Asian markets fall on geopolitical fears

October 26, 2018 | Expert Insights

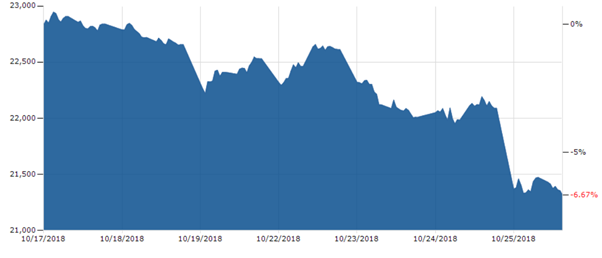

Markets in Asia tumbled Thursday on the back of a sharp fall in U.S. markets that erased all the gains made this year, as investor concerns mount that economic growth is peaking amid an uncertain geopolitical backdrop.

Background

The Dow Jones Industrial Average is a stock market index founded in 1885. The first industrial average was calculated on May 26, 1896. The index is owned by S&P Dow Jones Indices (owned by S&P Global). It is an index that shows how 30 large publicly owned companies based in the United States have traded during a standard trading session in the stock market. Like every other market index, it goes through a period when it is on the rise and it goes through a period when it is on the decline. A period when there is an increase is referred to as the ‘bull’ market and when there is decline, it is called a ‘bear’ market. Since 2009, Dow has been experiencing a bull market.

In 2018, the Dow Jones reached an all-time high of 26,000. However, soon afterwards, the stock market began to decline. In February, it witnessed its steepest fall in six years. The decline was mainly due to large US tech companies like Google, Exxon Mobil, Apple and Chevron reporting weak earnings. The immediate global markets around the world experienced a sharp decline, thus sparking a world-wide sell-off. Stock markets around the world suffered steep falls and nearly $4 trillion have been lost within days.

Stock markets are a bellwether for investor confidence and market stability. Volatile trading sessions and drops in value can be caused by serious geopolitical developments such as war, economic sanctions or an act of terrorism.

Analysis

Markets in Asia tumbled Thursday on the back of a sharp fall in U.S. markets that erased all the gains made this year, as investor concerns mount that economic growth is peaking amid an uncertain geopolitical backdrop.

In Japan, the Nikkei Index was down more than 3 percent on opening, dropping more than 700 points. The MSCI Asia Pacific Index fell slightly over 2 percent, sliding it further into a bear market. In South Korea, the Kospi Index fell, sliding over 20 percent from a peak in January. Chinese markets and Hong Kong’s Hang Seng Index also tanked.

The losses follow a major drop in the Nasdaq after in technology shares fell, sliding more than 12 percent since the end of August. Standard & Poor’s 500-stock index, which tracks a broader group of U.S. companies, has lost $2 trillion in value since late September, down 9 percent. The Dow Jones industrial average, meanwhile, lost 608 points Wednesday and is down 8.3 percent in the past three weeks.

Jitters on Wall Street have spread to Asia, as investors fear that a bull run on Wall Street is running out of steam. Borrowing costs are rising amid tightening from the Federal Reserve, and worries that economic growth is slowing are increasing. The trade war between the United States and China has added to uncertainty, too, and analysts have warned of rising inflation in parts of the region. Volatility, they say, is likely to define the region’s markets for some time to come, which stabilized earlier this month but as of Thursday had lost almost $5 trillion so far this year.

Top Asian markets have been hammered this year by rising US interest rates and fears over slowing global economic growth, particularly in China. Stocks in Shanghai and Hong Kong have tumbled into bear market territory as the Chinese economy has lost momentum and faced a growing threat from the trade war with the United States.

The sell-off this past week, he added, has been “led by a decline in tech stocks,” which has put additional pressure on the region’s markets.

Assessment

Our assessment is that the ongoing trade war is sapping the growth of both China and the US. Due to their importance in the global economy, the trade is causing a domino effect on other economies as well. We believe that the stock markets will continue to underperform until China and the US agree to a ceasefire and scale down their tariffs.

IndiaWatch

Based on global cues, the Sensex and Nifty indices are also expected to open trading on Thursday in the red. Additionally, rising oil prices and the fall in the value of the Indian rupee will exert significant pressure on India’s largest stock indices. India has been suffering a gradual reduction in global investor confidence and the dip in Wall Street will certainly impact the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) performance this week.

Comments