GII VERSUS BRI

July 9, 2022 | Expert Insights

The Group of seven-member inter-governmental political forums (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States of America) held its 48th global summit at Schloss Elmau in Southern Germany from 26th to 28th of June 2022.

While not stated openly, a major issue for discussion was dealing with Beijing’s Belt and Road Initiative (BRI). As the BRI spreads its tentacles from Asia and Africa into the European heartland, it emerges as a major financial challenge to the western world. For a long time, the West has been warning the benefactors of the danger of the BRI investments turning into a debt trap, something that only benefits the Chinese drive towards global economic primacy.

For South Asian countries like India, this warning could not have been timelier as the region bears mute witness to the collapse of the once flourishing Sri Lankan economy, one of the primary benefactors of BRI in South Asia.

Background

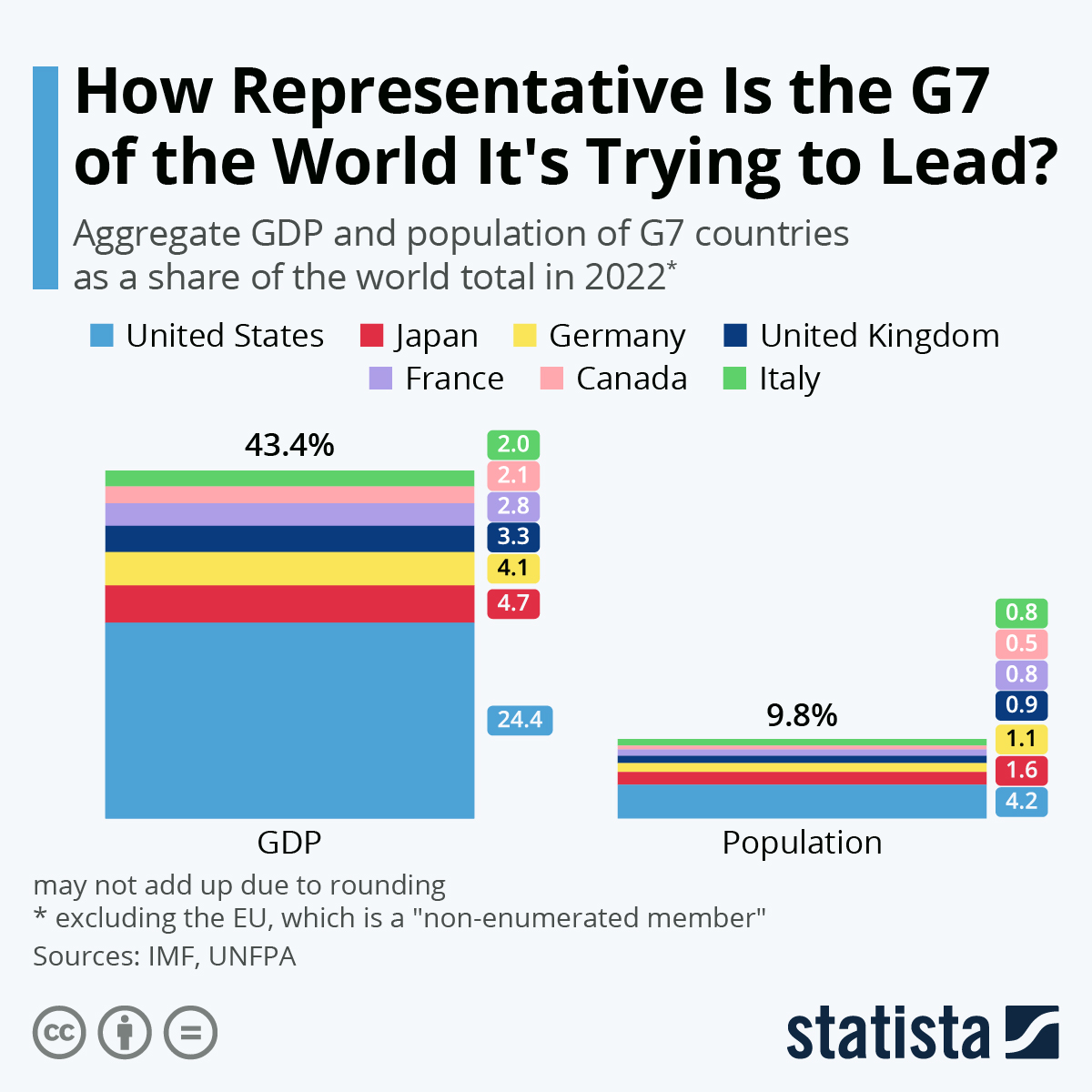

The G7 is undoubtedly an exclusive club of the rich and the might. Approximately 770 million individuals make up this category, which as of 2020, accounts for over 50 per cent of the global net wealth (around $418 trillion) and between 32 to 46 per cent of the overall gross domestic output.

Beijing's Belt and Road Initiative (BRI), introduced in 2013, has made huge strides since collaborating with the developing economies from Asia to Europe. Consisting of the Silk Road Economic Belt, which is land-based and the Maritime Silk Road, BRI endeavours to establish and enhance relationships between the nations along the route, build multi-tiered, multi-dimensional, and composite connectivity networks, and achieve diverse, autonomous, balanced, and sustainable development in those nations.

The G7 model of Global Infrastructure and Investment (GII) approaches the issue in a slightly different manner. Revisiting the BRI archetype and making necessary changes in the GII will benefit both the host and the investing country at the same time. President Biden makes it clear that this initiative will not be based on an act of charity but as a revised business proposal that will include the member countries as well as the World Bank and the International Monetary Funds (IMF) in close ties with the funding countries.

The U.S. is willing to invest 200 billion dollars in grants and federal investments over five years. Similarly, Europe will invest approximately 317 billion dollars over a similar period in the developing countries.

Analysis

While Beijing and its supporters call the BRI the best thing that has happened to the developing world, comparing it rather favourably with the avaricious western colonial enterprises in Asia and Africa. However, its critics, and there are many, label it nothing more than neo-colonialism, and whenever a benefactor nation of BRI suffers an economic collapse, the Chinese debt trap is blamed. It is alleged that BRI has majorly brought no gains for the host countries but has only led them to a sinking economy. As a result, G7 countries decided to re-introduce a previously laid proposal before the council to rival the Chinese BRI and rescue the dipping economies.

Beijing has responded positively to this G7 model. Chinese foreign ministry spokesperson Zhao Lijian, according to Reuters, said, "China continues to welcome all initiatives to promote global infrastructure development. We believe that there is no question that various related initiatives will replace each other."

From ground zero upwards, both the models look quite similar as they focus on infrastructure development. But in many countries, BRI has actually led to running down the nation’s economy, leading to an unsustainable debt trap. The recipient nations have been forced to transfer critical public assets to private entities or directly to Beijing itself, and nearer home, we have the example of the Sri Lankan government doing exactly the same. Whether the GII will be able to evade a similar debt trap is something the developing world will have to wait and watch.

Assessment

- The BRI draws world attention primarily to infrastructural development for the host country. Apparently, the development model is just a cloak to conceal the real intent and seek control of critical public assets to further Chinese strategic interests. These could be strategically located ports and multi-modal communications centres, which choke points for any nation's economy. Ports, in particular, are dual-use facilities and can provide rest, recuperation, replenishment and command and control hubs to maritime forces during hostilities and for power projection missions. The financial benefits would be the icing on the cake, but for the sake of strategic goals, they can be forsaken.

- The GII is still at the conceptual stage, and it has a long way to go before it can pose as a real competitor to the deeply entrenched BRI. The Chinese model has already fructified on the ground, while the West must turn its pledges into projects. In these hard times, when even strong economies like the U.S. and the EU are staring at recession, whether these promises actually turn real is something that can only be pondered upon at this junction.

Comments