Infosys

February 8, 2017 | Expert Insights

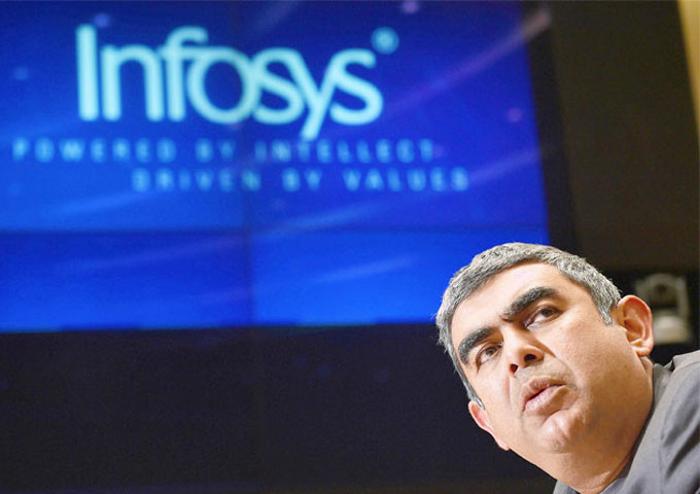

Are there rumblings of a war within?

In recent weeks, differences have been reported between Infosys CEO Vishal Sikka and a group of the IT giant’s promoters. The differences are over the increase in compensation to the CEO, handsome severance packages to executive appointments, appointment of relations of political personalities to the board and a new model for doing business.

In 1981, Infosys was founded by seven engineers, including Narayan Murthy, Kris Gopalkrishnan and Nandan Nilekani, who went on to become respected leaders of Indian Industry. By Mar 1999 (18 years later) Infosys was the costliest share on the market and was amongst the 20 biggest companies by market capitalization, with NASDAQ. The story of Infosys, is taught in business schools around the world and it remains one of the most respected companies, in the world. Since its formation, the public listed company was controlled by promoter-executive appointments, on its board of directors. It was only in Sep 2014, that Vishal Sikka took over as the first non-promoter CEO. The new CEO also chose to retain his base of operations in Seattle, USA.

Do the Founders still have a Say in Infosys Affairs?

The founders together own 12.75% of Infosys, with Narayan Murthy and his family owning the largest block. Majority of the Board members, including Chairman R Sehasayee firmly back the CEO Vishal Sikka. At this juncture, there appears to be little chance of a boad room battle, like the recent Tata Sons fiasco.

Does the IT Major Need for a New Business Strategy?

The Indian IT sector, used to returning double-digit growth figures, has for the last two years been only returning single-digit figures. Many experts have pointed out that Indian majors like Tata Consultancy Services (TCS), Infosys and Wipro have been slow in adapting to SMAC (Social-networking, Mobile, Analytics and Cloud Computing)) technologies. In contrast, Accenture, the Dublin Ireland incorporated company, with a large presence in India, has been more proactive. In 2016 Accenture reported revenues of US$ 32.9 billion and was named by Fortune Magazine, as the most respected IT company in the world. Infosys’s new management believes that the company’s older businesses of application development & maintenance, infrastructure management and BPO are slowing down with contracting margins. They believe that the company needs to innovate and offer value-added services. Such a strategy will involve major acquisitions but it appears the founders are wary of treading on this path.

Did the CEO Deserve the Compensation Hike?

In 2014, when Vishal Sikka was appointed CEO he accepted a compensation of approximately US$ 7 million. In 2016, this was increased to US$ 11 million. However, the Board defends the raise saying much of the package is in the form of stock and stock options. They point out that Infosys earlier policy of low-compensations worked as promoter-employees had huge stock equity of the company, which paid handsomely. They also point out that in fact, in the revised policy the cash component of the CEO has actually been reduced.

Were the Severance Packages too Generous?

Last year, CFO Rajiv Bansal was given a severance package of Rs. 17.4 Crs. The board points out that the sum relates to 24 months’ pay, which is in accordance with contractual rights and obligations. Similarly, former General Counsel David Kennedy received a severance package of Rs. 5.85 Crs.

Did Infosys Appoint Relations of Politicians to its Board?

Last year, Dr. Punita Sinha was appointed to the Infosys Board as an Independent Director. She is also the wife of Union Minister Jayant Sinha. The Board contends that she was appointed on individual merit and that she is eminently qualified.

Assessment

The bill in US Congress on H1B visas, if it becomes law, will have major impact on the IT major’s conduct of business and profitability. The weakening of the Re against the US$, higher cost of Indian labor and the need to adapt to new technologies are other challenges the IT sector engage with, to maintain the US$ 82 billion that India earns from IT exports. The disquiet in the Infosys Board over shifting values, are probably manifestations of larger challenges facing the industry.