A case of mounting US debt

December 14, 2018 | Expert Insights

According to recent US Treasury Department figures, the total public debt outstanding has increased by $1.36 trillion, or 6.6 per cent, since the start of 2018, and by $1.9 trillion since President Donald Trump took office.

Background

A national debt occurs when a country spends more than the Treasury collects. Historically, during periods of war and recessions, the US debt as a share of the Gross Domestic Product had been high. For instance, during World War II, the debt held by the public as a share of GDP peaked at 113 per cent of GDP in 1945. However, debt declined over the following 35 years. Besides, ageing demographics and rising healthcare also have accumulated to the concern of long-term sustainability of the government’s fiscal policies to manage the public debt.

During the 1980s, excessive defence spending and sweeping tax cuts led to a new period of rising debt. However, in the ‘90s, the increase in taxes and defence cuts led to an economic boom that significantly reduced the debt as a percentage of GDP. Consequently, from 1998, US experienced four consecutive years of budget surpluses.

During George W.Bush’s Presidency, deficits returned as the period saw an expansion in war spending in the Afghanistan and Iraq, in addition to Medicare. Under President Barak Obama, the country experienced the Great Recession, hence the government continued the Bush administration’s bank bailout program that brought billions in the fiscal stimulus due to the rising annual deficits.

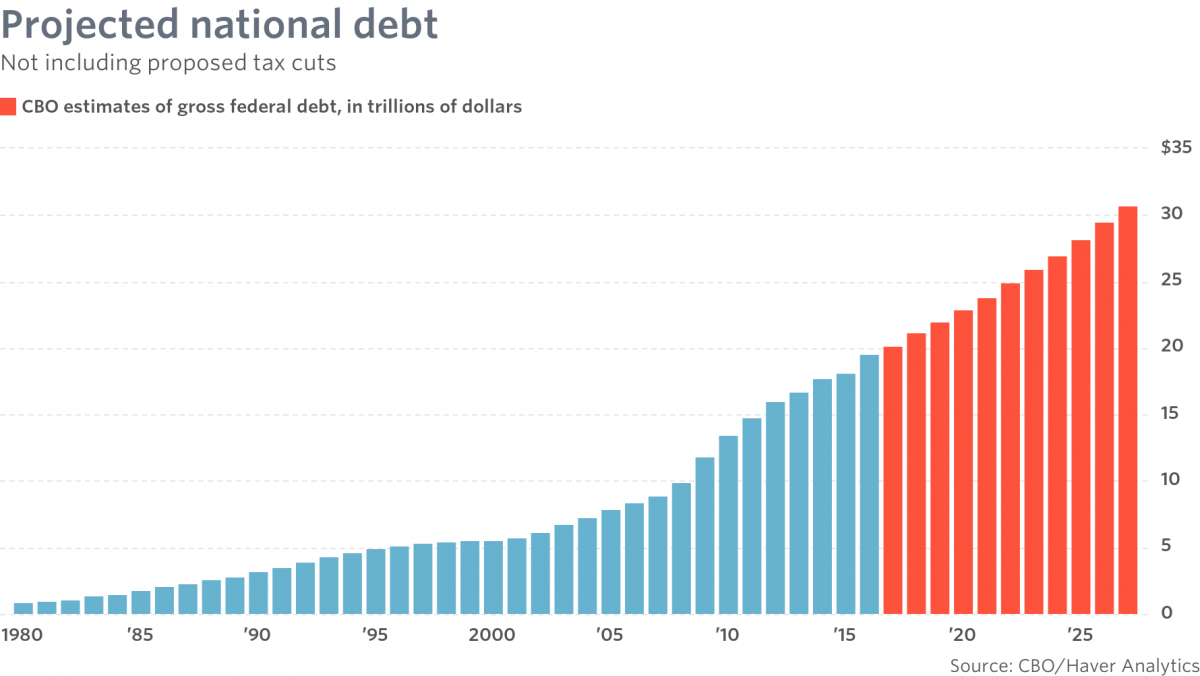

As of July 31, 2018, debt held by the public was $15.6 trillion and the intragovernmental holdings equalled to $5.7 trillion, for a total of $21 trillion. Public debt estimated to approximately 77 per cent of GDP in 2017, thus, ranking 43rd highest out of 207 countries. The Congressional Budget Office forecast in April 2018 that the ratio will rise to nearly 100 per cent by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

Analysis

Latest data from the US Treasury Department show that the federal government’s present debt is around $21.85 trillion. They also show that the total public debt outstanding has jumped by $1.36 trillion, or 6.6%, since the start of 2018, and by $1.9 trillion since President Trump took office. This latter figure is roughly the size of Brazil’s gross domestic product.

The debt had increased to cover the budget deficit that had expanded by an estimate of $779 billion in President Trump’s first full fiscal year. By the end of the first term, the debt is expected to rise by $4.4 trillion despite low levels of unemployment and low interest rates in the country.

The former chair of the US Federal Reserve Janet Yellen said: “I think things have improved, but then I think there are gigantic holes in the system…The tools that are available to deal with emerging problems are not great in the United States”.

According to economists surveyed by Bloomberg, GDP increased to a record $19.39 trillion at the end of 2017 as the annual rate climbed to 2.2 per cent from 1.8 per cent in 2007. However, U.S. growth will deteriorate to an annualised 1.9 per cent by 2020, thus, putting pressure on the widening deficit.

The Deputy head of the International Monetary Fund (IMF) David Lipton had recently warned that “the storm clouds of the next global financial crisis are gathering despite the world financial system being unprepared for another downturn.”

Thus, in the long-term government borrowing may “crowd out” private investment, reducing productivity and incomes.

Harvard professors Carmen Reinhart and Ken Rogoff have concluded, “again and again, countries, banks, individuals, and firms take on excessive debt in good times without enough awareness of the risks that will follow when the inevitable recession hits.” Government debt, they find, “is certainly the most problematic.”

Counterpoint

Though the Congressional Budget Office projections show federal debt rising to WWII levels as a per cent of the economy a decade from now, they are optimistic. They assume steady growth with no recessions, no new programs added to the budget and no new costly wars.

Assessment

Our assessment is that the rising debt burden in the US will have a significant impact on the economic prosperity of the country. We believe that since debt is deferred taxes, the burden will shift to future generations and as a result, taxes would increase and wage growth will be stunned. However, we also feel that in the long run with increasing government spending combined with a rising federal debt could lead to a major financial crisis.

Comments