LOSING ITS DAZZLE?

July 2, 2022 | Expert Insights

As the terrible 2021 passed, there was optimism in the air in India's diamond industry. With rapid inoculation of the populace by one of the world's largest vaccination programmes that kept morbidity low during the third wave of the pandemic, prospects were rosy as global markets opened with a vengeance. Weddings, giftings and shopping sprees commenced with a vengeance, and the entirely export-oriented Indian diamond industry was confident of quickly reaching pre-pandemic revenues, some US $24. Industry analysts projected a growth rate of 5-7 per cent in the medium term as demands grew and prices soared.

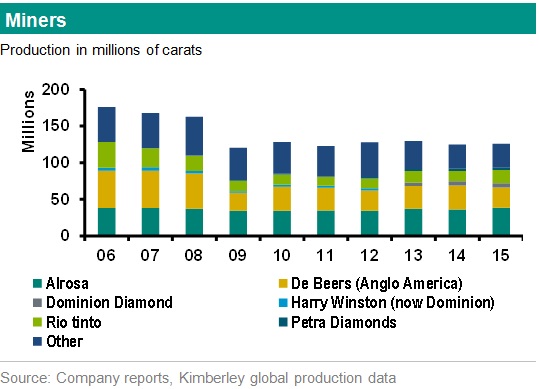

Then Russia attacked Ukraine, and the effect of the war in far-off eastern Europe had its reverberations in the diamond hubs of Gujarat. The western sanctions on Russia banned all trade with the latter. As per CRISIL, nearly 30 per cent of the global supply of rough diamonds is sourced by Alrosa, the Russian diamond mining company, which is one of the largest of its kind in the globe. The Indian diamond industry cuts and polished 80 to 90 per cent of the world's rough diamonds, and the ban has severely impacted the industry, which was just recovering from the pandemic.

Background

With Russia isolated from the SWIFT banking systems, there is no way Indian diamond merchants could ensure an uninterrupted supply, despite their known flexibility to get around hurdles.

The impact is starting to appear in Ground Zero- i.e., Surat, the City of Diamonds and other cities of Gujarat. Employing nearly a million workers, mostly poorly paid daily wagers, the Indian diamond polishing industry is largely spread over Surat, Ahmedabad, Bhavnagar, and Mumbai. India is the global leader in cutting and polishing rough diamonds and meets 60 per cent of the world's supply in terms of value and 80 per cent in volume.

Fresh uncut diamonds are imported from various parts of the world, gaining their shine and price in the local markets of Surat. The industry has now come to a standstill due to the US sanctions on Russia, which have not only affected Russia but also its trading partners.

Analysis

The diamond market contributes 7.5 per cent to the GDP (Gross Domestic Product) of India and 14 per cent to the total merchandise export of India. 12.5 per cent of the overall import are from Russia, and Namibia is the largest exporter with 57.8 per cent of overall imports to India. The US sanctions on Russia not only include a trade ban on Russia but the countries involved in diamond export need to certify that the diamonds sold in the global market are not from Russia. As the US is one of the largest consumers of diamonds in the world, such a certification would be mandatory for sale to the western markets, which are the principal customers.

The diamond hub of India, although a large-scale production unit, encompasses several small-scale industries under whom largely daily wagers work on the labour-intensive cutting and polishing. The sanction will have a significant impact on these baseline workers, who will now be affected in the most viable way. Four thousand large- and small-scale units that used to work for more than ten hours a day for seven days a week are now reduced to working for five to six hours a week.

The impact will not be confined to Surat or Gujarat but will find echoes throughout India’s huge jewellery industry. If a diamond does not go through Surat for cut-polishing, then the diamond is not at all considered a diamond in the Indian or global jewellery market.

The US and Europe, along with gulf countries such as Dubai and Hong Kong, are the largest consumers of diamonds in the world. Their domestic markets will face severe challenges with these sanctions. Eight out of ten diamonds found around the global market have been processed in India.

The supply disruptions have led to spiralling prices, making it impossible for small-scale diamond/ jewellery merchants to stay in the market and employ their craftsmen. The loss of employment of such small-scale labourers is imminent, as only large-scale units could cope with the current situation. Some small-scale merchants are dependent on loans, and this situation has given rise to debt conditions for such merchants and labourers.

Are these sanctions really meant to hold Russian funding for the war, or has it reversed the effect back on the west and the world is a debatable issue as of now

Assessment

- The Indian Government must take urgent steps to find a solution to the disruption in the supply of Russian diamonds. The diamond polishing industry is important to the Indian economy not only as an earner of precious foreign exchange but also as a provider of employment to many poor people. The impact of the disruption will be reflected in the Indian GDP in the long run.

- Sanctions imposed in a knee-jerk fashion are causing pain to the weak and poor far from the area of conflict. Just like the global food scarcity being caused by the sanctions spurred by the war, niche employment opportunities are also being taken away. While Russia, a resource-rich nation with a small population, will swiftly recover once the status quo ante in global trade is restored, the long-term impact on developing economies will be hard to repair.

Comments