THE WIDENING GAP

October 15, 2022 | Expert Insights

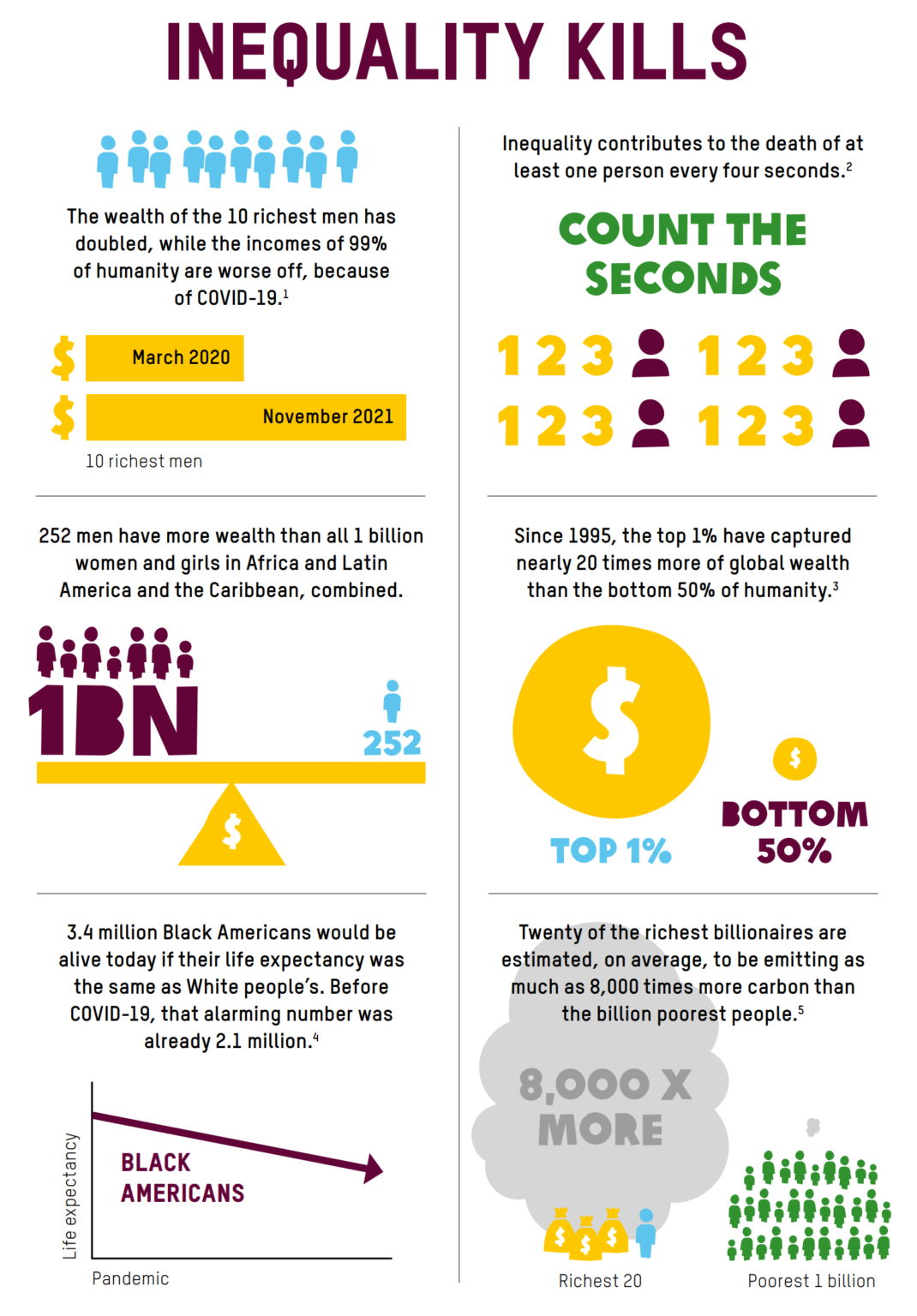

Oxfam International and Development Finance International (DFI) research reveals that rich and emerging countries have exacerbated economic inequality since the pandemic outbreak in 2020. How can the world curb this inequality and its impact?

Background

The unequal distribution of wealth and opportunities among various social groups, referred to as economic inequality, concerns almost every right-thinking government. Huge numbers around the globe remain inexorably trapped in poverty with few opportunities to advance socially. Due to travel restrictions, state-wide lockdowns, and the virus itself, which affected people inside and across nations in wildly disparate ways, the global coronavirus pandemic has worsened existing disparities.

But, being born into poverty does not necessarily mean that you will remain poor; social assistance programmes in conjunction with education and skilling can lift people out of subsistence and reduce inequality. A universal basic income may be the solution, which several countries are currently researching.

Analysis

The 2022 Commitment to Reducing Inequality Index (CRI Index) is the first in-depth examination of the kinds of policies and initiatives that 161 nations may have adopted during the first two years of the pandemic to address inequality. The index reveals that, despite the biggest health crisis in a century, half of the lower-middle-income countries reduced their healthcare budget. 70 per cent of all countries reduced their contributions to education, while nearly half slashed their contributions to social protection.

Two-thirds of countries failed to boost their minimum wages in accordance with economic development as poverty levels reached record highs and workers grappled with decades-high costs. Despite the intense strain on public resources, 143 of 161 nations froze, and 11 even decreased the tax rates for their wealthiest citizens. Irrespective of the pandemic, health spending fell in half of the poorest countries, while taxes on the wealthy and corporations were frozen or even decreased in 95 per cent of all nations. The vast majority of governments reduced their contributions to spending on social safety, education, and health care. They also resisted raising taxes on astronomical riches and extravagant earnings.

According to Oxfam and DFI study of IMF data, 78 per cent of all governments worldwide propose additional spending cuts over the next five years, totalling $7.8 trillion. Lower-income nations spent 27.5 per cent of their budgets on debt repayment in 2021, more than they did for health care, over 12 times more than for social protection, and twice as much for education. The Trilateral Commission, established in 2021, advises prioritising investment and providing a fair start to maximise equality of opportunity. A child's early life experiences are crucial in fostering greater fairness.

"Developing nations pay $4 in debt repayment to wealthy creditors for every dollar spent on healthcare. For them to reduce inequality significantly, complete debt relief and higher taxes on the wealthy are crucial,” says Matthew Martin, Director of DFI.

The dilemma posed by rampant economic inequity is made worse by stagnant wages; corporate profitability has not always translated into pay increases in recent decades.

However, there is a silver lining in the dark clouds. Some low-income and middle-income countries have taken significant steps to alleviate inequality. Costa Rica and New Zealand raised their highest marginal tax rates by 10 per cent and 6 per cent, respectively. Thanks to international contributions, social spending in the Occupied Palestinian Territory grew from 37 to 47 per cent of its overall budget. The tiny Island republic of Maldives implemented its first national minimum wage, and Barbados passed comprehensive laws to enhance women's work rights.

Assessment

- The government, businesses, the private sector, civil society organisations, and individuals must all actively participate in reducing inequality. Government and trade union collaborations could successfully manage a "people-focused" business strategy by providing their members with fresh training opportunities and employment services.

- One of the most effective mechanisms for implementing the redistribution of wealth in society and curb inequality is taxation. Governments will need to step up their coordination of foreign taxes, including creating standards, sharing information, and enforcing them. This must be incorporated into the globalised financial system to prevent tax competition from other nations from undermining the public policy of one country.

Comments