US China trade talks ends

August 24, 2018 | Expert Insights

U.S. and Chinese officials ended two days of talks on Thursday with no major breakthrough as their trade war escalated with activation of another round of dueling tariffs on $16 billion worth of each country’s goods.

Economists reckon that every $100 billion of imports hit by tariffs would reduce global trade by around 0.5 percent.

Background

The United States and China are two of the largest economies in the world. Both countries consider the other as a partner in trade and an adversary in geopolitics. Diplomatic relations between the US and China was first established in 1844 with the Treaty of Wanghia. This agreement allowed the US to trade in Chinese ports. After the Qing Dynasty was overthrown, in 1911, the US recognized the legitimacy of the Republic of China (ROC) government.

The U.S.–China Strategic and Economic Dialogue were created in 2009. Every year, high-level representatives from both nations open up dialogue to improve economic partnership. In 2017, the meetings that occurred were reported as being “tense”. Upon conclusion, the two countries canceled a joint press conference and did not release a statement. They also did not release a plan of action.

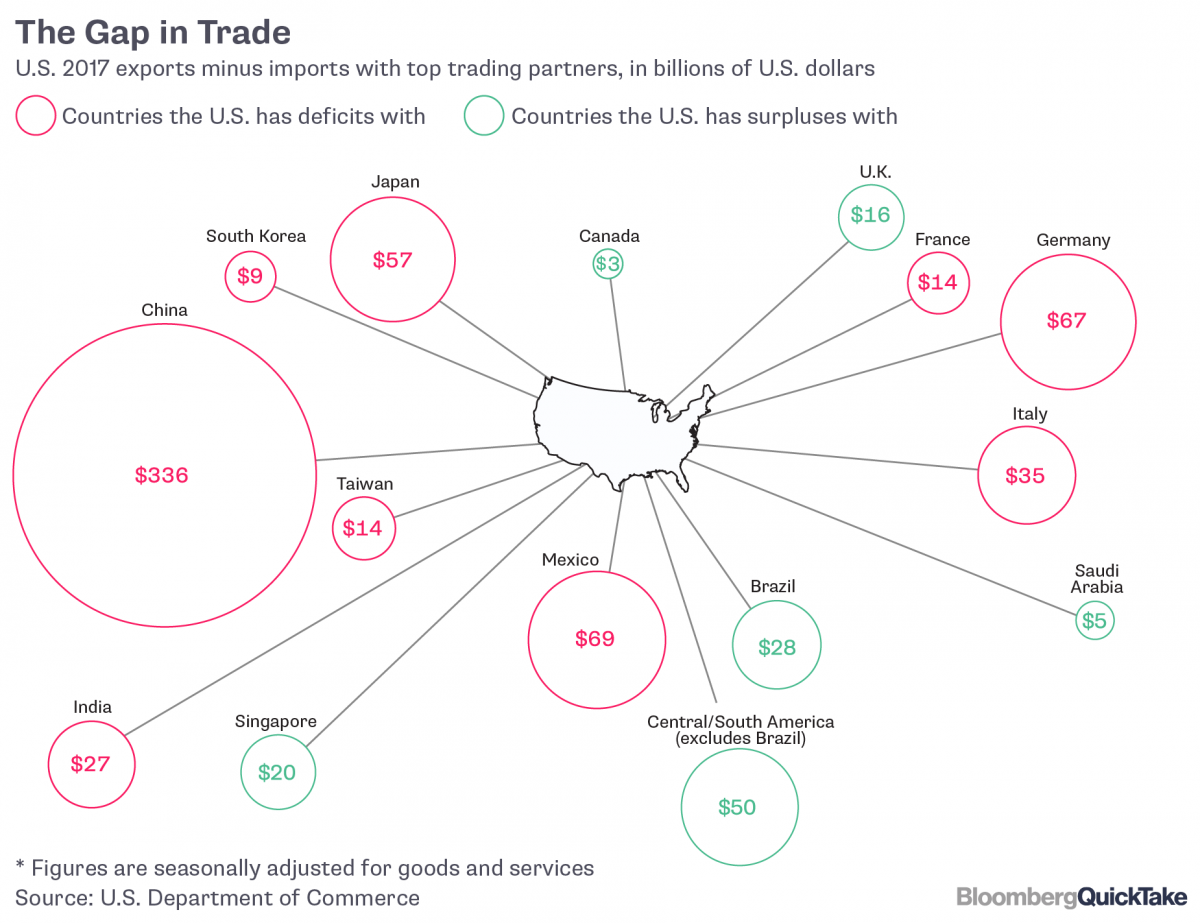

US President Donald Trump has previously been a critic of China. He blamed the country for loss of jobs within the US and has often criticized the US trade deficit with China. China's trade surplus with the United States widened in 2017 while total foreign trade volume maintained rapid growth.

Read more on our extensive analysis on the US tariffs on Chinese imports and China’s retaliatory tariffs here.

Analysis

A renewal of trade talks between the United States and China ended on Thursday with little sign of progress as Washington moved ahead with additional tariffs and President Trump met with legislators to discuss a new law aimed at curbing Chinese investment.

Chinese President Xi Jumping’s top economic adviser, Liu He, will visit Washington next week to continue discussions with President Donald Trump's economic team, the White House said Monday.

The two sides had met with low expectations for this week’s meetings and no further talks had been scheduled, a person familiar with the discussions said. The person, who requested anonymity to discuss the private deliberations, also said Chinese officials had raised the possibility that no further negotiations could happen until after November’s mid-term elections in the U.S.

Trump told Reuters on Monday that he did not “anticipate much” from the meeting, and that he had “no time frame” when it came to resolving the escalating trade war.

In a statement, the White House said the countries “exchanged views on how to achieve fairness, balance, and reciprocity in the economic relationship, including addressing structural issues in China” identified by the U.S. in an investigation into Chinese intellectual-property practices. China did not immediately issue its own statement.

The conclusion of the talks came just hours after Beijing and Washington put forth their latest round of tit-for-tat tariffs on Thursday. The $16 billion in imports hit by each side took the total value of goods covered as a result of President Donald Trump’s trade war with China to $100 billion.

But the Trump administration is preparing a far larger tranche of tariffs covering some 6,000 products from China with an annual import value of $200 billion that is expected to take effect as early as next month.

U.S. officials are due to meet in Washington on Friday with delegations from the European Union and Japan, to discuss joint efforts to confront China at the World Trade Organization over its industrial subsidies and the conduct of its state-owned enterprises.

The latest American tariffs — which come on the back of $34 billion worth of tariffs on Chinese goods that were implemented in July - have spurred U.S. importers to place additional orders to be shipped and delivered ahead.

That has already contributed to the higher ocean and air freight rates, and elevated warehousing costs in America, said Henry Ko, managing director for Asia at Flexport, a U.S.-based freight forwarding company. Overall, the entire supply chain will incur additional costs, added Ko.

Trump has threatened to impose duties on over $500 billion of Chinese goods exported annually to the U.S. unless China agrees to sweeping changes in its intellectual property practices, industrial subsidy programs, and tariff structure.

China’s Ministry of Commerce said on Thursday that the latest US import duties violated World Trade Organization rules and that China had no alternative “but to take countermeasures”.

This week also saw the USTR hold an unprecedented six-day public hearing ahead of further tariffs on US$200 billion of Chinese goods, expected to go into effect in September. Initially proposed at 10%, the duties could be raised to as much as 25%, at Trump’s direction.

Assessment

Our assessment is that if the hawks in the Trump administration get their way, it might lead to a temporary disengagement of the two economies. We feel Beijing will allow the Chinese Yuan to passively devalue in order to cope with the impact of the U.S. tariffs although authorities will likely blame any decline in the currency on the markets. We believe that the trade war will put pressure on the Indian economy as the cost of production will rise due to the increased price of raw material. We also believe that this can impact both the parity of the Indian rupee and the trade deficit.

Comments