Regulating Bitcoin

December 5, 2017 | Expert Insights

As fears continue to rise on whether digital currencies are used to for money laundering and fraud, the UK government has revealed that it along with EU leaders are planning a crackdown on Bitcoin, the most valuable cryptocurrency in the market.

Background

Cryptocurrency is a digital asset (in other words a form of digital money) that is designed to stay secure. It uses cryptography to secure its exchanges making it nearly impossible to counterfeit. Cryptocurrency in particular is classified as a subset of digital currencies.

Bitcoin was the first decentralized cryptocurrency. It was first created in 2008 by either an anonymous programmer or a group of programmers under a pseudonym, Satoshi Nakamoto. “Nakamoto” released Bitcoin in 2009 as an open source software. It is not controlled by any government and is one of the most popular cryptocurrencies in the world. Litecoin, Peercoin, Namecoin and Ripple are among the other cryptocurrencies available.

Initial coin offering (ICO) is means of crowdfunding through the use of cryptocurrency. This form of crowdfunding is not regulated as cryptocurrency is unregulated. ICO is a method employed by companies to raise money. They sell investors digital tokens in exchange for cryptocurrencies like Bitcoins. As the field is unregulated, there is also an increased risk of investor scams.

US regulators such as the Securities and Exchange Commission have tried to deflate the so-called bubble around this boom. US has said that digital tokens should comply with the country’s securities laws. Most recently, China has called a freeze on fundraising through initial coin offerings. According to media reports, the country is seeking to completely shut down the usage of cryptocurrencies. UK government has also said that those who are willing to invest in such schemes should be aware of the risks of losing it all. Most recently, James Dimon, the Chairman, President and Chief Executive Officer of JPMorgan Chase came out strongly criticizing cryptocurrencies, especially Bitcoin.

Analysis

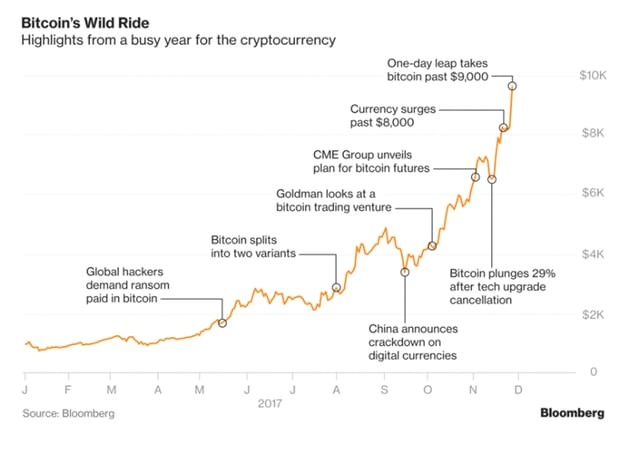

Bitcoin by market value clocked a high of $11,831 on December 3rd but closed below the previous record high of $11,377. As per CoinMarketCap, week-on-week, bitcoin (BTC) is up 18 percent, while on a monthly basis, it has gained more than 50 percent.

There have been fears that given Bitcoins are decentralized, it is used for illegal purposes as well including money laundering and fraud. As fears continue to rise on whether digital currencies are used to for money laundering and fraud, the UK government has revealed that it along with EU leaders are planning a crackdown on Bitcoin, the most valuable cryptocurrency in the market.

The UK Treasury department confirmed the reports in a statement noting, “We are working to address concerns about the use of cryptocurrencies by negotiating to bring virtual currency exchange platforms and some wallet providers within anti-money laundering and counter-terrorist financing regulation.”

The rules are expected to come into effect in the next few months. The Treasury said digital currencies could be used to enable and facilitate cybercrime. It added: “There is little current evidence of them being used to launder money, though this risk is expected to grow.”

The Treasury has also stated that anti-money laundering regulations should be updated to include cryptocurrencies, especially Bitcoins. It explained, “We are working to address concerns about the use of cryptocurrencies by negotiating to bring virtual currency exchange platforms and some wallet providers within anti-money laundering and counter-terrorist financing regulation.”

Bitcoin expert Dr Garrick Hileman, a research fellow at the University of Cambridge said, “I think these announcements have a powerful signalling effect and put the industry on notice that the 'cop on the beat' is concerned and watching crypto-currencies more closely now. This in turn will motivate companies to more effectively self-police bad actors.”

Scotland Yard has also issued a warning over the dangers inherent in cryptocurrencies. "Organised criminal groups have been early adopters of crypto-currencies to evade traditional money laundering checks and statutory regulations," said Det Supt Nick Stevens, from the Serious and Organised Crime Command. "Criminals have also used crypto-currencies to purchase illegal commodities on dark market sites with anonymity."

As the value of Bitcoins rise, experts are also sounding caution to investors over a potential bubble. Stephen Roach, a widely regarded economist said, “I've never seen a chart of a security where the price really has a vertical pattern to it. And Bitcoin is the most vertical of any pattern I've ever seen in my career. This is a dangerous speculative bubble by any shadow or stretch of the imagination.”

Bank of England deputy governor Sir Jon Cunliffe said, “People need to be clear this is not an official currency. No central bank stands behind it, no government stands behind it.”

Assessment

Our assessment is that as the value of Bitcoin continues to rise in an unprecedented manner, governments across the world are trying to monitor it and bring it under regulation. We believe that cryptocurrencies, viewed as hard money, will find increased users from all sectors. Thus, authorities should work towards ensuring unlawful players in that system will be held accountable.

Comments