Federal Reserve hikes interest rates

December 14, 2017 | Expert Insights

For the third time this year, the US Federal Reserve has raised the interest rates by 0.25%. The central bank has noted that this has been introduced as the US economy has made “solid gains.”

Background

The Federal Reserve System (also known as the Federal Reserve or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913. The main goal behind establishing the body was to create a central control of the monetary system that will prevent financial crises. In the event of a financial downturn, the Federal Reserve steps in to provide key aid.

Over the years, the Federal Reserve a played a key role in saving the American economy (and in turn the global economy) from imploding. It’s roles and responsibilities were expanded after the Great Depression, that caused a global meltdown. The timing of the Great Depression varied across nations; in most countries it started in 1929 and lasted until 1941. It resulted in international trade being reduced by 50% and unemployment rose.

A rise in the Fed funds rate will likely cause a ripple effect on the borrowing costs for consumers and businesses that want to access credit based on the U.S. dollar. Whenever the Federal Reserve increases the interest rates, the prime rate increases, and the credit card rates also increases among others. A hike in interest rates boosts the borrowing costs for the U.S. government and fuel an increase in the national debt.

In June 2017, the Federal Reserve stated that it would be hiking key interest rates by 0.25%. This was the second time in the year when the interest rates were hiked. The hike in the interest rates were reflective of the central bank's confidence in the US economy. After a two-day meeting on 14th June, the Federal Reserve’s Open Market Committee raised its benchmark interest rate by 25 basis points from a range of 1% to 1.25%.

Analysis

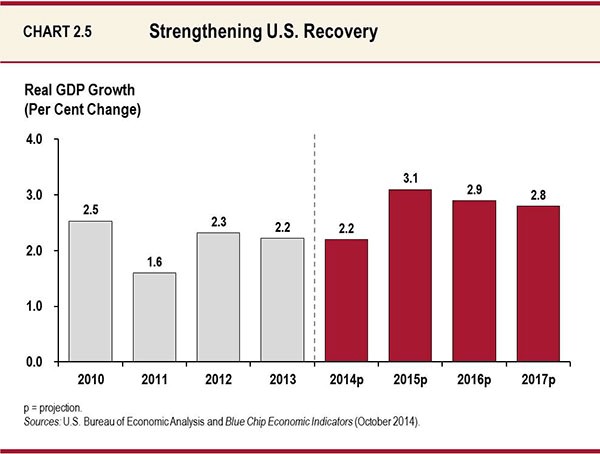

The US economy expanded at an annual pace of 3% during the three months to the end of September. The growth rate is higher than what had been forecast by experts. In the previous quarter the US GDP grew at an annual pace of 3.1%. On a year-on-year basis, GDP was up 2.3% according to estimates. The economy has grown for eight straight years, one of the longest stretches in history. Unemployment is down to 4.2%, its lowest since 2001.

Meanwhile, on November 2017, US President Donald Trump has nominated Jerome Powell to be the next Chair of the Federal Reserve. If nominated, he will replace Janet Yellen in February 2018. For the third time this year, the US Federal Reserve has raised the interest rates by 0.25%. The central bank has noted that this has been introduced as the US economy has made “solid gains.”

"The labor market has continued to strengthen and ... economic activity has been rising at a solid rate," the Federal Open Market Committee said in a statement following its two-day meeting. The federal funds rate will now hover in a range of 1.25% to 1.5%. It should be noted that despite hikes in 2017, the interest rates are still historically low.

Federal Reserve Chair Janet Yellen, who is stepping down from her post in February, said,” There’s less to lose sleep about now than has been true for quite some time, so I feel good about the economic outlook.”

Assessment

Our assessment is that the strong economic growth along with a drop in the unemployment rate in the US has provided confidence to investors and equity markets have risen as a result. This is unlikely to be the only hike in the interest rates in the near future. We believe in 2018, the Federal Reserve will hike the interest rates to 2%. The rise in interest rates has implications for emerging economies like India including pressure on the Rupee value, slow down of Dollar inflows in equity and debt and increased cost of international debt. We also believe that the Rupee value against the US dollar can come under pressure if Dollar outflows from the Indian markets take place.

Comments