OMINOUS OIL CUTS…

October 8, 2022 | Expert Insights

BACKGROUND

To maintain high prices despite worries about a recession, the oil-producing cartel OPEC+, which includes countries in the Persian Gulf and Russia, recently decided to cut output by two million barrels per day. Following US President Joe Biden's visit to Saudi Arabia this summer to try to mend fences, the news triggered a strong outcry from the US, with rumours suggesting that the Biden administration may be rethinking its involvement with oil-producing Venezuela. The White House swiftly denied any change in strategy toward Venezuela.

The Biden administration's response was uncharacteristically irate, with threats to investigate breaking up the world's oil cartel. It coincides with US and EU efforts to establish a price restriction on Russian oil exports that appear to have enraged the Saudis and ongoing US anxiety about high energy costs potentially causing a worldwide economic downturn.

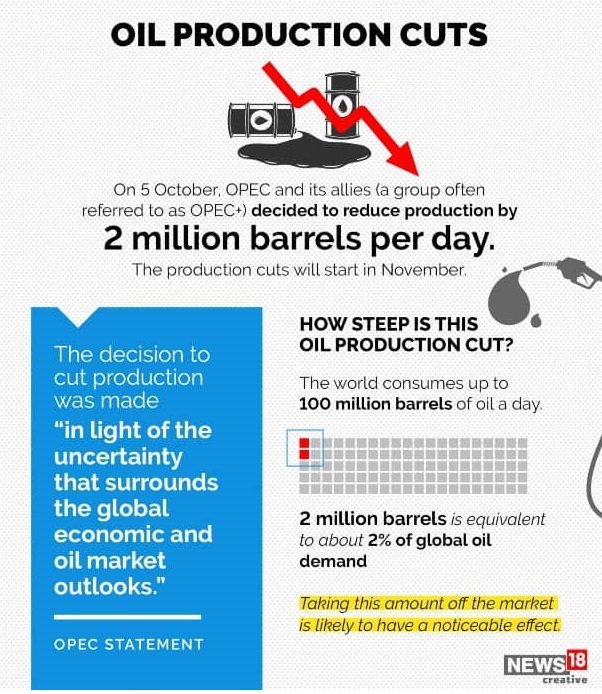

The OPEC + meeting of all the member countries comes at a juncture when the world is grappling with rising energy costs. The unprecedented decision can potentially worsen ties between the United States of America and Saudi Arabia when U.S. President Joe Biden has been trying to control soaring inflation and rising fuel prices at home before the mid-term elections. The decision by the OPEC Group has sent tremors throughout the global community, with the White House calling the decision “ short-sighted” and vowing to “deliver another ten million barrels from the Strategic Petroleum Reserve to the market the next month, continuing the historic releases the President ordered in March.” Today, the world consumes about 100 million barrels of oil daily, so taking 2 million off the global market could cause a dent. The OPEC Group further released a statement to justify the decision to cut oil production by about 30%, blaming it on “uncertainty that surrounds the global economy and oil market outlook.”

ANALYSIS

The Kremlin made nearly one hundred billion dollars in the first hundred days of Russia's conflict with Ukraine by selling electricity on international markets. Over 60% of this came from selling crude oil and petroleum-based products. This unexpected windfall has been Russian President Vladimir Putin's lifeline financially, aiding in stabilizing the Russian economy amidst a barrage of foreign sanctions. Cutting this lifeline has proven to be a difficult challenge to solve—one that requires innovative measures. With competitive global oil markets, crude oil prices are well over $100 per barrel, and Western countries are struggling with inflation.

Many observers believed that the OPEC+ decision to side with Russia at the expense of the United States and its Western allies by reducing output by up to two million barrels per day was a sign of Russian support. It is no secret that Riyadh has had a tense relationship with the Biden administration despite Biden's recent visit to the country; Saudi Arabia was the main driver of this cut, which Russia supported. The sudden decision by the OPEC countries could also come across as a sharp reprimand against U.S. President Joe Biden, who, despite comments in the past about Saudi Arabia being a pariah state, recently visited the head of the Saud family to show interest in production increases.

The strategy now being utilized against Iran, which calls for oil sales money to go into escrow accounts outside of the nation, is one tried-and-true way to accomplish this. The G7 should carefully study this since it might be a viable option. One potential issue is that it demands compliance from pro-Russian and neutral nations, like China and India, without providing them with a compelling incentive to do so.

Instead of reducing oil exports, the policies adopted by the G7 aim to reduce income going to Russia. The discounts are predicted to be substantially lower than the ones offered by Iraq recently. The West will have implemented a successful strategy if the Russian oil supply can meet global demand without benefiting the Kremlin.

Assessment

- The Biden administration has been promoting the notion of a "price cap" since June to address Russia's enormous oil revenues without lowering supply.

- The main factor that has allowed Russia to survive the shock of Western sanctions is the high oil price. The fall of the rouble was brief, and the Central Bank of Russia likely has more than recouped the 300 billion dollars in reserves that Western central banks froze at the start of the war.

- The main issue is whether Russia will have to sell to new customers at a deeper discount once the restriction is in effect. Western capitals expect some dishonesty but consider the risk to be worthwhile.

Comments