China’s war on cryptocurrency

February 5, 2018 | Expert Insights

China will be increasing its efforts to curb cryptocurrency trading in the region by blocking all websites related to cryptocurrency trading and initial coin offerings (ICOs). This also includes foreign platforms.

The latest development was confirmed in an article on Financialnews.com.cn, which is a unit of the People’s Bank of China.

Background

Blockchain is the world's leading software platform for digital assets. It is a decentralized and distributed digital ledger of cryptocurrency. It cannot be controlled by any single entity and it has no single point of failure.

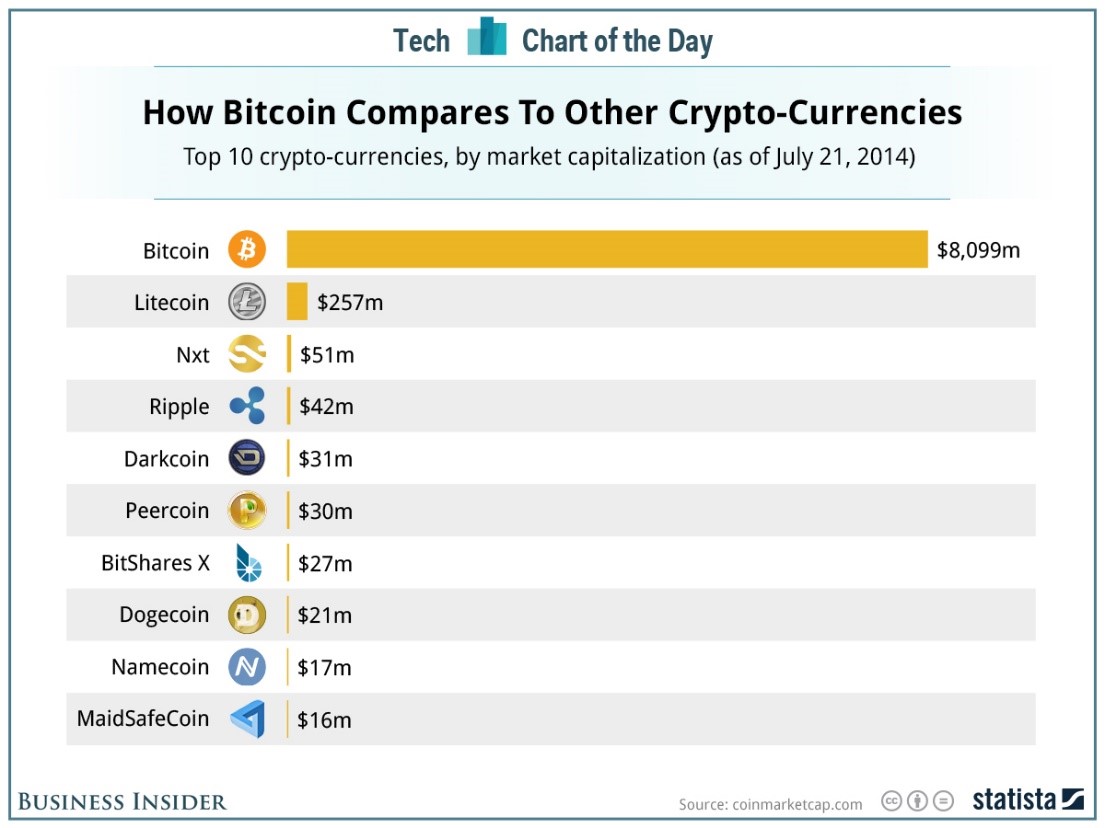

Bitcoin is a peer-to-peer electronic cash system which is a decentralized electronic currency that is not controlled by any government. It is one of the most popular cryptocurrencies in the world. Litecoin, Peercoin, Namecoin and Ripple are among the other cryptocurrencies available.

In the final months of 2017, the value of Bitcoins began to rise exponentially along with other cryptocurrencies. At one point it was trading at $20,000 thus sparking a slew of warnings from experts and analysts. Other cryptocurrencies like Ripple and Dogecoin have also performed incredibly well in the past year.

However, experts have also noted that the craze around Bitcoins and other cryptocurrencies might be a bubble. Some governments too have begun taking concerted action against trading of cryptocurrencies. Given the volatility of the market, the Reserve Bank of India issued two warnings regarding Bitcoins in 2017. In addition, the South Korean government announced that it shall be banning all cryptocurrency exchanges. This has resulted in the plummeting in the value of Bitcoins and has thrown the cryptocurrency market in further turmoil. In addition to the ban, the country’s police and tax authorities also raided the region’s local cryptocurrency exchanges over alleged tax evasion. This was considered a huge blow to the future of cryptocurrency exchanges as South Korea is one of the most valuable markets.

ICO

Initial coin offering (ICO) is a means of crowdfunding through the use of cryptocurrency. This form of crowdfunding is not regulated as cryptocurrency is unregulated. Despite the inherent risks, ICOs have become increasingly popular, especially with companies in Silicon Valley.

Analysis

China in particular has taken an aggressive stance against cryptocurrency exchanges especially Bitcoin. In September 2017, China called a freeze on all fundraising through initial coin offerings. The country also shut down exchanges with hopes of completely undercutting cryptocurrencies. In addition, three of the nation’s largest cryptocurrency exchanges, OKCoin, Huobi and BTC China issued statements noting that they would shut down trading.

China will be blocking all websites related to cryptocurrency trading and initial coin offerings (ICOs). This also includes foreign platforms. The latest development was confirmed in an article on Financialnews.com.cn, which is a unit of the People’s Bank of China.

“To prevent financial risks, China will step up measures to remove any onshore or offshore platforms related to virtual currency trading or ICOs. ICOs and virtual currency trading did not completely withdraw from China following the official ban … after the closure of the domestic virtual currency exchanges, many people turned to overseas platforms to continue participating in virtual currency transactions,” said the article. The piece also warned, “Overseas transactions and regulatory evasion have resumed … risks are still there, fuelled by illegal issuance, and even fraud and pyramid selling.”

“It is common for people to use VPNs [virtual private networks] to trade cryptocurrencies, as many exchange platforms relocated to Japan or Singapore,” said Donald Zhao, an individual bitcoin trader who relocated to Tokyo from Beijing late last year, following the ban. “I think the new move literally means it would be even harder to circumvent the ban in China … people promoting related business programmes may be arrested,” Zhao said.

Despite, its resistance to the Bitcoin, China paradoxically seems to be navigating towards Blockchain technology nevertheless. In June 2017, the People’s Bank of China opened its own new cryptocurrency research lab. Additionally, in September 2017, the Ministry of Industry and Information Technology launched a research facility called the Trusted Blockchain Open Lab. The facility was built to support the nation’s ongoing development of the technology.

Assessment

Our assessment is that the latest development has shown that despite continued crackdowns, China has so far been unsuccessful in shutting down cryptocurrency related activity in the region. However, the ban issued by South Korea as well as China’s efforts could negatively affect the value of cryptocurrencies like Bitcoins whose value has continued to freefall in the recent weeks. We believe that even though Blockchain technology may soon be considered hard currency in the future, the value of such cryptocurrencies will continue to wildly fluctuate if there is no regulation.

Comments