OPEC to maintain production cut

December 1, 2017 | Expert Insights

The Organization of the Petroleum Exporters (OPEC) as well as Russia have announced that the nations would continue to maintain the output cut till the end of 2018. This has been done in a bid to ensure global oil prices do not collapse.

Background

Organization of the Petroleum Exporting Countries (OPEC) is group comprised of 14 oil producing nations. It was founded in 1960. The current members of OPEC are - Algeria, Angola, Ecuador, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, and Venezuela. Indonesia used to be a member but it suspended its OPEC membership in December 2016.

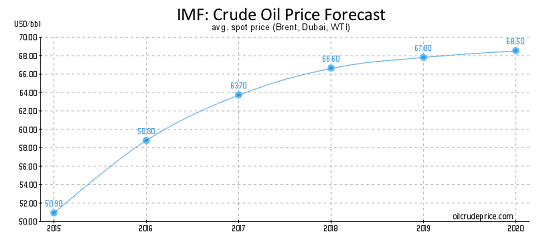

From 2010 until mid-2014, world oil prices were around $110 a barrel. However, price of oil has fallen significantly in the recent years. It is now around $50. To address the sluggish prices, OPEC nations came to an agreement in November 2016 to cap their output until the oil glut was reduced. In May 2017, they agreed to extend that deal by nine months. This isn’t the first time oil prices have been severely hit due to a glut. Prices of oil fell in the 80s due to falling demand. It resulted in a six-year decline in the price of oil.

In July 2017, the OPEC nations met once more to discuss plans on whether they should further cap oil output by 1.8 million bpd beyond March 2018. The meeting was held in Russia and was attended by non OPEC oil producing countries as well. During this meeting, Saudi Arabia, announced that it will limit its oil exports to 6.6 million bpd (barrels per day). This is a million bpd lesser than the previous year.

Analysis

In November, due to various factors, price of oil rose to its highest since mid-2015. Brent crude futures LCOc1 were up 59 cents at $61.53 per barrel having hit a session peak of $61.70 earlier. Recently, OPEC nations once again discussed the issues of oil prices along with Russia. The group (and Russia) has agreed to extend production curbs, aimed at boosting the oil price, by nine months.

OPEC also decided to cap the combined output of Nigeria and Libya at 2017 levels below 2.8 million bpd. These two countries had been exempted from the deal in the past as both nations have been grappling with political and economic unrest.

Saudi Energy Minister Khalid al-Falih said that it was premature to talk about exiting the cuts at least for a couple of quarters. He also stated, “When we get to an exit, we are going to do it very gradually ... to make sure we don’t shock the market.”

However, there are concerns that OPEC’s efforts will be undercut by US production of shale. “If producers in the U.S. increase their rig count over the next few months due to higher prices then I expect another price collapse by the end of 2018. I hope that all U.S. shale companies will maintain their current rig counts and use all excess cash flow to increase dividends back to their shareholders,” said Scott Sheffield, executive chairman of Pioneer Natural Resources Co (PXD.N)

Gary Ross, a veteran OPEC watcher and founder of Pira consultancy said that given the current political climate in some of the OPEC nations could push the prices higher. He said, “Everywhere you look there is an ever-present risk to supply. In Iraq’s Kurdistan there is a major risk to oil exports because of tensions with Baghdad, in Libya militias are still fighting, in Nigeria the risks of disruptions are significant, Venezuela is on the verge of default, Iran could again face U.S. financial sanctions and even in Saudi Arabia political risk is on the rise.”

OPEC is showing “a strong commitment to normalizing inventories and also to remain data dependent, which reduces the risk of both unexpected supply surprises and excess stock draws,” Goldman Sachs said in a note.

The oil price fell slightly after the latest deal, which had been expected. Brent Crude was down 0.3% at $62.35 a barrel.

Assessment

Our assessment is that OPEC’s production cuts pushed through by Saudi Arabia have so far resulted in the rise of oil prices. However, it is possible that US shale producers may increase rig count and their own production. This would undercut any reforms from OPEC and could potentially keep prices low. However, there are a lot of unknowns that can still affect prices in the near future. Venezuela, Iraq, Libya and few other OPEC nations are facing massive political unrest and economic turmoil. The possibility of increased military conflict in the Middle East also looms in the corner.

Comments