Intel: Seeking Subsidies?

April 22, 2023 | Expert Insights

At a time when the common perception is that semiconductors are selling like hotcakes and it is a suppliers' market, Intel Inc, one of the world's largest semiconductor companies, threw in a surprise.

In January 2023, Intel Corporation announced its projection of a financial loss for the current quarter. This announcement came as a nasty surprise to investors due to the company's pessimistic forecast for the PC market and decelerating expansion in its crucial data centre division. The trading of the company's shares experienced a decline of 9.5 per cent subsequent to the closing bell. Intel incurred a loss of $700 million due to a significant decline in its profit margins, which reached a multi-year low.

Background

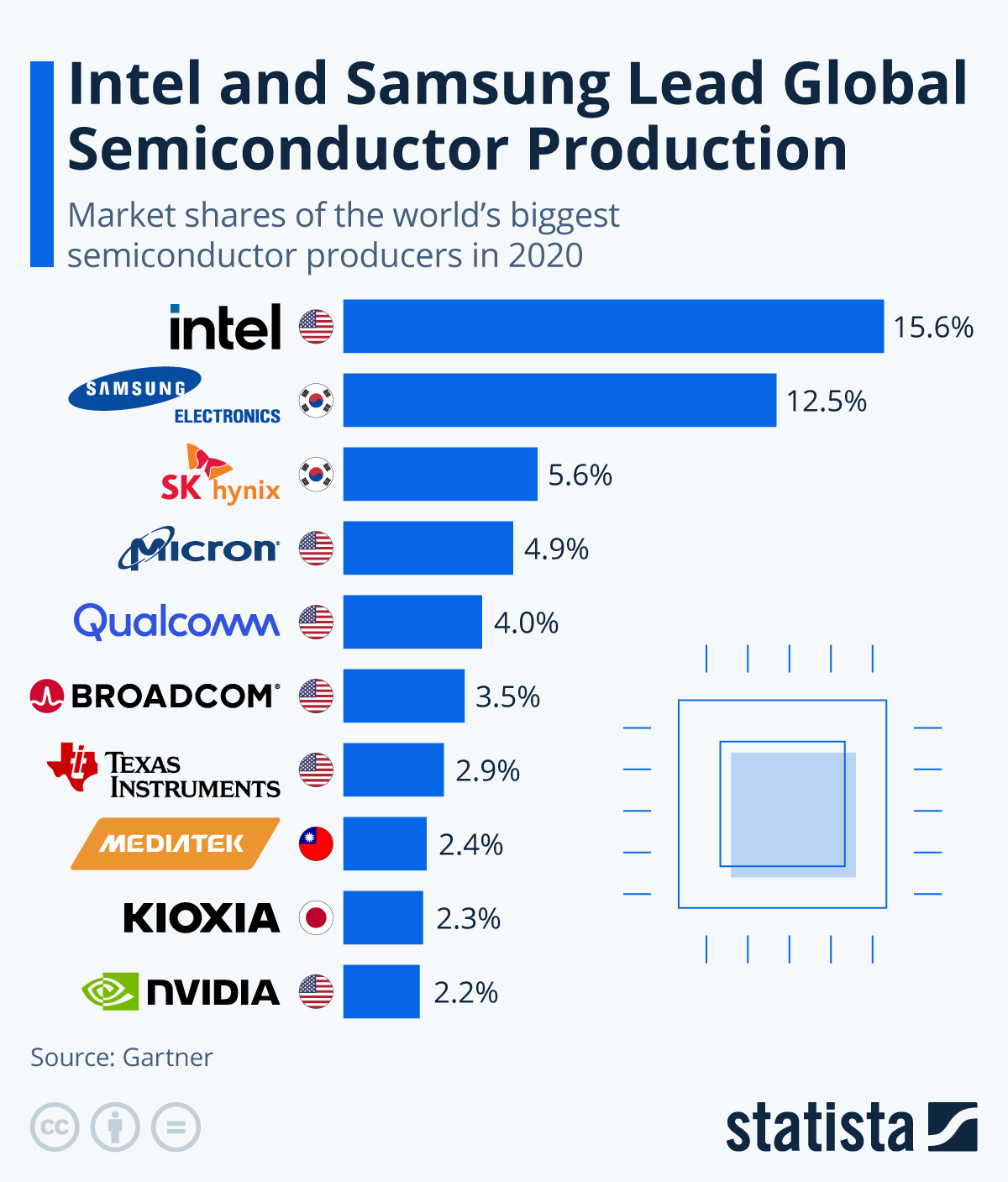

The semiconductor industry at a global level is primarily dominated by two major players, namely the United States and China. The respective positions of these players have a significant impact on their economic and technological competitiveness. The United States has traditionally been a leading player in semiconductor innovation and design, boasting globally renowned corporations such as Intel, Qualcomm, AMD, and Nvidia headquartered within its territorial boundaries. Furthermore, the United States harbours a robust system of research institutions, universities, and venture capital firms that offer assistance for semiconductor innovation and nascent enterprises.

China has recently become a significant contender in the semiconductor sector, with the government providing active support to its domestic semiconductor industry through various measures, including subsidies. China's semiconductor industry has been growing rapidly, and the country has been investing heavily in its domestic chip manufacturing capabilities. In fact, China is now the world's largest consumer of semiconductors, but it only produces about 16 per cent of the semiconductors it consumes, which means it relies heavily on imports. However, China's government has prioritised becoming more self-sufficient in chip manufacturing, and the country is investing heavily in the industry. This poses a significant threat to the United States' national security interests.

The potential of semiconductors and microchips is optimistic, as they are anticipated to undergo further advancements and technological innovations. The escalating need for complex and specialized microprocessors across diverse sectors, including Artificial Intelligence, the Internet of Things, and Edge Computing, offers prospects for expansion and advancement. Furthermore, the current inclination towards energy-efficient and sustainable solutions is propelling the emergence of innovative materials and manufacturing methods. The semiconductor sector is anticipated to witness enduring growth and development in the forthcoming years, propelled by the changing requisites of the digital economy. The semiconductor industry will continue to play a crucial role in promoting innovation and growth as the demand for advanced and high-performance chips rises with the ongoing evolution of technology. Intel co-founder and Moore's Law creator Gordon Moore died at 94 recently. His prediction that transistors in a circuit will double every 24 months helped grow the semiconductor industry.

Analysis

Intel Inc is facing increasing challenges from the global supply chain and China's growing power. In 2022, Intel experienced a 60 per cent decline in profits and a 20 per cent decrease in revenue, resulting in a credit rating downgrade by Moody's, Fitch, and S&P. The organization has initiated the procedure of terminating a substantial number of staff members and has reduced the remuneration of its workforce by 5 to 10 per cent. The Chief Executive Officer of Intel, Pat Gelsinger, attributed the downfall to ongoing negative economic factors. According to a recent statement by Pat Gelsinger, the CEO of Intel, it is anticipated that the semiconductor industry will continue to experience supply shortages until the year 2024.

Intel has faced stiff competition from other chip manufacturers such as Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung. Both TSMC and Samsung have been investing heavily in new technologies and expanding their production capacity, making them more attractive to customers looking for advanced chips. In contrast, Intel has struggled to keep pace, and its manufacturing process has fallen behind TSMC and Samsung's.

Moreover, the pandemic has highlighted the fragility of global supply chains. The demand for electronics and semiconductors has skyrocketed, but supply chain disruptions have caused shortages and price spikes. The shortage of semiconductors has been particularly acute, affecting industries from automotive to consumer electronics.

Intel's success is critical to the United States' technological leadership and national security interests. The company has been a leader in the semiconductor industry for decades, and its chips power many critical systems, including those used by the military and intelligence agencies.

The United States government should be concerned with Intel's lack of growth and should be considering ways to maintain its global primacy in the innovation of advanced chips. One way the government can help is by providing subsidies to Intel. Subsidies would enable the company to invest in new technologies and expand its production capacity, allowing it to remain competitive with TSMC and Samsung. This would help to ensure that the United States has a strong domestic semiconductor industry and reduce its reliance on imports.

Subsidies would also help to mitigate the impact of supply chain disruptions. Intel could use subsidies to build new fabs in the United States, reducing its reliance on overseas suppliers. This would help to ensure a stable supply of semiconductors and reduce the risk of shortages in critical industries. Subsidies would also help to counter China's growing power in the semiconductor industry. China's government has provided significant subsidies to its domestic chip manufacturers, giving them a competitive advantage over foreign companies.

However, some experts argue that subsidizing domestic companies in the semiconductor industry to increase American competitiveness is erroneous because it misunderstands the dynamics of the industry. An alternative would be incentivising foreign firms to invest in the United States and honour their commitments to produce semiconductors domestically. This strategy would be more effective than rescuing Intel.

Industry experts have refuted the claim that American hegemony in the semiconductor industry is required to reduce the risk of conflict with China. Chip technology in military applications is typically several years behind the most recent advancements. In addition, the industry is presently led by East Asian companies such as Taiwan Semiconductor Manufacturing Co. and Samsung.

For the United States to attract foreign investment, it must provide competitive incentives. The $195 billion that Samsung will invest in Texas over the next 20 years is a positive start, but additional efforts are required to entice other corporations to pursue similar opportunities. Instead of providing financial assistance to domestic companies, the Department of Commerce should prioritize efforts to encourage foreign industry leaders to invest in the United States' semiconductor industry.

Despite this, the United States has historically been a centre of semiconductor innovation. In addition, the nation is home to a flourishing network of research institutions, universities, and venture capital firms that support semiconductor innovation and emerging companies.

Assessment

- Intel Inc needs to be saved with U.S. subsidies to combat global supply chain challenges and China's growing power. The United States government must provide subsidies to Intel to ensure the company can continue innovating and producing advanced chips.

- Subsidies would help to reduce the impact of supply chain disruptions, mitigate the threat posed by China's growing power in the semiconductor industry, and ensure that the United States has a strong domestic semiconductor industry. Failure to provide subsidies would put the United States' technological leadership and national security interests at risk.

- Intel's current difficulties demonstrate the need to re-evaluate the U.S. semiconductor industry's industrial policy. It may be more effective to prioritize foreign investment to promote economic competitiveness than to support Intel exclusively.

Comments