Oil prices to fluctuate

August 29, 2018 | Expert Insights

Oil prices fell marginally on Tuesday, caused by a gradual rise in output from the OPEC coupled with additional supplies from Venezuela, Africa and Iran.

Background

From 2010 until mid-2014, world oil prices were around $110 a barrel. However, the price of oil has fallen significantly in the subsequent years. It is currently traded around $ 70. To address the fundamental issue of listless prices, OPEC nations in November 2016 came to an agreement to pare their output until the oil plentitude was reduced. In May 2017, OPEC agreed to extend the reduction by nine months. This isn’t the first time oil prices have been severely hit due to a glut. Prices of oil fell in the 80s due to falling demand. It resulted in a six-year decline in the price of oil.

In July 2017, the OPEC nations met once more to discuss plans on whether they should further cap oil output by 1.8 million bpd beyond March 2018. The meeting was held in Russia and was attended by non-OPEC oil-producing countries as well. During this meeting, Saudi Arabia announced that it would limit its oil exports to 6.6 million bpd. This is a million-bpd lesser than what was produced the previous year.

Analysis

International Brent crude oil futures were at $76.14 per barrel, down 7 cents from their last close.

Traders speculate that the markets would rise but the upside was shortened by conflicting price signals.

The monitoring committee of the OPEC found that oil producers participating in a supply-reduction agreement, which included Russia, cut output by an additional 9 percent in July.

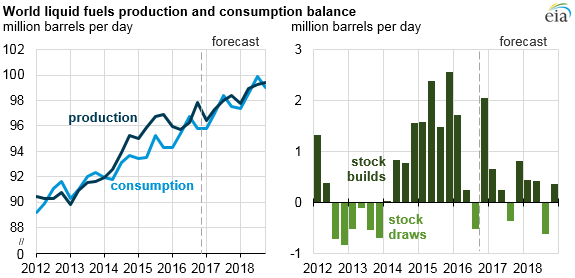

OPEC and its members agreed in late 2016 to cut output from 2017 by around 1.8 million barrels per day (bpd) versus October 2016 levels.

Weekly inventory data will be published by the private American Petroleum Institute (API) later on Tuesday and official data is due on Wednesday from the U.S. Energy Information Administration (EIA).

Meanwhile, the International Energy Agency (IEA) on Monday has warned of further supply disruptions from Venezuela where an economic crisis has cut deep into the OPEC member's oil output.

Venezuelan crude oil exports had halved in the previous two years to just 1 million bpd by July 2018, according to trade flow data.

“We can expect a further fall,” the IEA’s Executive Director Fatih Birol told Reuters in Norway on Monday.

Birol also warned that African OPEC-members Libya and Nigeria “seem both still fragile countries” despite some recent improvements.

However, Birol also said it was too early to gauge the impact of the U.S. sanctions that will target Iran from November.

Analysts said a fall in the dollar over the past two weeks was also supporting crude, as it makes oil purchases cheaper for countries using other currencies at home.

The findings of the OPEC monitoring committee for last month compare with a compliance level of 120 percent for June and 147 percent for May. This means there has been a steady increase in oil output.

The oil prices fell below US$ 70 per barrel, due to the escalating trade dispute between the US and China.

However, the oil prices could move northward when the US’s new sanctions on Iran come into force in November 2018.

Iran currently exports 2.5 million bpd but that could reduce to below 1.5 million bpd after November.

Assessment

Our assessment is that the volatility of the oil prices will continue beyond November 2018 when there could possibly be a reduced output from Iran. We feel that the sanctions will impact the price of oil in coming months. We believe that OPEC is likely to increase the output to keep the supply steady. We also feel that the US will step up on exporting oil itself, to compensate for any shortfall in global supply.

Comments