THE BEGINNING OF THE END

November 26, 2022 | Expert Insights

When people hear the word crypto, they are either excited or shy away from the jargon-laden conversation waiting to come. The mysterious software programme making rounds over the internet is well-known for two main reasons- its high returns and volatility. Everyone from blue-collar workers to private banks wants to invest in cryptocurrencies though they do not necessarily know how it works or what it does. With the growing popularity of various cryptocurrencies, like Bitcoin, Ethereum, Dogecoin, and Monero, there is a rising concern over their decentralised nature.

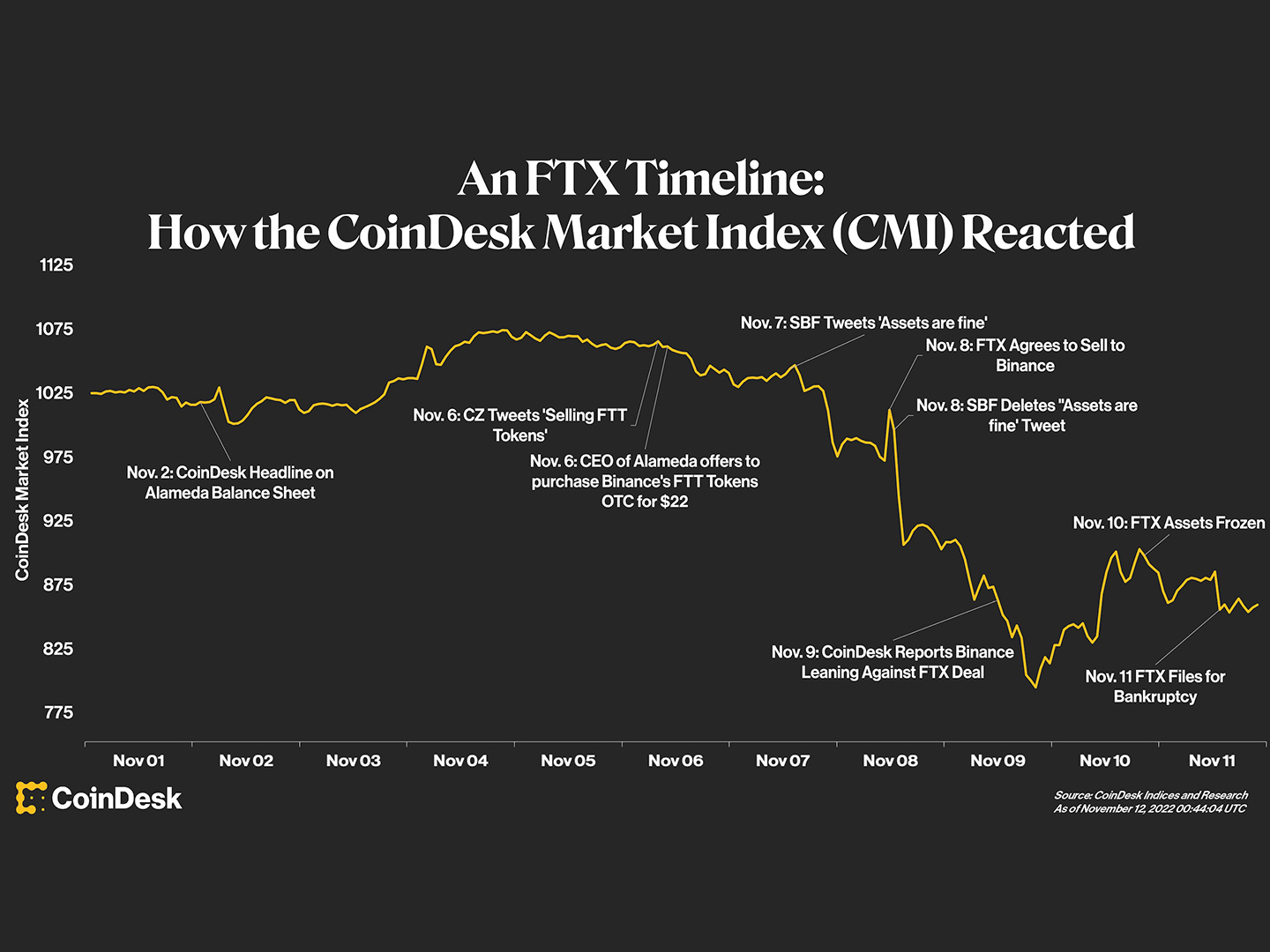

On 12th November, when cryptocurrency exchange FTX filed for bankruptcy, it came as a surprise considering the booming crypto market. It was the vindication that its legion of critics awaited, having raised frequent warnings of the market’s opaque governing structures. In the days that followed, popular cryptos like Bitcoin and Ethereum saw a dip in value. Moreover, allegations were levelled against the firm for misusing investments without accountability or transparency.

Background

At its core, cryptocurrencies were formulated as a decentralised digital currency that would one day make banks redundant. The digital assets work on a blockchain mechanism, allowing the currencies to be part of an immutable record of all transactions. The use of blockchain technology has proved to help promote digital artworks and platforms like the metaverse.

Despite all the different functions created by blockchain, the ecosystem is usually incomplete without including cryptos. For example, the most commonly used payment option for purchasing digital artwork would be a digital currency. Similarly, most purchases made in the metaverse, or any utopian digital world, are made using cryptocurrencies.

FTX, also known as Future Exchange, is an online trading platform specialising in cryptocurrencies. Numerous trading platforms like FTX and Binance have emerged since the beginning of the crypto boom in 2015. These platforms allow commoners to invest in cryptocurrencies without technical know-how. The popularity of FTX skyrocketed during the pandemic for its easy interface and low transaction costs.

FTX’s young founder Sam Bankman-Fried was hailed by many as the next big thing in the crypto world. Bankman made numerous appearances in international fora and events promoting the FTX and its endeavours. FTX roped celebrities like NFL player Tom Brady and basketball player Stephen Curry to promote the platform. The exchange reached new heights through marketing and aggressive takeovers of competitors, increasing its revenue from 10 million USD in 2019 to 1 billion USD in 2021.

On 2nd November, a cryptocurrency analysis firm, Coindesk, released the balance sheet of online trading firm Alameda. Alameda was started by Bankman earlier in 2017. The balance sheet showed that the firm had a significant amount of FTX tokens. FTX tokens were given to FTX users as an incentive to trade on the platform. The balance sheet also pointed out that if the price of the tokens were to fall, then the company would be bankrupt.

The news added more volatility to the crypto market since investors felt they had been duped since their money was being funnelled into another firm without their consent. To make matters worse, people started selling off FTX tokens rapidly, like a bank run. As a result, FTX's token value dropped significantly, forcing FTX to stop traders from selling their tokens. However, the damage had already been done, and within a matter of days, the company was forced to file for bankruptcy. Its billionaire founder became a millionaire after losing 94 per cent of his net worth.

Analysis

The FTX fiasco will invariably have a long-lasting impact on the crypto world for two main reasons. The first and foremost reason is the opaque structures governing the trading platforms. Any private entity must regularly conduct internal audits and release audit reports to its investors. In the case of FTX, there were little to no internal audit reports presented to clients and investors. No one raised any concerns since the platform was making record-breaking profits year after year. Once the balance sheet of Alameda Research was released, FTX investors did not know how it would affect FTX since they had access to limited data. Similar to other major financial meltdowns like the Lehman Brothers crash in September 2008, most decisions were made recklessly by one or a few people assuming that their play would not be exposed. In the case of FTX, Bankman had the power to transfer resources between two of his firms without any oversight or barriers. He used FTX tokens to fund his side project, hoping that Alameda would eventually become profitable, but this backfired when the balance sheet was released.

The second important reason would be the role of the government. Many governments around the world have been suspicious of cryptocurrencies. But despite these suspicions, governments have been forced to allow crypto trading due to its popularity and revenue generation. With the FTX crash, this will change. Governments will take a more proactive role in monitoring crypto exchanges and bring new legislations that could force them to reveal their internal audits to investors periodically. But once governments start interfering with the functioning of these exchanges, they would eventually become more institutionalised. Any form of institutionalisation goes against the core values of cryptocurrencies created to make a decentralised system. The downfall of FTX has created a conundrum for the crypto world that is challenging to resolve.

Assessment

- The US will penalise FTX and its founder for mismanagement of resources. In addition, criminal charges may be levied against higher management for lack of transparency. According to reports, an investigation by the Department of Justice and Securities and Exchange Commission is already underway, and this should send a strong message to crypto managers.

- The value of cryptocurrencies such as Bitcoin has reached an all-time low due to the FTX crash. However, the crypto market faced stagnation months before the crash, and it was Bankman who had helped struggling crypto firms escape from insolvency. In this case, the crypto world might just need a new saviour.

Comments