Optimistic about UK’s growth?

January 22, 2018 | Expert Insights

Despite concerns over Brexit, the world economy will help boost Britain in 2018. Lord Jim O'Neill, the former Conservative Treasury minister and Remain supporter has stated in an interview that the economic prognosis for Britain remains bullish for the coming year.

Background

In 2016, Britain narrowly voted to leave the European Union. Experts have voiced concerns over the stability of the region’s economy post Brexit. At first it seemed optimistic as UK’s economy grew in a higher than expected rate for the first three months after the vote. But this trend reversed in 2017.

Based on its performance post the vote, the International Monetary Fund had predicted that the UK would grow at 2% in 2017. However, it lowered its forecast in July announcing that growth rate was likely to be 1.7%. Commenting on the growth, IMF said that UK’s performance has been “tepid.”

Top global organizations like Morgan Stanley, Citigroup Inc., Standard Chartered Plc and Nomura Holdings Inc have already announced they will be shifting their EU base outside of London. The country and city that has emerged the top pick for these companies has been Frankfurt in Germany. Additionally, it has been reported that Goldman Sachs Group Inc. and UBS Group AG are also similarly considering moving to Frankfurt.

In December 2017, UK Prime Minister Theresa May struck a last-minute deal with the EU regarding key issues. According to this deal, there will be no "hard border" in Ireland. The rights of EU citizens in the UK and the rights of UK citizens living elsewhere in the EU would also be protected in accordance to the deal. UK is officially set to leave in 2019.

There have been fears that a ‘hard Brexit’ would leave companies and organizations in the UK at a disadvantage in Europe as they would no longer be allowed to be part of EU’s single market. However, Bloomberg has since reported that Spanish and Dutch finance ministers have agreed to push for a Brexit deal that keeps Britain as close to the European Union as possible.

Analysis

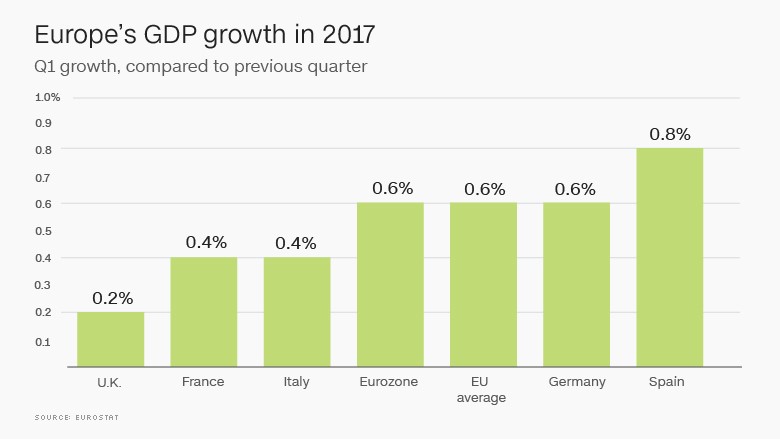

A decade after the financial crisis, economies have begun showing signs of recovery. In 2017, International Monetary Fund (IMF) projected a higher than expected growth for China, Japan and the Eurozone countries like Germany, France, Italy and Spain. Due to the strong performances expected from these nations, global growth is expected to be 3.5%. IMF’s chief analyst Obstfeld said, “The recovery in global growth that we projected in April is on a firmer footing; there is now no question mark over the world economy’s gain in momentum.”

Lord Jim O'Neill, the former Conservative Treasury minister and Remain supporter has stated in an interview that the economic prognosis for Britain remains bullish for the coming year. He said, “I certainly wouldn't have thought the UK economy would be as robust as it currently seems. That is because some parts of the country, led by the North West [of England], are actually doing way better than people seem to realise or appreciate. As well as this crucial fact, the rest of the world is also doing way better than many people would have thought a year ago, so it makes it easier for the UK.”

However, not all experts share in his views. Cambridge Econometrics recently published a report that noted that growth across the UK could be on average 3% lower by 2030 than it would have been if Britain remained within the EU's single market and customs union. O'Neill has dismissed these numbers and stated that this wasn’t as bad as it could have been.

In the recent weeks, the value of Pound rose to the highest it has been since the Brexit vote came to pass.

Assessment

Our assessment is that UK’s economy will be able to weather the Brexit as long as it remains a “soft Brexit.” A hard Brexit would have put UK companies at a distinct advantage. However, other concerns remain. Experts and analysts have already begun sounding the alarm over probable triggers that could result in another global financial crisis and recession. In that scenario, UK will be further hit as it won’t have the safety net provided by the EU.

Comments