Do You Want to Be a Hero?

August 18, 2020 | Expert Insights

"Do you want to be a hero? Many of you have had to close your operations and make very difficult decisions that are affecting human beings, their families, and their livelihoods ... what could you have done differently? ... I think it's possible to prepare so that the next time, you can be a hero."

As many as 94 percent of the Fortune 1000 companies’ supply chains have been affected by coronavirus-driven disruptions. As per Resilinc, the leading cloud provider of supply chain resilience and risk management intelligence found that the world’s largest 1,000 supply chain companies own more than 12,000 facilities (factories, warehouses and other operations) in COVID-19 quarantine areas. In some cases, supply chains have proved ineffective in responding to demand, as was the case for the markets for sanitisers, face masks, disinfectants, PPEs etc. For others, demand and supply have drastically dropped, resulting in production stops, the danger of bankruptcies, and the need for governmental support.

Companies have clearly not invested enough in supply chains to be able to weather such a crisis. This is mainly because the established methods of supply chain resilience are far too expensive. Maintaining redundancies in inventory can be extremely expensive, and an investment in resilience may seem far too costly to be worth safeguarding against low risk-high impact events like the current crisis. Furthermore, it is difficult to pitch expenditure on supply chain resilience when the best-case scenario is that the supply chain remains unaffected.

Besides, resilience also means that companies need to factor in other possible risks of disruption to their supply chain. These can range from regional disruptions — like the recent explosion in Beirut — or labour unrest that threatens production, to a global disruption like the pandemic. All these factors make achieving supply chain resilience a daunting task.

CORE CAPABILITIES

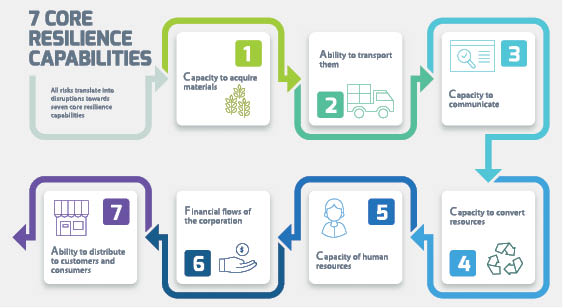

Professor Jim B. Rice believes that these problems can be surmounted. He describes how every single risk to a company, though they may be infinite in number, all boil down to a limited, finite number of outcomes. From there, calculating the risks and the necessary investment for resilience becomes easier. Professor Rice articulated how all risks translate into disruptions towards seven core resilience capabilities — the capacity to acquire materials; the ability to transport them; the capacity to communicate; the capacity to convert resources; the capacity of human resources; the financial flows of the corporation; and the ability to distribute to customers and consumers. Every disruption to the supply chain of a company can be classified under one of these seven core resilience capabilities. For example, the current crisis has severely impacted the capacity for companies to acquire and transport resources and materials, as well as the capacity of human resources (where employees' work cannot be performed online).

Companies also face the question of how much to invest in this resilience. Although there is no perfect formula, firms try to quantify the amount they need to invest based on an expected value calculation: invest as much as the impact of a disruption that could be averted by the investment, multiplied by the probability of that disruption occurring. The issue faced here is that for low risk-high impact events, companies using this calculation are left woefully underprepared. Prof. Rice spoke about how an options pricing system, as a means of calculating the required investment, could be useful in achieving a resilient Sales and Operational Planning (S&OP).

However, a more cost-effective road to resilience is flexibility in the supply chain. This can be achieved in multiple ways and is far more helpful than maintaining redundancy in inventory.

First, a company must know all its suppliers. Mapping upstream suppliers several tiers back can be vital. Companies that fail to do this will be unable to respond or even understand the impact of a disruption when a crisis erupts. After the 2011 Sendai earthquake in Japan, it took weeks for many companies to understand their exposure to the disaster because they were unfamiliar with suppliers upstream. But by that time, any available capacity was gone.

Second, it is necessary to integrate the supply chain and business continuity community into the decisions taken as a part of business management. The usual practice is for business management to make decisions independent of other stakeholders in the supply chain. The tradition has been to optimise individually, creating a 'boom and bust' process, where supply chain disruptions are more likely to have an amplified impact. Integrating capital budgeting, operations, and supply chain management into the decision-making process can achieve resilience and flexibility, and be the lifeline for a company in any eventuality.

Although Prof. Rice expects an increase in supply chain resilience from now on, he doubts it will be extremely drastic. After all, 9/11 had a similar effect. Supply chain resilience increased due to increased fears, but not in as drastic a fashion as was predicted.

Author: Synergia Foundation Research Team

Comments