Venezuela in crisis

November 15, 2017 | Expert Insights

International credit ratings agency Standard & Poor's has since declared Venezuela to be in "selective default".

The country has failed to make $200m (£153m) in repayments on its foreign debt.

Background

Despite having world's largest proven oil deposits, many Venezuelans have lived in abject poverty. The former President, Hugo Chavez, was in office from 1999 to 2013. In that period, billions of dollars were spent in generous social programs. After his death, his successor, Nicolas Maduro took office. There has been a rise in inflation and a shortage of basic goods. A drop in the oil prices had added to the administration’s problems.

From 2014, there have been recurrent protests against the government because of many of these issues. Detractors blame the current economic policies for the crisis. People are also disillusioned by the high level of urban violence prevalent in the nation.

The protests have increased from 2017. There have been calls for fresh elections to remove United Socialist Party (PSUV) from power. However, the government remains as powerful as ever in the nation. Recently, a new constituent assembly was instated in Venezuela. The assembly is filled with Maduro supporters and has the power to re-write the nation’s constitution.

The nation’s economy has become increasingly unstable and there is hyperinflation in the region. In August 2017, CNN reported that 3,164 Bolivars was equivalent to $1. This is a problem because private banks let Venezuelans withdraw 30,000 bolivars ($2.88) from an ATM at a time.

The hospitals in the country are running out of medicines and they are unable to treat those admitted. A recent study revealed that at least 93% of Venezuelans cannot afford to buy enough food. The study also stated that 73% of the population have lost weight in 2017 alone. Reports note that people have taken to scavenging through trash.

Analysis

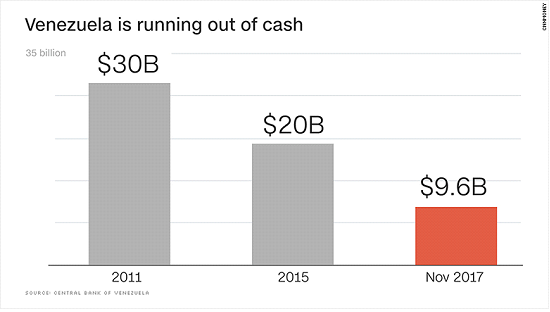

Amid all the political turmoil, Venezuela's cushion of cash has fallen to its lowest point in over 20 years. Venezuela only has $10 billion in reserves. A nation’s reserves is the amount of funds it has to address any crisis and to ensure economic stability. Additionally, the nation has incurred $140 billion in external debt. This includes loans from countries like Russia and China.

International credit ratings agency Standard & Poor's has since declared Venezuela to be in "selective default". The country has failed to make $200m (£153m) in repayments on its foreign debt. This could have been the first of many defaults on more than $60 billion in international bonds. President Maduro has revealed that he is currently trying to restructure Venezuela’s foreign debt. The nation is also dealing with harsh financial sanctions that was issued by the US in August 2017.

The latest developments could have a negative effect on the global oil market. If the global oil market were to lose Venezuela’s 2 million BPDs, then would cause a huge aftershock. Dan Yergin, vice chairman of IHS Markit said, “It would certainly be a very tight market, because of course you already have production restraints by OPEC and non-OPEC. Venezuela is an important (oil) producer. It has lost a lot of the talent, a lot of its capabilities, what its production really is, and it seems on verge of turmoil.”

The International Monetary Fund predicts that inflation in Venezuela will hit 650% this year and 2,300% in 2018.

Assessment

Our assessment is that Venezuela’s is in the midst of deep financial and humanitarian crisis. If enough holders of a particular bond demand full and immediate repayment, it can prompt investors across all Venezuelan bonds to demand the same thing. As Venezuela doesn't have the money to pay all its bondholders right now, investors would then be entitled to seize the country's assets -- primarily barrels of oil -- outside its borders. If the economy continues to collapse, then the nation may not be able to feed its population.

Comments