The rising price of oil

January 3, 2018 | Expert Insights

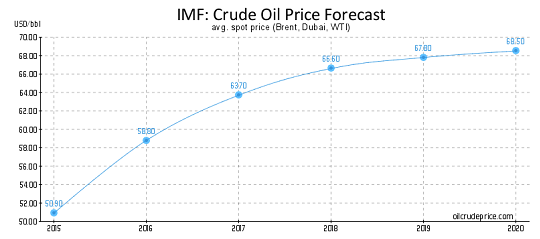

The price of oil has continued to rise in the recent weeks. It traded above $67 on January 2nd, 2018. This is the highest level achieved during trade since 2015.

What are the implications of this among developing nations like India?

Background

Organization of the Petroleum Exporting Countries (OPEC) is group comprised of 14 oil producing nations. It was founded in 1960. The current members of OPEC are - Algeria, Angola, Ecuador, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, and Venezuela. Indonesia used to be a member but it suspended its OPEC membership in December 2016.

From 2010 until mid-2014, world oil prices were around $110 a barrel. However, price of oil has fallen significantly in the recent years. It is now around $50. To address the sluggish prices, OPEC nations came to an agreement in November 2016 to cap their output until the oil glut was reduced. In May 2017, they agreed to extend that deal by nine months. This isn’t the first time oil prices have been severely hit due to a glut. Prices of oil fell in the 80s due to falling demand. It resulted in a six-year decline in the price of oil.

In July 2017, the OPEC nations met once more to discuss plans on whether they should further cap oil output by 1.8 million bpd beyond March 2018. The meeting was held in Russia and was attended by non OPEC oil producing countries as well. During this meeting, Saudi Arabia, announced that it will limit its oil exports to 6.6 million bpd (barrels per day). This is a million bpd lesser than the previous year.

In November, due to various factors, price of oil rose to its highest since mid-2015. Brent crude futures LCOc1 were up 59 cents at $61.53 per barrel having hit a session peak of $61.70 earlier. Recently, OPEC nations once again discussed the issues of oil prices along with Russia. The group (and Russia) has agreed to extend production curbs, aimed at boosting the oil price, by nine months well into 2018. OPEC also decided to cap the combined output of Nigeria and Libya at 2017 levels below 2.8 million bpd. These two countries had been exempted from the deal in the past as both nations have been grappling with political and economic unrest.

Analysis

The price of oil has continued to rise in the recent weeks. It traded above $67 on January 2nd, 2018. This is the highest level achieved during trade since 2015.

This spike in oil prices are also partly due to current unrest in Iran, which is a major oil producing nation. Even though the protests have not yet affected Iran’s oilfields, fears about renewed risks in the region added to the momentum.

“Geopolitical risks are clearly back on the crude oil agenda after having been absent almost entirely since the oil market ran into a surplus in the second half of 2014,” said Bjarne Schieldrop at Nordic bank SEB. “Geopolitical risks started to impact the oil price again last autumn as production cuts then had drawn inventories significantly lower.”

U.S. West Texas Intermediate crude futures traded hit $60.74 at one point and Brent crude futures, the international benchmark, hit $67.29. “Falling inventories globally and strong economic growth offset the restart of the Forties pipeline and the resumption of production following a pipeline outage in Libya,” said Jeffrey Halley, senior market analyst at futures brokerage Oanda in Singapore.

However, the rising US oil production continues to pose a threat against OPEC’s agenda. “U.S. tight oil production growth warrants close monitoring as it could spoil OPEC’s market-balancing efforts, pushing the market into surplus in 2018,” Barclays bank said.

Assessment

Our assessment is that as we have stated earlier, rise in oil prices will significantly affect the Indian economy. India, which depends on imports to meet 80% of its oil needs, will have to spend approximately Rs 9200 crores more every year for a one dollar per barrel increase in crude prices. The prices of diesel and petrol have already risen in 2017 in India. Will the rise of oil prices further hinder the Indian economy?

Comments