China’s economic woes

November 7, 2017 | Expert Insights

China’s financial system is becoming increasingly vulnerable due to high levels of leverage, or borrowing. The governor of People’s Bank of China (PBOC) Zhou Xiaochuan has warned as much in a new article for the bank’s website. He signaled that China could fall prey to financial problems in the world’s second-biggest economy.

Background

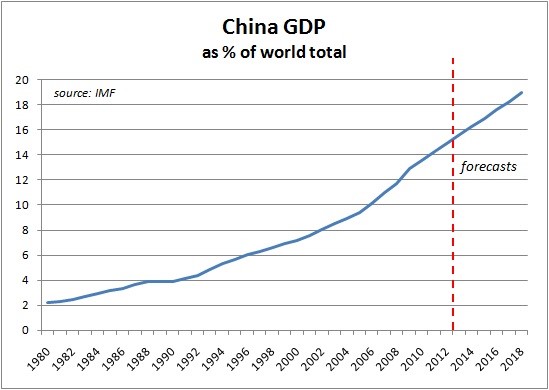

China is the second largest economy in the world after USA. According to certain forecasts, its GDP growth is slated to overtake America’s GDP in another 10 years. A hub for manufacturing industry, China is the fastest growing economy. Its economic growth has been over 10% for over 30 years.

However, in the recent years, China’s exponential growth has come at the cost of increased debt. According to statistics, its debt is more than 250% of the GDP and is much higher than the US. It is, however, lower than Japan, which remains the world’s most indebted leading economy. Experts have said that if China’s trajectory continues, then it will be looking at an economic slump sooner than later.

Due to China’s increasing build-up of credit, Standard & Poor Ratings has downgraded China’s long-term sovereign credit by one step. The nation’s credit has gone from AA- to A+.

Kim Eng Tan, an S&P senior director of sovereign ratings explained the company’s decision noting, “Despite the fact that the government has shown greater resolve to implement the deleveraging policy, we continue to see overall credit in the corporate sector to stay at a 9 percent point. We’ve now come to the conclusion that while we do expect some deleveraging in the next few years, this deleveraging is likely to be much more gradual than we thought could have been the case early this year.”

Analysis

China’s financial system is becoming increasingly vulnerable due to high levels of leverage, or borrowing. The governor of People’s Bank of China (PBOC) Zhou Xiaochuan has warned as much in a new article for the bank’s website. He signaled that China could fall prey to financial problems in the world’s second-biggest economy.

Risks of damage to the financial markets in China are “hidden, complex, sudden, contagious and hazardous,” according to Zhou. He wrote, “High leverage is the ultimate origin of macro financial vulnerability. In sectors of the real economy, this is reflected as excessive debt, and in the financial system, this is reflected as credit that has been expanding too quickly.”

Zhou added, “[In the good times] all industries and local governments enthusiastically pursued rapid growth and demanded [the central bank] ease money supply.”

Qingdao University economics professor Yi Xianrong said such a blunt accusation was rare from a Chinese official. Yi said China’s monetary policy had been held hostage by “the investment impulse of local governments” adding, “It has been that way for a long time and I don’t see signs of change as long as GDP remains key to assessing local officials’ performance.”

Experts have warned of the rising bubble in China’s real estate markets especially in the larger cities. Some have even compared it to the sub-prime mortgage bubble in the USA that ultimately led to the 2008 financial crisis and the global recession.

Earlier this month, Moody’s Investors Service analysts led by Michael Taylor said financial-sector regulation would likely continue to restrain the growth of shadow banking activities and address some key imbalances in the financial system. “However, the authorities continue to face challenges in preventing the de-risking of the financial sector from causing systemic disruption,” they wrote.

During the recently concluded National Congress that was held in China, President Xi Jinping said that the government would promote job creation and helping the economy expand.

Assessment

Our assessment is that an economic downturn in China would have global consequences that could jumpstart another global recession. It would negatively impact the equity markets and the world’s fastest growing economy might come to a stand-still. The growing mortgage problem and the growing debt could add to China’s financial woes. We believe Zhou’s article will be followed by financial deleveraging by the authorities that will rein in liquidity in the interbank market.

Comments