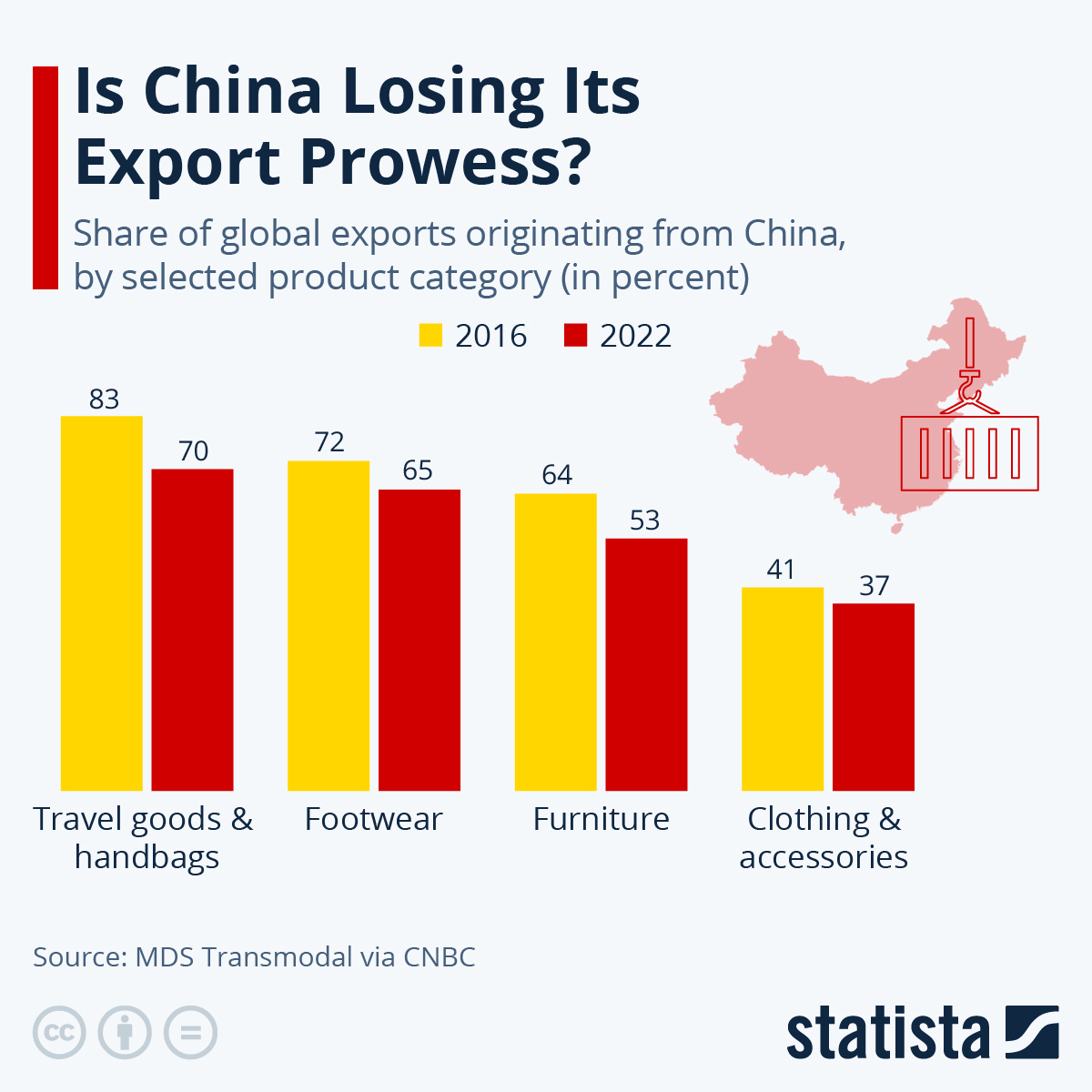

- A slowdown in the economy of the world's largest exporter and second-largest economy fuels concern over the world economy. The trend is already being reflected in falling stocks in Asia-Pacific markets, Europe and the U.S.

- Chinese Supply chain disruptions are expected to impact the revenue of companies internationally, adding to pressure from rising global interest rates and ongoing economic disruptions stemming from the Ukraine war.

Comments