OIL POWER BALANCE SHIFTING EAST?

November 26, 2022 | Expert Insights

Hidden behind the glitter and glamour of the inaugural ceremony of the 2022 FIFA World Cup in Qatar (an event cited by Forbes as the costliest world cup to date with over $ 220 billion spent in the last ten years) was a quiet signing ceremony whose impact will last much longer than any World Cup. On November 21, QatarEnergy and Sinopec inked a deal to guarantee China's Liquified Natural Gas (LNG) supply for the next 27 years, secure from market volatility and competition.

Coming at a time when the war in Ukraine has stretched the demand for energy to unprecedented levels, the deal propels this small oil-rich nation into the forefront of energy geopolitics.

However, the question remains how the rest of the world, especially Europe and the U.S., will look at the fallouts of the deal and whether there will be a geopolitical blowback. As Europe is left scrambling for alternative power sources during the bitter, long winter months, energy has become an even more intense arena for great power competition.

Background

The geopolitics of oil over the past 120 years have played a pivotal role in international relations, being one of the primary reasons for 20th-century wars. Some would say the U.S. intervention in Kuwait and Iraq is a continuum of this eternal competition.

As the pressure to reduce coal consumption mounts and crude oil output dips, natural gas has grown in importance. Once an affordable technology to transport it as LNG was commercialised, enabling its transportation over the oceans in huge specially designed LNG tankers, its consumption, especially in power generation, skyrocketed. It being the least polluting hydrocarbon makes it even more attractive.

With LNG surpassing coal as the world’s number two energy source and potentially overtaking oil’s share in many large, industrialised economies, LNG exporters like Qatar, Iran, Russia, and the U.S. are finding themselves as major players in the international power game regarding energy security and sustainability.

Analysis

The present volatility in LNG supply due to the Russia -Ukraine war and the sanctions on Iran has proved to be a bonanza for Qatar. The Gulf nation has used its huge LNG reserves to meet the burgeoning energy hunger of Asian powers while ignoring Europe, left cold and energy deficient by Russian sanctions. Western allies like the U.S., Israel and Australia have pitched in to fill somehow the deficit left by the shutting of the Russian oil faucet. However, these barely scratch the surface.

This kind of energy situation was never envisaged in Europe. The bulk of the infrastructure developed to unload tanker-borne LNG safely is heavily concentrated in Western European coastal nations, leaving landlocked Central and Eastern European countries mostly disconnected from the network. This perpetuates the latter's dependency on Russian and Qatari pipeline supplies. The European Commission is now considering a proposed joint purchase of gas to avoid this conundrum.

All said and done, LNG, though less polluting than coal and oil, does cause global warming; therefore, EU countries like Germany have baulked at buying LNG for long-term use. This conforms with their pledge to phase out fossil fuels. They believe LNG deals would work against their climate commitments made under the European Green Deal and Paris Agreement. Obviously, China has no such qualms, and Qatar, which stands to make enormous profits, is also not inclined to let go of a good opportunity to recoup its expenses on the World Cup. In an increasingly disruptive energy market, Qatar sees an assured long-term source of revenue, and China gets its energy security- a win-win for both!

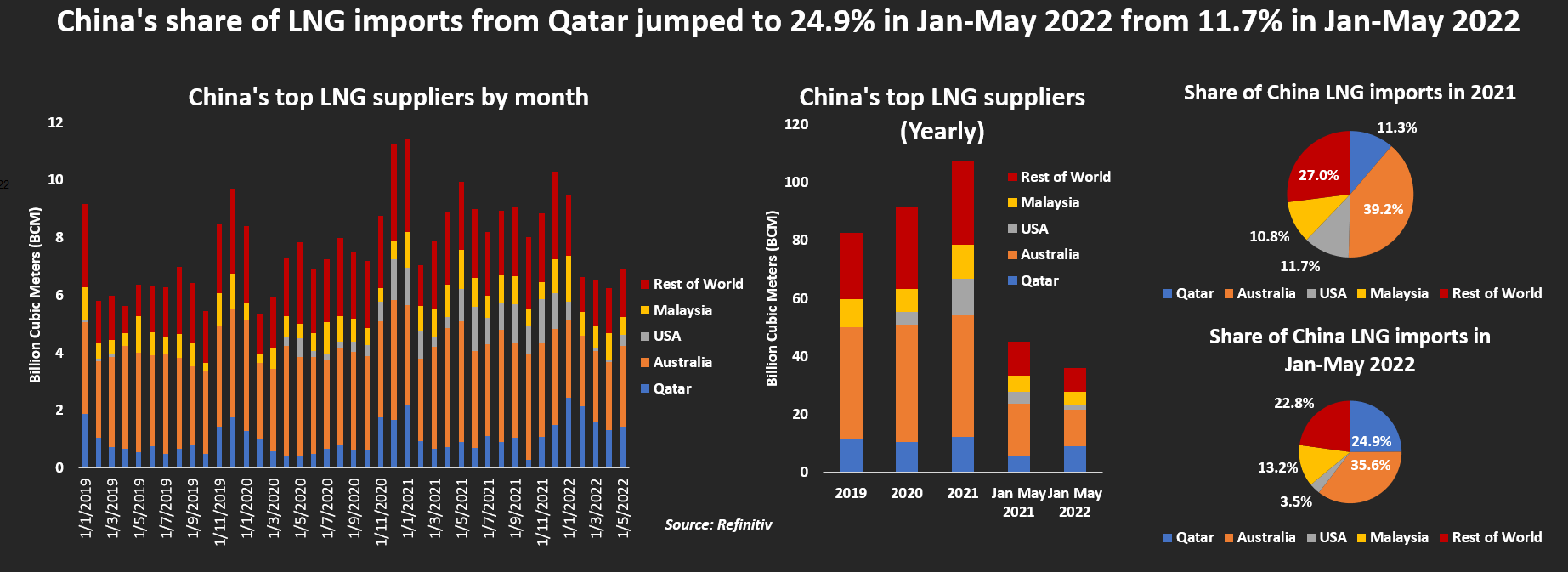

In fact, Asia's gas consumption has doubled in the past two decades, with China emerging as the primary driver of the growing Asian market for LNG. In a bid to control coal pollution, China imported more LNG in 2021 and 2022 than any other country, accounting for nearly 60 per cent of global LNG demand growth. Most of China's imports are long-term contracts with Persian Gulf countries, and it closed a similar 25-year deal with Iran in 2020 worth $ 400 billion.

The 2022 China-Qatar gas deal is not just about energy security but also signifies the growing ties between the two regarding their converging geopolitical orientation and interests in Afghanistan, Iran and the larger regional security issues in West Asia. Qatar is Iran's maritime neighbour, and the two countries share the world's largest gas field, and it serves China to nurture a favourable strategic partnership with both.

The American withdrawal from Afghanistan in August 2021 entailed Qatar being officially designated as the representative of American interests in Afghanistan. The gulf country even partnered with Turkey to initiate talks for maintaining airports in Taliban-ruled Afghanistan. The LNG deal could be a spoiler as the U.S. hopes to induct moderate Qatar into the Abrahams Accord, a move that the latter has been shunning since 2021.

China's interest in expanding its naval presence in the northern Indian Ocean implies its ambitions to acquire a military foothold in the Persian Gulf region. Talks of establishing a Chinese base in partnership with the UAE were halted under American pressure. However, the possibility of a Chinese military base in the Gulf with Qatar's help remains real, mostly because the latter already hosts a Turkish military base and has not shied away from permitting the Taliban to establish a political office. During the 2022 FIFA World Cup, Qatar is hosting Zakir Naik, a controversial religious preacher charged in India with several cases.

Indian Perspective

With sluggish domestic production and persistent demand growth, India imports almost 90 per cent of its LNG, most of which comes from Qatar. India’s unwillingness to strike long-term deals with Qatari companies can be attributed to existing price ceilings on gas, resulting in their inability to pass on costs to industrial and residential customers.

Some analysts suggest that the practice of Indian LNG importers relying more on short-term deals and spot market imports occurs because India's gas market and domestic production are still evolving. However, given the projected growth in the imbalance between natural gas supply and demand in India, some exposure to competitively priced and strategically beneficial long-term contracts seems necessary.

Assessment

- These moves demonstrate Qatar's willingness to use its oil and LNG exporter status to make bold and assertive geopolitical choices that can go against Europe, the U.S. and India's interests.

- For India, Qatar's growing strategic ties with Turkey and now with China and other Southeast Asian countries present an opportunity to strengthen its renewable energy production and diversify its energy supplies by building influence with the U.S. and African producer nations like Nigeria, Angola, etc.

- Although Qatar aims to expand its LNG production by almost 65 per cent in the upcoming decade, there is little new production or discovery of a new field of this non-renewable source, leading to fears of total depletion and unsustainability. It is also aware that with the demand to reduce pollution gathering pace, even LNG may come under fire once the current energy crisis subsides. In its national interest, Qatar cannot ignore the commercial opportunity provided by the Chinese deal.

Comments