US hikes interest rates, again

March 22, 2018 | Expert Insights

The US Federal Reserve Bank has announced that it will be raising its benchmark interest rate by 0.25%. This increase was widely expected by economists.

Background

The Federal Reserve System (also known as the Federal Reserve or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913. The main goal behind establishing the body was to create a central control of the monetary system that will prevent financial crises. In the event of a financial downturn, the Federal Reserve steps in to provide key aid.

Over the years, the Federal Reserve has played a key role in saving the American economy (and in turn the global economy) from imploding. Its roles and responsibilities were expanded after the Great Depression, that caused a global meltdown. The timing of the Great Depression varied across nations; in most countries it started in 1929 and lasted until 1941. It resulted in international trade being reduced by 50% and a rise in unemployment.

A rise in the Fed funds rate will likely cause a ripple effect on the borrowing costs for consumers and businesses that want to access credit based on the U.S. dollar. Whenever the Federal Reserve increases interest rates, the prime rate increases, and credit card rates also increase among others. A hike in interest rates boosts the borrowing costs for the U.S. government and fuel an increase in the national debt.

In June 2017, the Federal Reserve stated that it would be hiking key interest rates by 0.25%. This was the second time in the year when interest rates were hiked. The hike in the interest rates were reflective of the central bank's confidence in the US economy. After a two-day meeting on 14th June, the Federal Reserve’s Open Market Committee raised its benchmark interest rate by 25 basis points from a range of 1% to 1.25%.

In December 2017, the US Federal Reserve raised the interest rates by 0.25% for the third time in the year. The central bank has noted that this has been introduced as the US economy has made “solid gains.”

Analysis

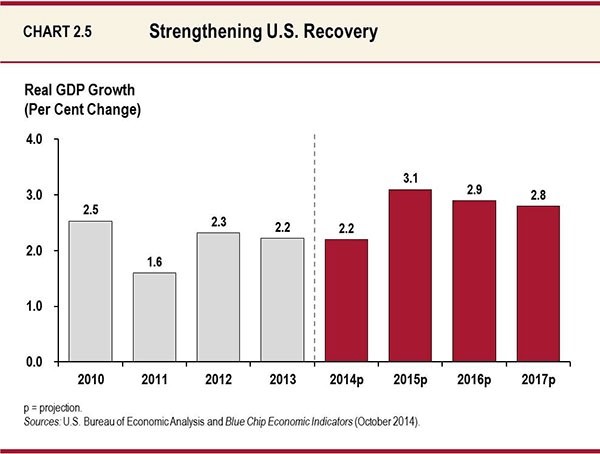

In January 2017, with a vote of 84-13 in favour. Jerome Powell was confirmed by US lawmakers as the new Chairman of the Federal Reserve. In March 2018, the Federal Reserve announced that it is once again increasing its benchmark interest rate. Citing a strengthened economic outlook, the interest rates have been increased by 0.25%.

“This decision marks another step in the ongoing process of gradually scaling back monetary policy accommodation, a process that has been underway for several years now,” Federal Reserve Board Chairman Jerome Powell told reporters at his maiden news conference.

“Indeed, the economic outlook has strengthened in recent months. Several factors are supporting the outlook, fiscal policy has become more stimulative, ongoing job gains are boosting incomes and confidence, foreign growth is on a firm trajectory and overall financial conditions remain accommodating,” he added.

It has also been revealed that the interest rates would be increased at least two more times in 2018. The increase in rates was widely expected and did not affect the markets much. “The guidance in terms of the future rate hikes is a touch more hawkish than originally expected. 2019 looks like we’re going to get a faster pace of rate hikes,” said Matt Miskin, market strategist at John Hancock Investments. “This a new Fed chairman starting with a bit of a hawkish tone as he takes leadership.”

Even though markets have remained unfazed by the increase in interest rates, there continues to be concerns over a potential trade war between the US and China. Pankaj Pandey, research head at ICICI Securities, spoke from an Indian perspective and noted the fears about a trade war. He said, “That would be a bigger challenge for global investors which will impact most of the markets including India. Otherwise, I don’t think Fed rates hike will hurt FII flows to India.”

Assessment

Our assessment is that the strong economic growth along with a drop in the unemployment rate in the US has provided confidence to investors; and equity markets have risen as a result. Even though the global economy is on the rise, increased fears of a potential trade war between China and the US has investors around the world concerned.

Read more: More hikes in US interest rates?

Comments