A Grim Outlook for S.Asia

January 7, 2023 | Expert Insights

The South Asian economy faced numerous challenges in 2022. The region underwent a 9.2 per cent increase in food shortages and inflation rates last year. Pakistan experienced one of its worst floods in years, and Sri Lanka was pushed to the verge of economic collapse. Meanwhile, other countries in the region struggled to reel back from the impact of the pandemic. With such dire conditions, the area is expected to see a relatively slow growth rate in 2023. The Asian Development Bank (ADB) predicts a 0.2 per cent slump in economic growth and a 0.5 per cent increase in inflation rates this year.

Along with the ADB, the International Monetary Fund (IMF) and the World Bank (WB) have predicted that the region will experience limited or restricted economic growth. However, most often than not, South Asian countries have exceeded on-paper projections. How and whether the region can move away from the predicted trajectory is a pertinent question worth understanding.

The Outlook

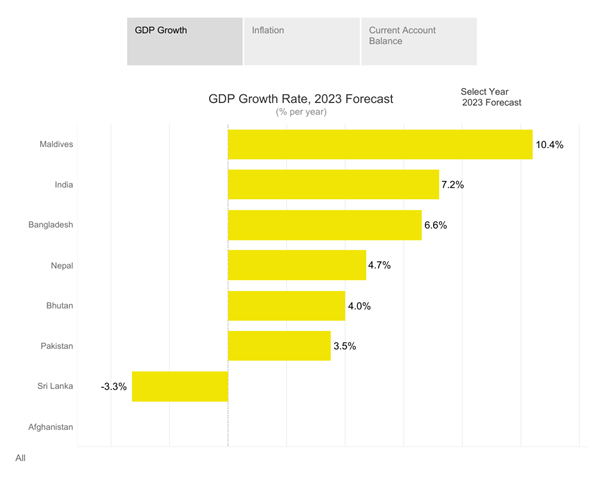

Given below are the expected growth rates and predictions provided by the IMF, WB, and ADB for South Asian economies in 2023:

India: The country is expected to witness a comfortable 7.2 per cent growth rate in 2023. Growth rate projections for the country were increased by the end of 2022 after the government confirmed the lowest debt-to-GDP ratio in the past 15 years.

Pakistan: The fallouts of the catastrophic floods in 2022 and mounting external debt are expected to increase inflation rates to 23 per cent and restrict growth rates to 3.5 per cent. The government must repay nearly USD 30 billion in external loans by June 2023. Unemployment rates and trade deficits will likely increase due to dwindling foreign currency reserves and depreciating currency value.

Maldives: The government’s rapid revival of the tourism industry is expected to increase the growth rate in the country by 10.4 per cent. Fiscal deficit and inflation rates will remain at moderate levels in 2023. Stabilizing energy prices will further aid the country’s growth trajectory.

Nepal: The country is projected to have a 4.7 per cent increase in growth rate in 2023, compared to the previous year’s 5.8 per cent. Subdued oil prices and tight monetary policies are expected to reduce the inflation rate by 0.2 per cent. A stable inflow of remittances and an increase in foreign employment will likely reduce the country’s trade deficit.

Bhutan: The country’s GDP is expected to grow by 4.5 per cent, and the inflation rate is expected to increase by 5.5 per cent in 2023. The agriculture, livestock, and forestry sectors, in particular, are likely to see a 3.23 per cent increase in growth rate.

Sri Lanka: The country’s real GDP is expected to fall by 4.2 per cent in 2023. Taxes will likely be increased to revive the country’s purchasing power.

Bangladesh: Inflation rates in the country are expected to increase by 0.5 per cent due to rising fuel hikes. Growth rate projections for 2023 have been reduced from 7.1 to 6.6 per cent due to a sluggish recovery from the pandemic.

Afghanistan: Inflation rates are expected to rise from 11 per cent due to socio-politico-economic instability surrounding the country since 2021. Lack of accountability and transparency will continue to prevent the Taliban regime from establishing a stable public financial management system.

Analysis

The ongoing Ukraine-Russia crisis, along with the resurgence of COVID-19 around the world, are vital factors that have impacted the growth and development of South Asian economies. With food and oil prices skyrocketing due to the war, countries like Bangladesh and India had to increase fuel prices. The increase in fuel prices and reduction in food subsidiaries resulted in protests and political unrest in Bangladesh. The goods and services industries in both countries were affected by energy shortages.

The resurgence of the pandemic left tourism-based economies in the region in limbo. However, Nepal and Maldives were able to revive their tourism industry by relaxing COVID-19 restrictions. India, Sri Lanka, and Bangladesh were less fortunate, though.

Internal socio-political issues have plagued Pakistan, Sri Lanka, and Afghanistan over the past two years. Pakistan and Afghanistan have witnessed a surge in terrorist and insurgent activity since 2021. The rise in terror attacks and reduced foreign investments increased the government’s dependence on foreign aid. In addition, Pakistan’s annual floods turned catastrophic due to climate change, resulting in losses worth nearly USD 15.2 billion. Sri Lanka’s economic crisis was exacerbated by mismanagement of resources, mounting foreign debt, and incapable leadership.

At the outset, one must note that not all South Asian countries underwent an economic slump or crisis in 2022. Nepal and Maldives, for example, showcased a bump in economic growth after their tourism and travel industries began functioning at pre-pandemic levels. Likewise, India's goods and services industry witnessed a similar spike after numerous countries shifted supply chains from China to other South Asian countries.

The interdependence between countries like Bhutan, Nepal, and India for trade and tourism will likely stabilize the region's economic growth to a certain extent. For example, Bhutan's growth trajectory will be directly proportional to India's growth since its currency is pegged to the Indian rupee. With India projected to have a decent growth rate, Nepal will also witness the same. However, the interdependence could also hamper regional growth if COVID-19 restrictions are re-imposed this year. With increasing cases in China, the closing of borders in South Asia and the restriction on the movement of goods and people cannot be ruled out.

Deteriorating socio-politico-economic conditions in Pakistan, Sri Lanka, and Afghanistan are unlikely to change in 2023. The Lankan and Pakistani governments have received loans from the IMF and are expected to default on payments. As a result, both countries will need help with choosing to depend on IMF loans or start implementing restrictive fiscal policies. Choosing IMF loans will increase foreign debt, and tightening fiscal policies will lead to more civil unrest.

Assessment

- Exports from South Asia are expected to decline due to increasing protectionary policies in Europe and the US. In addition, growing inflation and unemployment across the globe have forced countries to reduce spending and focus on their domestic industries. Europe, in particular, will follow tight fiscal policies due to the ongoing food and energy crisis.

- With countries already issuing restrictions on visitors from China, global supply chains could face another slowdown if China closes its international borders. China is a significant trading partner for all South Asian countries. Growth rates will be significantly hit if trade with China witnesses a decline. S

Comments