13th IMF bailout for Pakistan

February 13, 2019 | Expert Insights

Pakistani Prime Minister Imran Khan met IMF chief Christine Lagarde to discuss conditions of a bailout package for Pakistan. It has to deal with current account deficit and IMF reform demands which can hurt its growth prospects.

Background

The IMF is an international organisation of 189 countries working on monetary cooperation and international monetary stability. It helps member countries in three ways:

· Economic surveillance

· Lending

· Capacity building

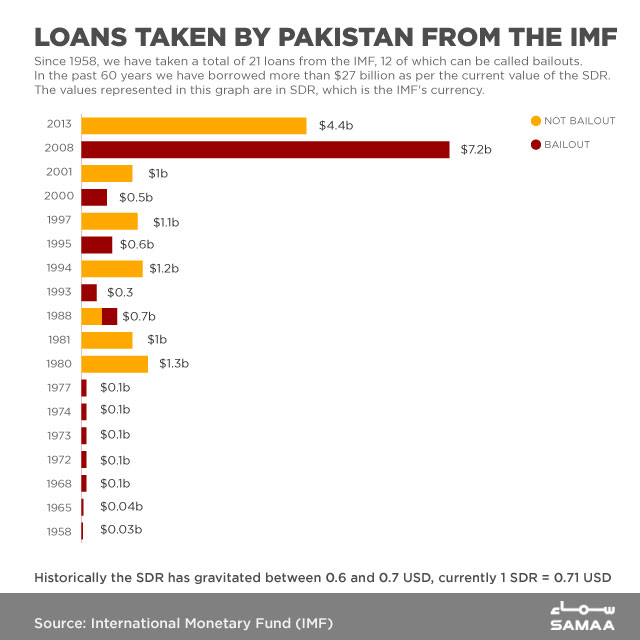

Pakistan has taken 21 loans from the IMF, out of which 12 are bailouts. In 60 years, the country has borrowed $27 billion as per the current value of Special Drawing Right (SDR).

IMF requires collateral from countries for loans. It requires the government to correct its macroeconomic imbalances in the form of policy reform. In order to receive the loans, governments have to take measures such as devaluing the country's currency, balancing the budget with spending cuts and tax increases, and curbing imports to tame the trade deficit. If the conditions are not met, the funds are withheld.

The government of Pakistan fell short of broadening the tax base or privatizing state-owned companies as IMF hoped. In addition, the higher oil prices and growth demanded for more imports, widened current account gap, reserves began to slide and the currency was devalued multiple times. Due to this, it has failed to meet the conditions attached to its previous IMF loans.

According to the IMF, Pakistan’s growth, which hit 5.8 percent in the 12 months to end of June 2018, will slow to 4 percent in 2019 and about 3 percent in the medium term.

Analysis

International Monetary Fund head Christine Lagarde used a meeting with Pakistani Prime Minister Imran Khan to reiterate calls for reforms to its struggling economy, but there was no sign of agreement on a bailout package.

Pakistan is seeking what would be its 13th IMF bailout since the late 1980s, but the deal has been held up by differences over demands Khan’s government fears may harm growth.

Lagarde said her meeting with Khan at the sidelines of the World Government Summit in Dubai had been “good and constructive” and she reiterated IMF willingness to help. “I also highlighted that decisive policies and a strong package of economic reforms would enable Pakistan to restore the resilience of its economy and lay the foundations for strong and inclusive growth,” she said in a statement.

Pakistan’s finance ministry said the government and the IMF would work together on policy priorities and reforms aimed at reducing imbalances and sustaining jobs. “In this regard, deliberations between Pakistani authorities and IMF staff will continue to finalise an agreement on the contours of a program,” it said in a statement. Pakistani officials have said they are worried that strict IMF conditions could constrain growth prospects.

The armed forces continue to control foreign policy. Lack of political stability, uncompetitive and low-value exports and imported machinery mean that the balance of payments deck is stacked against it. Shortfalls in power and high tariffs have gutted Pakistan’s manufacturing base. Also, the inflow of foreign currency and overvaluation of the Pakistani rupee has damaged the domestic industry.

The IMF is calling for structural reforms to the Pakistani economy, which has struggled to build up its manufacturing sector and strengthen exports, despite a sharp fall in its currency over the past year. The economic reforms include fiscal and monetary measures, corrective interventions for balance of payments sustainability, pro-poor spending, governance and development of a business-friendly environment.

Khan’s government has taken measures to tackle the fiscal deficit by increasing exports and attracting investments. Besides tax reforms, the government has made changes to bring ease of doing business. Citing immense potential for religious tourism, Pakistan has initiated new programs. The immediate balance of payment crisis has been averted with the help of China, UAE and Saudi Arabia.

Assessment

Our assessment is that the bailout packages from Middle Eastern countries and China weren’t sufficient to stabilize the economy and stop the mounting financial crisis. It can be noted that Pakistan has the potential to revamp its economy but the funding from China is likely to pull it back into a debt trap. China is lending in US dollars, for which Pakistan needs a large trade surplus. Pakistan has not been able to export enough. It is likely that if Pakistan cannot repay China, that they will be forced to hand over their key national assets, like in the case of Sri Lanka handing over Hambantota port and Kenya losing Mombasa port to China.

Read more:

Comments