India cuts import taxes on Palm Oil

January 2, 2019 | Expert Insights

New Delhi has reduced import duties on crude and refined palm oil, an essential import commodity for India’s rapidly growing economy. Malaysia stands to gain significantly from this recent import tax cut.

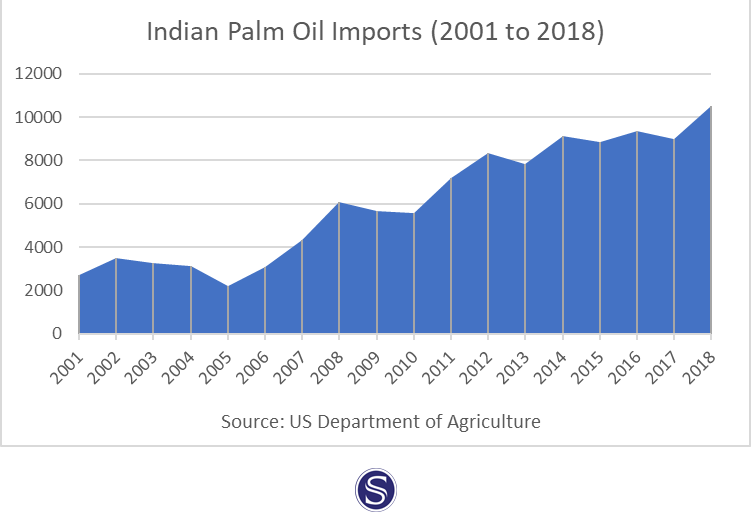

India relies on imports for 70 per cent of its edible oil consumption, an increase from 44 per cent in 2001/02.

Background

Palm oil is an edible vegetable oil derived from the mesocarp (reddish pulp) of the fruit of the oil palms. Along with coconut oil, palm oil is one of the few highly saturated vegetable fats and is semisolid at room temperature. Palm oil is a common cooking ingredient in the tropical belt of Africa, Southeast Asia and parts of Brazil. Its use in the commercial food industry in other parts of the world is widespread because of its lower cost and the high oxidative stability (saturation) of the refined product when used for frying.

The use of palm oil in food products has attracted the concern of environmental activist groups; the high oil yield of the trees has encouraged wider cultivation, leading to the clearing of forests in parts of Indonesia to make space for oil-palm monoculture.

Malaysia is the world's second largest producer of palm oil. It produced 18.79 million tonnes of crude palm oil on roughly 5,000,000 hectares (19,000 sq mi) of land. Though Indonesia produces more palm oil, Malaysia is the world's largest exporter of palm oil having exported 18 million tonnes of palm oil products in 2011. China, Pakistan, the European Union, India and the United States are the primary importers of Malaysian palm oil products.

Analysis

India has cut import taxes on crude and refined palm oil from Southeast Asian (ASEAN) countries after a request from suppliers, a government notification said. The reduction will lead to higher imports of palm oil by the world’s biggest edible oil buyer in coming months as it would narrow the difference between the tropical vegetable oil and competitors such as soybean oil and sunflower oil.

The duty on crude palm oil was lowered to 40 per cent from 44 per cent, while a tax on the refined variety was cut to 50 per cent from 54 per cent, according to the notification issued late on 31 December 2018. The cuts took effect on 1 January 2019. Malaysian shipments of refined palm oil will be taxed at 45 per cent compared with 54 per cent earlier, the government said in a separate notice.

In March 2018, India raised the import tax on crude palm oil to 44 per cent from 30 per cent and lifted the tax on refined palm oil to 54 per cent from 40 per cent.

Palm oil has been more competitive due to the duty reduction and this will lead to higher imports from January onwards, said Sandeep Bajoria, chief executive of the Sunvin Group, a Mumbai-based vegetable oil importer. India primarily imports palm oil from Indonesia and Malaysia and soy oil from Argentina and Brazil. It also buys small volumes of sunflower oil from Ukraine and canola oil from Canada.

Its palm oil imports dropped 6.4 per cent from a year ago to 8.7 million tonnes in the 2017/18 marketing year ended in October, according to Solvent Extractors’ Association (SEA), a Mumbai-based trade body. Indonesia and Malaysia, the top two palm oil producers, were seeking a reduction in the import tax by New Delhi as inventories were rising in both countries due to higher output.

India’s palm oil imports could have fallen in December but will jump this month as some importers had delayed shipments in anticipation of tax cuts. The effective duty difference between crude and refined palm oil has narrowed to 5.5 per cent from 11 per cent for shipments from Malaysia, which could lead to higher imports of refined palm oil.

Assessment

Our assessment is that the import tax reduction by New Delhi is a step towards more robust trade between India and ASEAN countries under the ‘Look East’ plan. We feel that the reduction in import duty will also reduce import prices of an essential commodity and ease inflation further.

Comments