IMF on Asian growth

May 9, 2018 | Expert Insights

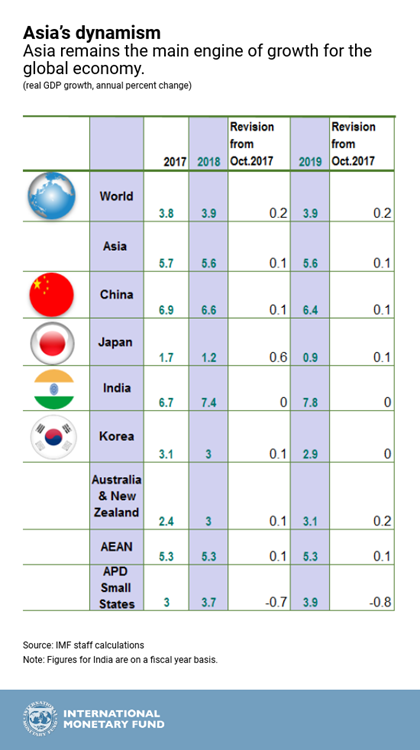

The IMF’s Regional Economic Outlook for the Asian and Pacific has forecast a 5.6% growth for the region for 2018 and 2019. India and China alone account for a third of this growth; India’s growth could increase to 7.8% in 2019.

Background

The International Monetary Fund (IMF) is an international organization headquartered in Washington, D.C. It is comprised of 189 countries that aim to “foster global monetary cooperation, secure financial stability, facilitate international trade, and promote high employment and sustainable economic growth”. It was formed in 1945 at the Bretton Woods Conference. Its initial goal was the reconstruction of the international payment system. However, its role has now changed to managing balance of payments difficulties and international financial crises.

Throughout 2017, there were increasing warnings against protectionism. IMF Managing Director Christine Lagarde cautioned nations against becoming complacent with growth. She pointed out there are a number of threats including political tensions, as well as rising inequality that could significantly affect economic recovery.

In 2018, there have been increasing fears of a trade war between the United States and China, two of the largest economies in the world. Critics fear that such a war between the two nations could disrupt global trade systems. These fears solidified in March, when US President Donald Trump announced global import tariffs of 25% on steel, and China promised retaliation. Since then, tensions have escalated. The US has imposed tariffs worth over $150 billion; Beijing responded with $50 billion worth of tariffs.

The IMF has forecast that 2018 will be the strongest year for global growth since 2011. According to the International Monetary Fund’s latest forecast, the global economy is on course to grow 3.9% this year, the fastest pace since 2011. Every major economy is expected to experience a balanced growth for the second year in a row. Despite ongoing disputes, the IMF predicts trade volumes to grow. Overall world trade volumes grew 4.9% in 2017, up from 2.3% in 2016. For 2018, the forecasts call for trade to increase by 5.1%.

Read more on these predictions here.

Analysis

“Asia continues to be the main engine of the world’s economy, accounting for more than 60 percent of global growth,” the International Monetary Fund noted in a recent report, which forecast a 5.6% growth for the region. India had the highest growth rate, and is expected to continue to grow at 7.4%. This could accelerate to 7.8% in 2019 as the country recovers from the impacts of the Goods and Services Tax and demonetization. China’s growth is expected to average 6.6% due to fiscal tightening measures. Japan and ASEAN are both expected to remain constant at 1.2% and 5.3% respectively.

The IMF noted that the outlook is positive in the short term as strong consumer and business confidence continues. The effects of US expansive fiscal policy and the recovery of the Euro could have positive effects in Asia. However, the agency warned that there are several risks ahead.

One major problem is inflation, which has remained below target in a number of economies. Analysts have noted that the Indian Rupee has been on a downward trend since the beginning of 2018, falling 5.15%. This week, the currency hit its lowest in 15 months at 67.13 rupees against a dollar. This may be primarily due to the rise in oil prices, which has coincided with increased government spending.

Protectionism may be another major concern. After President Trump rolled out the 25% tariffs on steel imports, officials in Delhi are still concerned that this will be the beginning of more tariffs that would negatively affect India. “A global shift toward inward-looking policies would be worrying given Asia’s trade openness—suppressing Asia’s exports and reducing foreign direct investment in the region,” the recent IMF report stated. IMF also cited geopolitical risks, natural disasters, and cyber-attacks as other medium-term threats.

In the Asian context, the IMF noted that some key structural reforms that would promote durable growth included narrowing gender gaps, addressing climate change, skilling the labour force to “adapt to the shifts in technology and trade”, and managing demographic transitions.

Assessment

Our assessment is that the current confrontation between the US and China poses a clear and present danger to global economy. As stated previously, we feel that tensions between the two nations could increase the volatility in the financial market. In Asian countries, shifting geopolitics in the Korean Peninsula and in the Middle East could also pose a significant threat. We believe that in such a global political scenario, governments could focus on policies that lower risks to the financial system.

Comments