India to export raw sugar

October 11, 2018 | Expert Insights

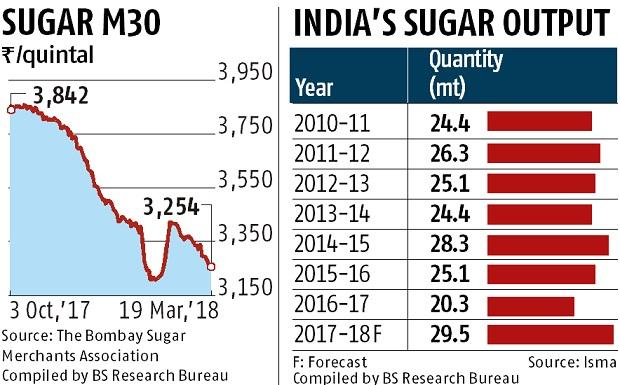

India to export raw sugar for the first time in three years as global prices rally. A rebound in New York prices to seven-month highs along with government subsidies are making exports lucrative for Indian sugar farmers.

Background

India’s modern history of agricultural movements began in the 1970s. Commonly called the “new farmers movements,” these movements involved widespread protests and the formation of farmers’ organizations. The aim of these protests was to modify the state’s intervention in the agrarian economy. Demands included lowering costs for inputs (such as seeds, fertilizers, water, and electricity), and higher selling prices.

India is the world’s second largest producer of sugar and Uttar Pradesh is the largest producer and cultivator of sugar within the country. Farmers have successfully experimented with higher-yield varieties in recent years which, coupled with progress in techniques, has resulted in record output this year.

Sugar mills in UP are likely to end up crushing over 1,100 lakh tons (LT) of cane this season, but they already owe ₹12,500 crore cane dues to farmers.

In 2007/08 India exported a record 2.7 million tonnes of raw sugar and 2.26 million tonnes of white sugar. India could export 4 million tonnes of sugar in 2018/19, including around 2.5 million tonnes of raw sugar.

Analysis

Indian sugar mills have signed deals to export raw sugar for the first time in three years as a rally in New York prices to seven-month highs along with government subsidies, made exports lucrative. Mills from the world’s second-biggest sugar producer were reluctant to sign new export contracts until recently as global prices were trading far below local prices.

However, a rally in international raw sugar prices along with a rupee hitting a record low has made exports viable. Mills have contracted to export 150,000 tonnes of raw sugar at around $280 per tonne on a free-on-board (FOB) basis for shipment in November-December.

More Indian exports could weigh on global prices and trim the market share of rivals Brazil and Thailand, the world’s top two sugar suppliers’ Indian mills traditionally produce white sugar for local consumption, but this year they are planning to export raw sugar as the country faces a surplus harvest for the second straight year.

India last month approved incentives such as a transport subsidy for export and a direct cane payment to farmers to encourage cash-strapped mills to export surplus sugar in the 2018/19 season. In March, India asked mills to export 2 million tonnes of sugar and fixed a mandatory export quota for each mill.

However, mills managed to export only around 450,000 tonnes in the 2017/18 marketing year that ended on Sept. 30 due to uncompetitive prices. Mills will try to achieve the export target of 5 million tonnes in the current year. Apart from raw sugar, mills have contracted to export 100,000 tonnes of white sugar at around $305 per tonne, FOB, for shipment in October-December, three dealers said.

India could start the new season with inventories of over 10 million tonnes of sugar and could produce another 35 million tonnes in the new season started on Oct. 1st.

Indians, known for their sweet tooth, consume about 25 million tonnes of sugar a year. Indian mills will produce raw sugar at the start of the season for exports as they have ample carry forward of white sugar from last year’s crushing to cater to local demand.

Assessment

Our assessment is that Indian agricultural exports are greatly benefiting from the ongoing trade war and the faltering exports of agricultural rivals like Brazil and China. In addition to sugar, India has now enjoyed greater export volumes in key food-grains such as soybeans, a traditionally US-dominated export commodity which has suffered limited supply under present sanctions. We believe that India should continue to leverage its position as a net agricultural exporter and take advantage of the ongoing trade dispute. We feel that given India’s growing trade deficit, a boost in agricultural exports should help cut down the deficit levels.

Comments