China’s Egypt project falls Through

December 18, 2018 | Expert Insights

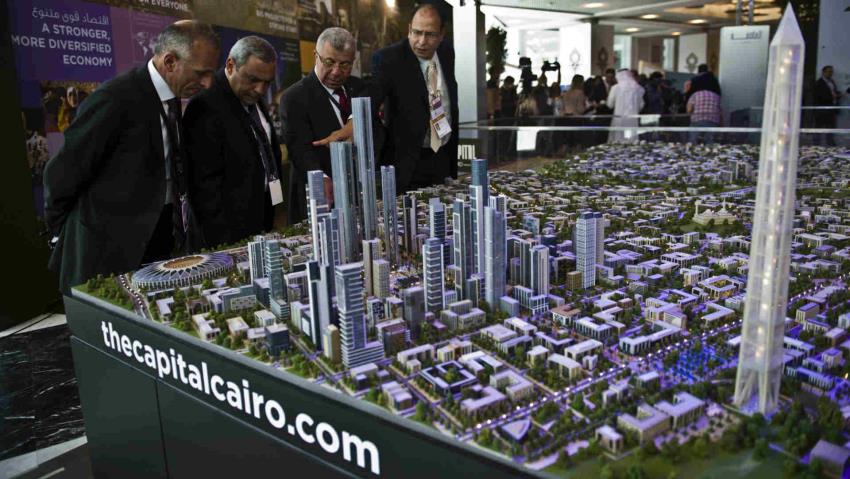

Talks between Egypt and Chinese builder CFLD for a $20 billion development in the new administrative capital have fallen through over disagreements on how to share revenue from the project.

Background

China and Egypt share an inter-state relation which dates back centuries. Both are the birthplaces for two of the most famous ancient civilizations and both countries have been extremely influential in their respective continents.

Bilateral trade reached about $4 billion U.S. dollars in 2007, up from $3.19b in 2006. In 2010, it was worth US$7.0 billion. Since 2011, Egypt has been the 5th largest trading partner of China in Africa.

From 2000 to 2012, there are approximately 39 Chinese official development finance projects identified in Egypt through various media reports. These projects range from jointly constructing an industrial park in the Northwest Suez Economic Zone beginning June 1, 2000, to the construction of a Chinese language school in Cairo in 2002 through a 4 million USD grant from the Chinese government. In 2014, Egyptian president El Sisi made a visit to China and signed a number of infrastructure deals, including the Cairo project.

Analysis

Two years of tough negotiations came to an end after Egyptian authorities sent a response to the final proposal by the Shanghai-listed China Fortune Land Development Co. on developing 15,000 acres (6,070 hectares) over 25 years in the new capital east of Cairo.

“We didn’t hear back,” Ahmed Zaki Abdeen, who heads the company created to oversee the construction of the new capital, told Bloomberg News. “The talks have stopped.”

Failure to reach an agreement will likely raise questions over Egypt’s ability to attract crucial foreign direct investments to propel economic growth. It may not, however, deter state-owned Chinese companies from pursuing other opportunities in the Arab country, thanks to strong ties between the two governments.

CFLD international declined to comment. Officials in CFLD Egypt did not respond to requests for comment.

Khaled Abbas, Egypt’s deputy minister for housing and urban communities, said authorities could collaborate with CFLD on another development, though not in the new capital. “This could be an alternative to the new capital project,” he said by phone, without elaborating.

Egypt has struggled to attract major foreign investments outside the oil and gas industry, even after floating its currency in November 2016 and taking painful measures to clinch a $12 billion loan from the International Monetary Fund. FDI fell $200 million to $7.7 billion in the fiscal year that ended in June 2018.

With the exception of the business district, which is being developed by another Chinese company, work on the new capital has so far been undertaken by the housing ministry, the military and Egyptian contractors who have bought smaller parcels of land outright.

Khaled Elhusseiny, a spokesman for the company overseeing the new capital project, said Egypt wanted 40 per cent of the project’s revenue, while CFLD offered 33 per cent.

CFLD began talks with the Egyptian government in June 2016 and signed a memorandum of understanding in October that year agreeing to plan, develop, manage and market a section of the new city.

The new administrative capital is one of several mega-projects launched by President Abdel Fattah El-Sisi since taking office in 2014 in an effort to reboot the economy and leave his mark on the most populous Arab nation.

The three-phase administrative capital project envisages transforming a 700 square kilometre swath of desert into a modern hub for government buildings, foreign embassies and major companies.

That project aims to ease pressure on traffic-choked Cairo, the sprawling 1,000-year-old city that is home to 23 million people. The first phase is due to be completed by mid-2019.

Assessment

Our assessment is that this is not the first major project a Chinese company has lost this year over cost and profit-sharing issues. We believe that Chinese companies are losing contracts across Asia and Africa due to rising costs and the huge debt burdens they levy on the host countries. We also feel that this maybe one of the major hurdles in Egypt’s drive to attract foreign investments.

Comments