Can the Us No Longer Outrun Its Debts?

June 9, 2023 | Expert Insights

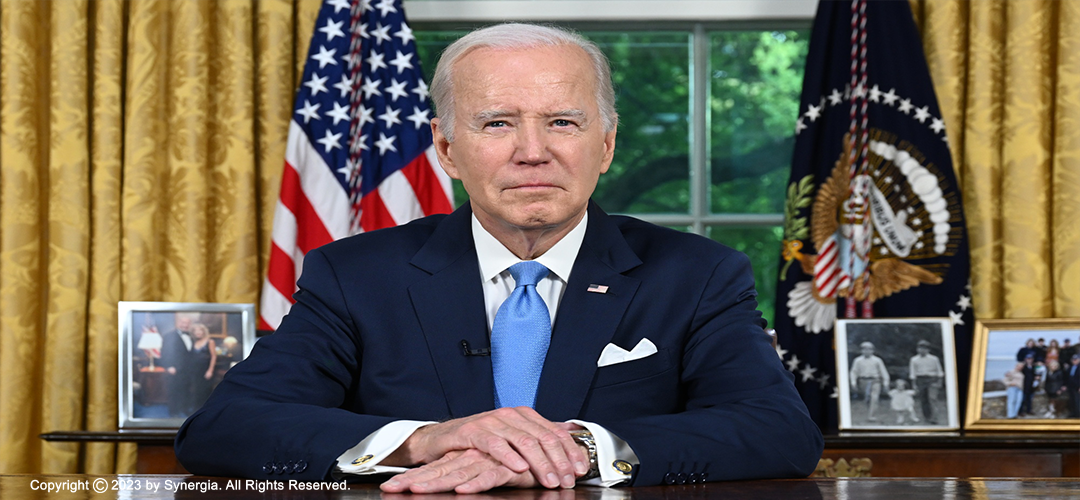

On June 3rd, President Biden signed a bill that suspended the U.S. government's @31.4 trillion debt ceiling for the next two years. This put to rest the global worry that the world's premier economy was heading dangerously towards a first-ever default with just two days to spare.

Background

Let us speculate what would have occurred if there had been a short breach (although clearly, no one expected the crisis to reach this stage even with only two days remaining). It is possible that the mid-June surge of quarterly payments of non-withheld taxes owed by higher-income taxpayers would have allowed the Treasury to push through the remainder of June and pay the government's bills on time, creating a short-term breach scenario that lasted no more than a week.

However, a breach, even when only for such a short period of time, would still have an impact, most immediately, on financial markets. Stock markets and other financial markets are expected to plunge as interest rates soar, and equity prices plummet. Short-term funding markets, essential to the flow of credit that helps finance the economy's day-to-day activities, are likely to freeze up as well.

It is unclear whether credit rating agencies would downgrade the Treasury debt in this scenario of a short-term breach of the debt ceiling. Some believe it will be downgraded if the Treasury fails to make a bond payment, but according to the rating agency, a short episode with full recovery would be unlikely to impact the credit ratings of the U.S.

Contrary to this statement, the nation’s debt was downgraded in 2011 for far less, citing the political dysfunction at the time, which has since intensified.

A mountain of credit implications would have followed a downgrade of the Treasury's credit score and downgrades on the debt of many other financial institutions, those backstopped by the U.S. government most greatly impacted.

The timing of the potential debt -ceiling was especially critical, as economists had feared a recession even if this crisis had not occurred. A recession would have been difficult to avoid with the Federal Reserve pushing up interest rates to quell wage and price pressures.

Analysis

Global investors may demand an increase in interest on Treasury debt to compensate for the risk of lawmakers breaching the debt limit once more in the future. An increase in interest on the trillions in Treasury debt would add up to a significant cost to taxpayers.

In the scenario that lawmakers had breached the debt limit but failed to reverse this course quickly, the impact on the economy could be cataclysmic. The country’s GDP could have fallen by 4.6 per cent through the remainder of this year and into 2024. This would have been followed by unemployment rising to over 8 per cent as nearly 8 million jobs would be lost.

The government would be unable to enact counter-cyclical measures in a breach-induced recession, leaving limited policy options to cushion households and businesses from the impact.

Traditionally, in times of crisis, investors buy up Treasury securities. But in this instance, there lies the possibility of investors choosing to instead turn to cash.

The Federal Reserve was forced to take extreme measures to avoid a full-blown liquidity crisis, the last time this happened during the onset of the Covid-19 pandemic. They slashed interest rates, bought multi-billion-dollar worth of bonds, offered huge cash injections to lenders, and opened credit lines for foreign central banks to ensure the continued flow of money through the U.S.'s financial systems.

However, these won't be enough if the creditworthiness of the U.S. government is in question, and the effort will likely be only partially successful if at all. This was made clear by the President of the Federal Reserve Bank of Minneapolis when he ominously warned that the Fed doesn't "Have the ability to protect the U.S. economy against the downside of a default".

Assuming that the debt ceiling was breached on June 8th, and the situation dragged on through July, the U.S. Treasury would be left with no choice but to eliminate government spending cumulatively worth $ 150 billion. A cut in spending like this would send waves through the economy and be a nasty hit to economic growth. The ripples would strike every other economy across the globe.

If the Treasury fails to make a debt payment in time, the country's credit rating will be moved to "R.D." or a "Restricted Default", which would have impacted U.S. Treasury securities, as well as other financial institutions and businesses backed by the U.S. government would carry a "D" rating until the default was corrected. This would not be great news for countries and entities that have heavily invested in U.S. Treasury Securities. This would cause interest rates to skyrocket on impacted institutions, including those on financial instruments that households and businesses use, such as Treasury bonds, mortgages, and credit card interest rates.

Borrowing costs would spike globally due to increased interest rates on U.S. treasuries. Meanwhile, stock prices will certainly collapse, and credit markets freeze up. The stock market could plummet 45%. This would impact retirement accounts and consumer confidence, increasingly contributing to an economic slowdown. A mass stock selloff could wipe out $10 trillion in U.S. household wealth.

International stock markets would not have been spared the massacre as was indicted by stocks in Europe that fell in anticipation of a deadlock.

For the global community, the biggest worry would be the impact on the U.S. dollar, in which many countries maintain their reserves. For example, India proudly claims that its foreign reserves are to the tune of more than $ 600 billion today. Experts assured that even if the confidence in the U.S. crumbles, the damage to the dollar might remain limited. The pre-eminent role of the currency in the global economy leaves investors with few other alternatives in a crisis, even if that crisis stems from within the U.S. This has been seen previously in 2011 when the S&P downgrade of the U.S.'s credit rating from AAA to AA+ pushed investors to rush into safe assets, such as U.S. dollars.

Assessment

- The move postpones to the crisis but does not eradicate it, opening the doors for the Treasury Department to start rolling out outstanding payments to keep the government machinery running. So, while Mr Biden may have sidestepped the mounting debt issue till the Presidential elections scheduled next year, the bigger problem persists for the new Congress to deal with.

- The U.S. has to curb its spending over the long term and become more responsible in its monetary policies. For far too long, Americans have maintained a level of consumption and quality of life that is no longer sustainable indefinitely. Financial prudence and a cut in government spending will have to become a norm.

Comments